Question: hello can you help me with question 4? iii) A finance broker can arrange a $2 million loan repayable in a lump-sum payment of $2761513

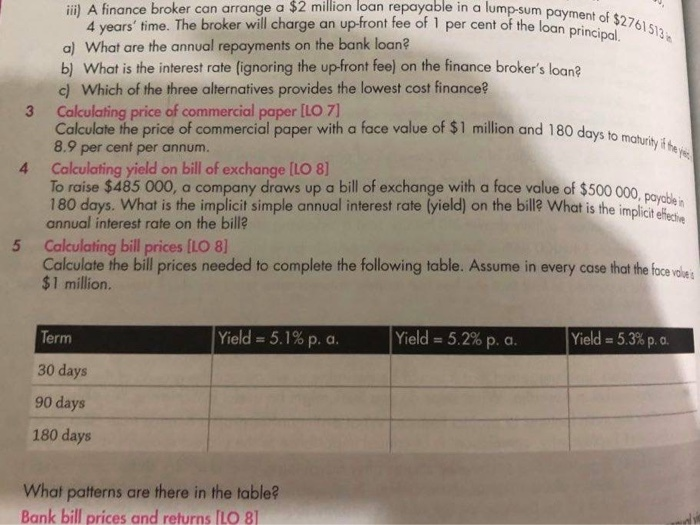

iii) A finance broker can arrange a $2 million loan repayable in a lump-sum payment of $2761513 a) What are the annual repayments on the bank loan b) What is the interest rate ignoring the up-front fee) on the finance broker's loan? c) Which of the three alternatives provides the lowest cost finance? Calculate the price of commercial paper with a face value of $1 million and 180 days to maturity at they 8.9 per cent per annum. 4 Calculating yield on bill of exchange (LO 8] To raise $485 000, a company draws up a bill of exchange with a face value of $500 000, payable in 180 days. What is the implicit simple annual interest rate (yield) on the bille What is the implicit elhecho annual interest rate on the bill? 5 Calculating bill prices [LO 8] Calculate the bill prices needed to complete the following table. Assume in every case that the face volue's $1 million. Term Yield = 5.1% p. a. Yield = 5.2% p. a. Yield = 5.3% p.o. 30 days 90 days 180 days What patterns are there in the table? Bank bill prices and returns (LO 81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts