Question: Has Patrick Kelly met his deductible? Explain with specific reference to financial data / figures , indicate this information in a table format with headings

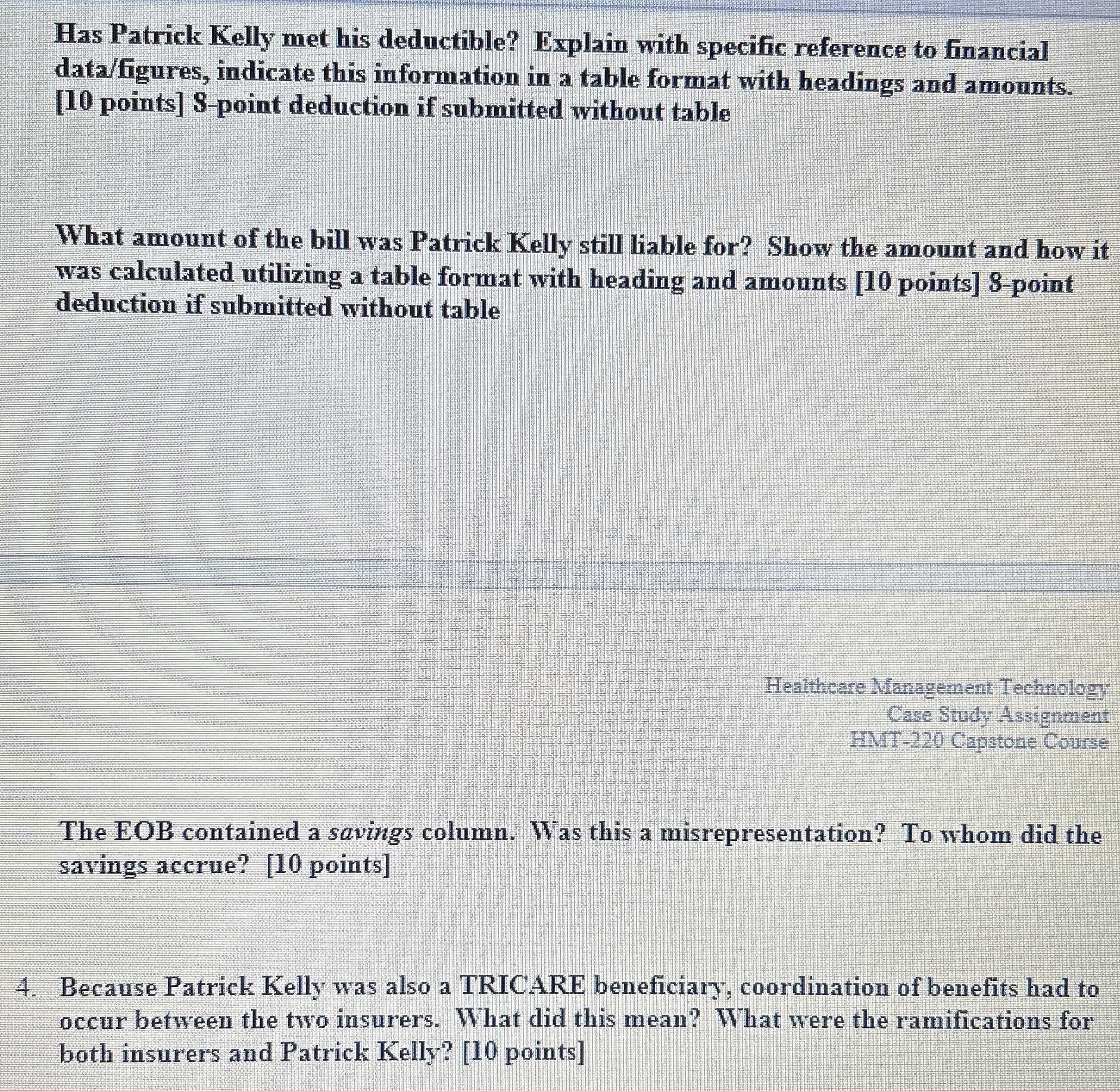

Has Patrick Kelly met his deductible? Explain with specific reference to financial datafigures indicate this information in a table format with headings and amounts. pointspoint deduction if submitted without table

What amount of the bill was Patrick Kelly still liable for? Show the amount and how it was calculated utilizing a table format with heading and amounts pointspoint deduction if submitted without table

Heatthcare Management Technology

Case Study Assigument HMI Capstone Course

The EOB contained a savings column. Was this a misrepresentation? To whom did the savings accrue? points

Because Patrick Kelly was also a TRICARE beneficiary, coordination of benefits had to occur between the two insurers. What did this mean? What were the ramifications for both insurers and Patrick Kelly? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock