Question: Guys i need tour help when comes to first and second questio. Please i need the real steps for both question. QUESTION 1 The Randolph

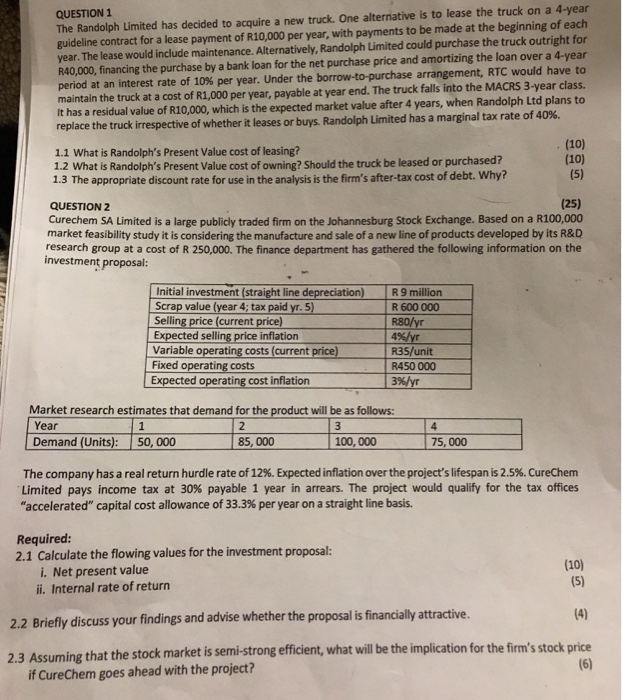

QUESTION 1 The Randolph Limited has decided to acquire a new truck. One alternative is to lease the truck on a 4-year guideline contract for a lease payment of R10,000 per year, with payments to be made at the beginning of each year. The lease would include maintenance. Alternatively, Randolph Limited could purchase the truck outright for R40,000, financing the purchase by a bank loan for the net purchase price and amortizing the loan over a 4-year period at an interest rate of 10% per year. Under the borrow-to-purchase arrangement, RTC would have to maintain the truck at a cost of R1,000 per year, payable at year end. The truck falls into the MACRS 3-year class. It has a residual value of R10,000, which is the expected market value after 4 years, when Randolph Ltd plans to replace the truck irrespective of whether it leases or buys. Randolph Limited has a marginal tax rate of 40%. 1.1 What is Randolph's Present Value cost of leasing? 1.2 What is Randolph's Present Value cost of owning? Should the truck be leased or purchased? 1.3 The appropriate discount rate for use in the analysis is the firm's after-tax cost of debt. Why? (10) (10) (5) QUESTION 2 (25) Curechem SA Limited is a large publicly traded firm on the Johannesburg Stock Exchange. Based on a R100,000 market feasibility study it is considering the manufacture and sale of a new line of products developed by its R&D research group at a cost of R 250,000. The finance department has gathered the following information on the investment proposal: Initial investment (straight line depreciation) Scrap value (year 4; tax paid yr. 5) Selling price (current price) Expected selling price inflation Variable operating costs (current price) Fixed operating costs Expected operating cost inflation R 9 million R 600 000 R80/yr 4%/yr R35/unit R450 000 Market research estimates that demand for the product will be as follows: Year 1 Demand (Units): 50,000 8 5, 000 100,000 75,000 The company has a real return hurdle rate of 12%. Expected inflation over the project's lifespan is 2.5%. CureChem "Limited pays income tax at 30% payable 1 year in arrears. The project would qualify for the tax offices "accelerated" capital cost allowance of 33.3% per year on a straight line basis. Required: 2.1 Calculate the flowing values for the investment proposal: i. Net present value ii. Internal rate of return 2.2 Briefly discuss your findings and advise whether the proposal is financially attractive. 2.3 Assuming that the stock market is semi-strong efficient, what will be the implication for the firm's stock price if CureChem goes ahead with the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts