Question: Harry Markowitz received the 1990 Nobel Prize for his path-breaking work in portfolio optimization. One version of the Markowitz model is based on minimizing the

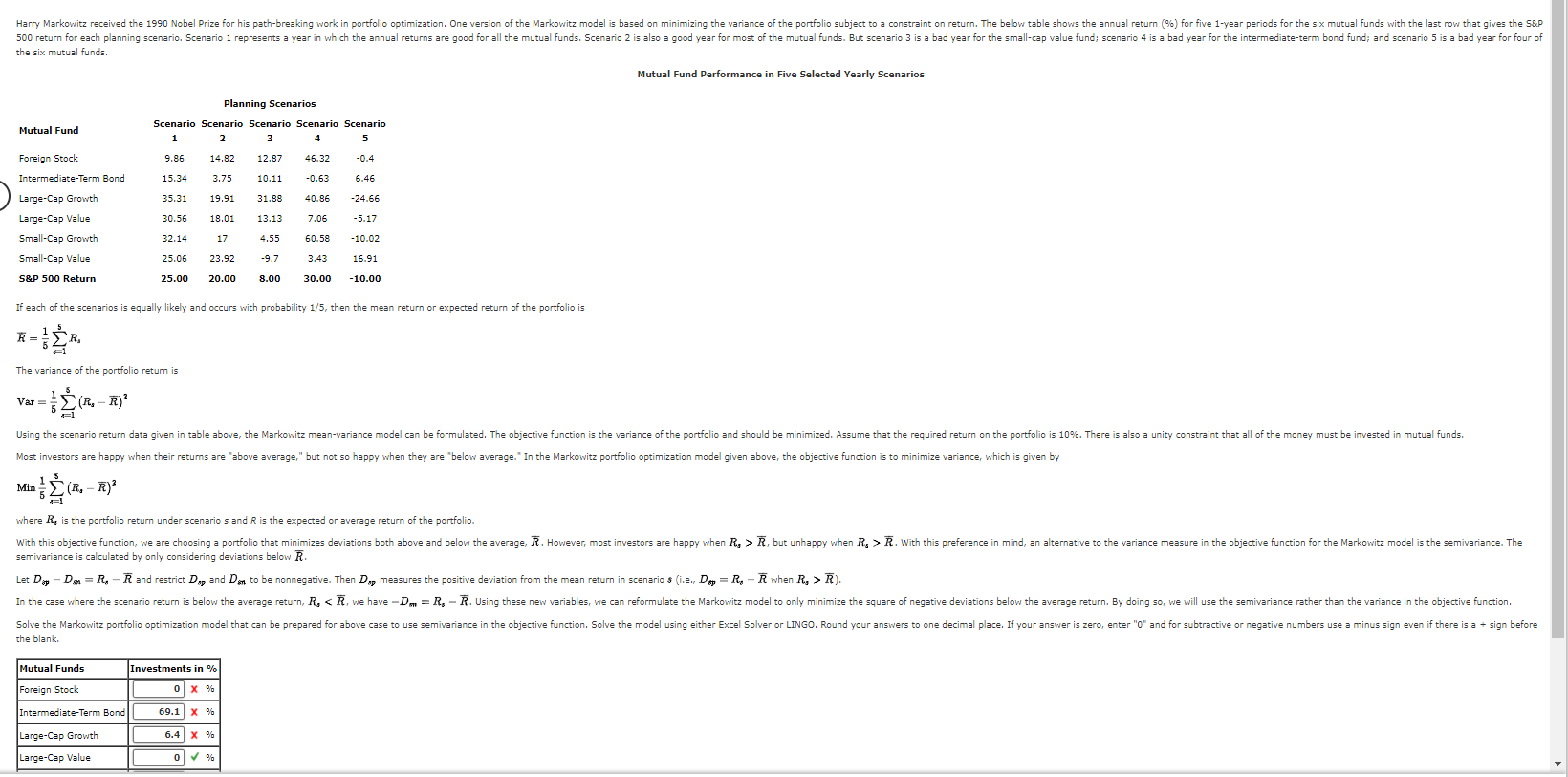

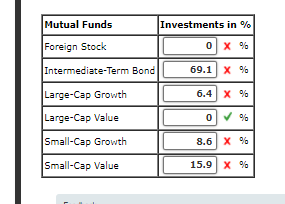

Harry Markowitz received the 1990 Nobel Prize for his path-breaking work in portfolio optimization. One version of the Markowitz model is based on minimizing the variance of the portfolio subject to a constraint on return. The below table shows the annual return (9%) for five 1-year periods for the six mutual funds with the last row that gives the S&P 500 return for each planning scenario. Scenario 1 represents a year in which the annual returns are good for all the mutual funds. Scenario 2 is also a good year for most of the mutual funds. But scenario 3 is a bad year for the small-cap value fund; scenario 4 is a bad year for the intermediate-term bond fund; and scenario 5 is a bad year for four of the six mutual funds. Mutual Fund Performance in Five Selected Yearly Scenarios Planning Scenarios Mutual Fund Scenario Scenario Scenario Scenario Scenario 5 Foreign Stock 9.86 14.82 12.87 46.32 -0.4 Intermediate-Term Bond 15.34 3.75 10.11 -0.63 6.46 Large-Cap Growth 35.31 19.91 31.88 40.86 24.66 Large-Cap Value 30.56 18.01 13.13 7.06 -5.17 Small-Cap Growth 32.14 17 4.5 50.58 -10.02 Small-Cap Value 25.06 23.92 9.7 3.43 16.91 S&P 500 Return 25.00 20.00 8.00 30.00 -10.00 If each of the scenarios is equally likely and occurs with probability 1/5, then the mean return or expected return of the portfolio is R = LER, The variance of the portfolio return is Var = =E(R, - R)? Using the scenario return data given in table above, the Markowitz mean-variance model can be formulated. The objective function is the variance of the portfolio and should be minimized. Assume that the required return on the portfolio is 10%. There is also a unity constraint that all of the money must be invested in mutual funds. Most investors are happy when their returns are "above average," but not so happy when they are "below average." In the Markowitz portfolio optimization model given above, the objective function is to minimize variance, which is given by E (R. - R)2 where R, is the portfolio return under scenario s and R is the expected or average return of the portfolio. With this objective function, we are choosing a portfolio that minimizes deviations both above and below the average, R. However, most investors are happy when R, > R, but unhappy when R. > R. With this preference in mind, an alternative to the variance measure in the objective function for the Markowitz model is the semivariance. The semivariance is calculated by only considering deviations below R. Let Day - Dom = R. - R and restrict Dep and Da to be nonnegative. Then Dep measures the positive deviation from the mean return in scenario s (i.e., Dep = Re - R when R, > R). In the case where the scenario return is below the average return, Ry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts