Question: have 1 and a half hour please need it quick 1) Suppose that an investor who demands a return of 20% from his/her portfolio has

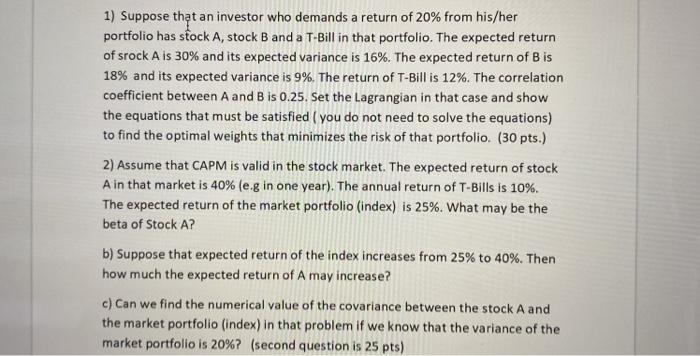

1) Suppose that an investor who demands a return of 20% from his/her portfolio has stock A, stock B and a T-Bill in that portfolio. The expected return of srock A is 30% and its expected variance is 16%. The expected return of Bis 18% and its expected variance is 9%. The return of T-Bill is 12%. The correlation coefficient between A and B is 0.25. Set the Lagrangian in that case and show the equations that must be satisfied (you do not need to solve the equations) to find the optimal weights that minimizes the risk of that portfolio. (30 pts.) 2) Assume that CAPM is valid in the stock market. The expected return of stock A in that market is 40% (e.g in one year). The annual return of T-Bills is 10%. The expected return of the market portfolio (index) is 25%. What may be the beta of Stock A? b) Suppose that expected return of the index increases from 25% to 40%. Then how much the expected return of A may increase? c) Can we find the numerical value of the covariance between the stock A and the market portfolio (index) in that problem if we know that the variance of the market portfolio is 20%? (second question is 25 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts