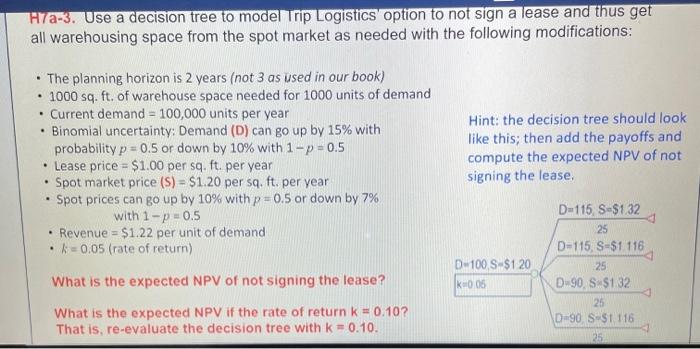

Question: H7a-3. Use a decision tree to model Trip Logistics' option to not sign a lease and thus get all warehousing space from the spot market

*****excel please******

*****excel please******H7a-3. Use a decision tree to model Trip Logistics' option to not sign a lease and thus get all warehousing space from the spot market as needed with the following modifications: - The planning horizon is 2 years (not 3 as used in our book) - 1000sq. ft. of warehouse space needed for 1000 units of demand - Current demand =100,000 units per year - Binomial uncertainty: Demand (D) can go up by 15% with probability p=0.5 or down by 10% with 1p=0.5 - Lease price =$1.00 per sq. ft. per year - Spot market price (S)=$1.20 per sq. ft, per year Hint: the decision tree should look like this; then add the payoffs and compute the expected NPV of not - Spot prices can go up by 10% with p=0.5 or down by 7% signing the lease. with1p=0.5 - Revenue =$1.22 per unit of demand - k=0.05 (rate of return) What is the expected NPV of not signing the lease? What is the expected NPV if the rate of return k=0.10 ? That is, re-evaluate the decision tree with k=0.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts