Question: has to be done on excel with formulas show Mr. Smith is a recent retiree who is interested in investing some of his savings in

has to be done on excel with formulas show

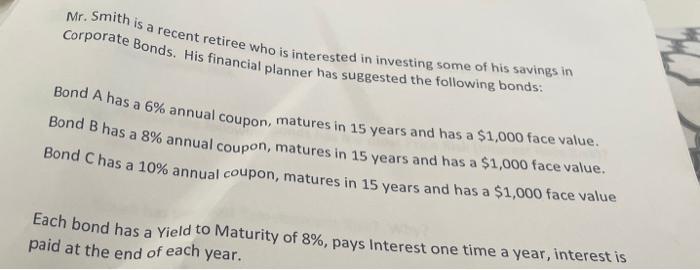

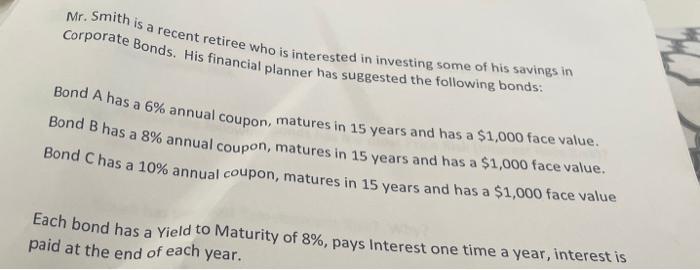

Mr. Smith is a recent retiree who is interested in investing some of his savings in Corporate Bonds. His financial planner has suggested the following bonds: Bond A has a 6% annual coupon, matures in 15 years and has a $1,000 face value. Bond B has a 8% annual coupon, matures in 15 years and has a $1,000 face value. Bond Chas a 10% annual coupon, matures in 15 years and has a $1,000 face value Each bond has a Yield to Maturity of 8%, pays Interest one time a year, interest is paid at the end of each year. a 10% el if the Yield to Maturity for each Bond remains at 8%, what will be the Price (Vo) 1 year from now

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock