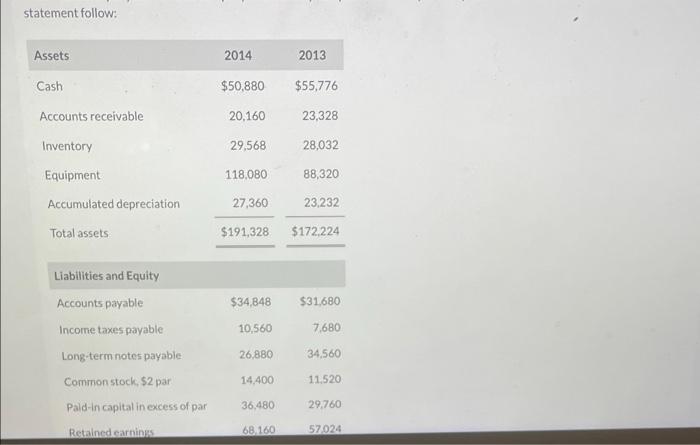

Question: Having a hard time understanding this chapter please hep statement follow: Assets 2014 2013 Cash $50,880 $55,776 Accounts receivable 20,160 23,328 Inventory 29.568 28,032 118.080

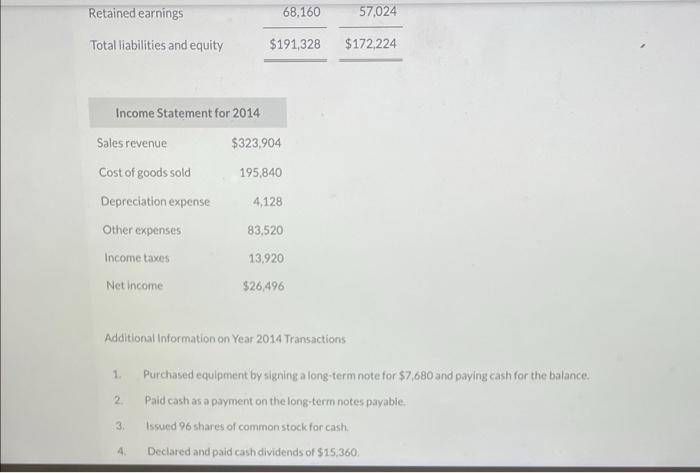

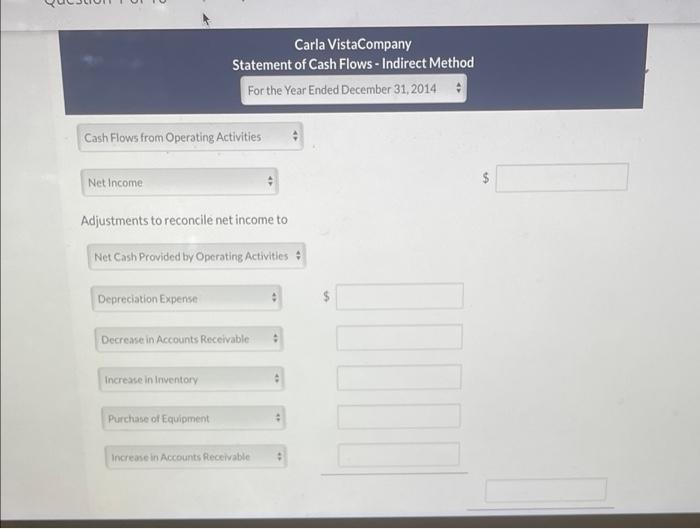

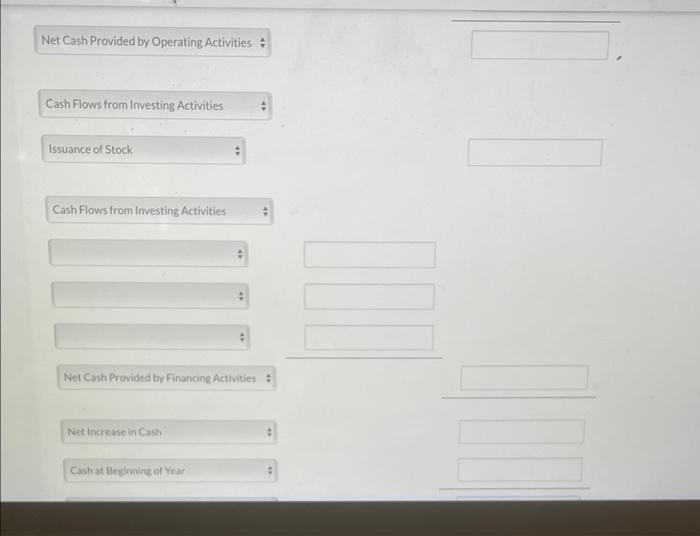

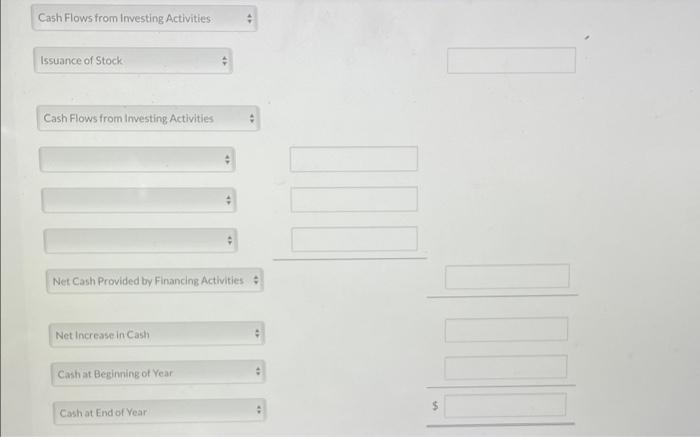

statement follow: Assets 2014 2013 Cash $50,880 $55,776 Accounts receivable 20,160 23,328 Inventory 29.568 28,032 118.080 88,320 Equipment Accumulated depreciation 27,360 23,232 Total assets $191,328 $172,224 $34,848 $31.680 10,560 7,680 Liabilities and Equity Accounts payable Income taxes payable Long-term notes payable Common stock, $2 par Pald-in capital in excess of par 26,880 34,560 14,400 11.520 36.480 29,760 Retained earnings 68.160 57,024 Retained earnings 68,160 57,024 Total liabilities and equity $191,328 $172,224 Income Statement for 2014 $323,904 Sales revenue Cost of goods sold Depreciation expense 195,840 4,128 Other expenses 83,520 13,920 Income taxes Net income $26,496 Additional Information on Year 2014 Transactions 1 2 a Purchased equipment by signing a long-term note for $7,680 and paying cash for the balance. Paid cash as a payment on the long-term notes payable Issued 96 shares of common stock for cash. Declared and paid cash dividends of $15,360. 3 4 Carla VistaCompany Statement of Cash Flows - Indirect Method For the Year Ended December 31, 2014 Cash Flows from Operating Activities Net Income $ Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Decrease in Accounts Receivable Increase in inventory Purchase of Equipment Increase in Accounts Receivable Net Cash Provided by Operating Activities : Cash Flows from Investing Activities Issuance of Stock Cash Flows from Investing Activities | Net Cash Provided by Financing Activities Net Increase in Cash Cash at Beginning of Year Cash Flows from Investing Activities: Issuance of Stock Cash Flows from Investing Activities Net Cash Provided by Financing Activities Net Increase in Cash Cahat Beginning of Year $ Cash at End of Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts