Question: Hea ES De Muncturing Income Statement for the Year Ended on December (Millioms af dollars) 5500 225 350 $150 Opera (ET) 170 20 the fun

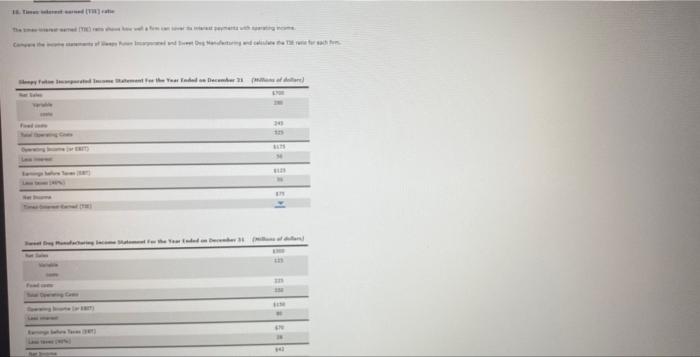

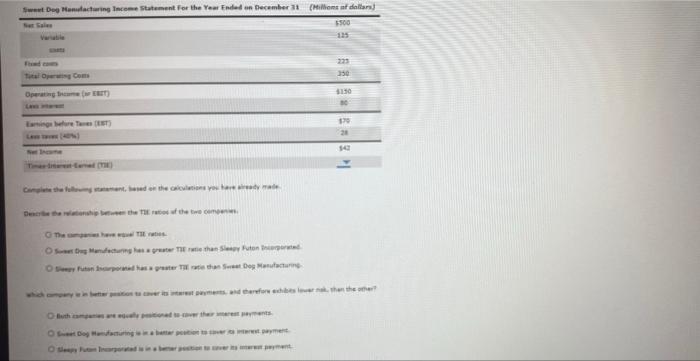

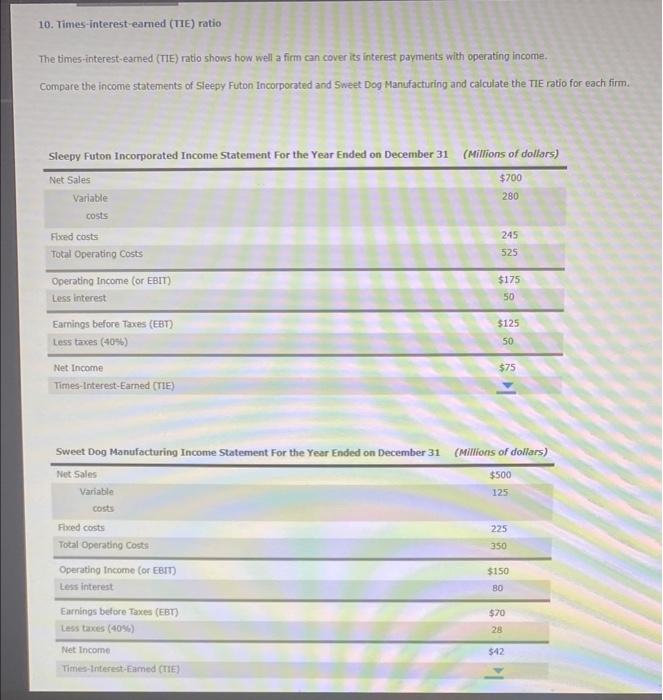

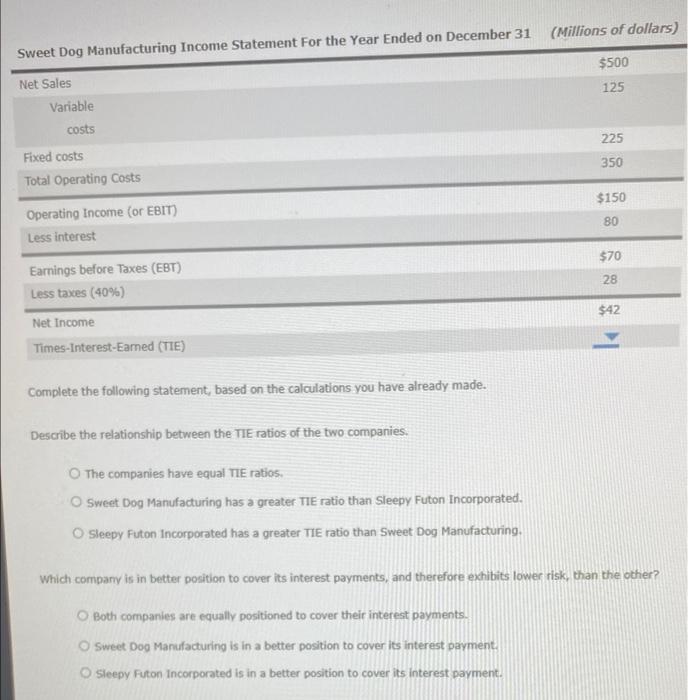

Hea ES De Muncturing Income Statement for the Year Ended on December (Millioms af dollars) 5500 225 350 $150 Opera (ET) 170 20 the fun or the action you are De the the two The O the Macturing her than yuton Out our ot De Mature But the O Downtown 10. Times-interest-eamed (TTE) ratio The times-interest earned (TIE) ratio shows how well a firm can cover its interest payments with operating income. Compare the income statements of Sleepy Futon Incorporated and Sweet Dog Manufacturing and calculate the TIE ratio for each firm. (Millions of dollars) Sleepy Futon Incorporated Income Statement For the Year Ended on December 31 Net Sales Variable costs $700 280 Faced costs Total Operating costs 245 525 $175 50 Operating Income (or EBIT) Less interest Earnings before Taxes (EBT) Less taxes (40%) $125 50 Net Income $75 Times-interest-Earned TIE) Sweet Dog Manufacturing Income Statement For the Year Ended on December 31 Net Sales Variable costs (Millions of dollars) $500 125 225 350 Fixed costs Total Operating costs Operating Income (or EBM Less interest $150 $70 Earnings before Taxes (EBT) Les taxes (40%) 28 $42 Net Income Times Interest.Eamed (IE) (Millions of dollars) Sweet Dog Manufacturing Income Statement For the Year Ended on December 31 $500 125 Net Sales Variable costs Fixed costs Total Operating costs 225 350 $150 Operating Income (or EBIT) Less interest 80 $70 28 Earnings before Taxes (EBT) Less taxes (40%) Net Income Times-Interest-Eamed (TIE) $42 Complete the following statement, based on the calculations you have already made. Describe the relationship between the TIE ratios of the two companies. The companies have equal TIE ratios. Sweet Dog Manufacturing has a greater TIE ratio than Sleepy Futon Incorporated. Sleepy Futon Incorporated has a greater TIE ratio than Sweet Dog Manufacturing Which company is in better position to cover its interest payments, and therefore exhibits lower risk, than the other? O Both companies are equally positioned to cover their interest payments. Sweet Dog Manufacturing is in a better position to cover its interest payment Sleepy Futon Incorporated is in a better position to cover its interest payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts