Question: hello can you help on this question please The following is a summary of the transactions for the year: a. Provided services, $100,000, of which

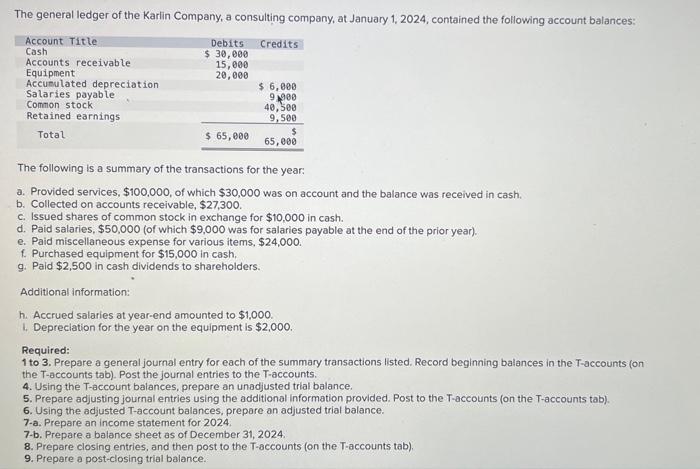

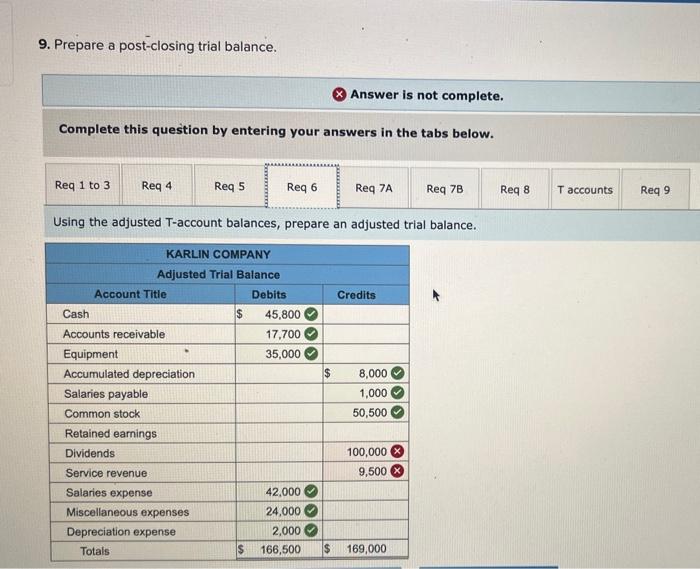

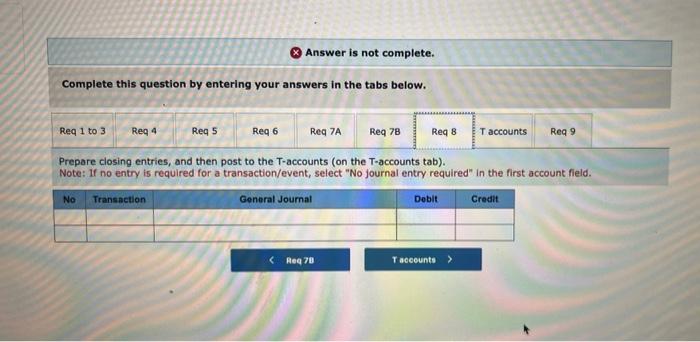

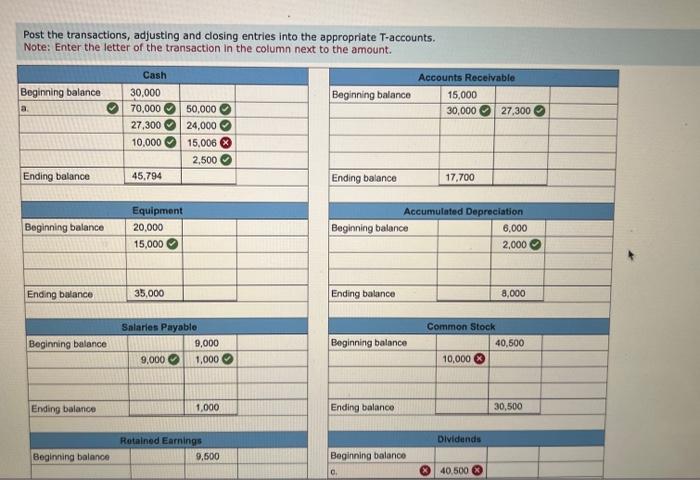

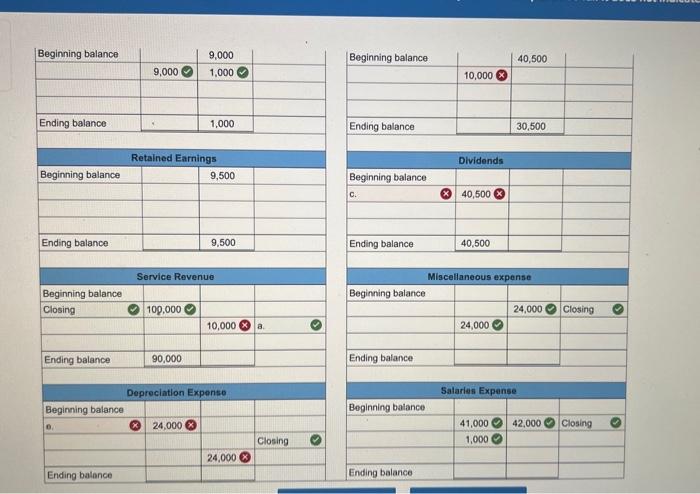

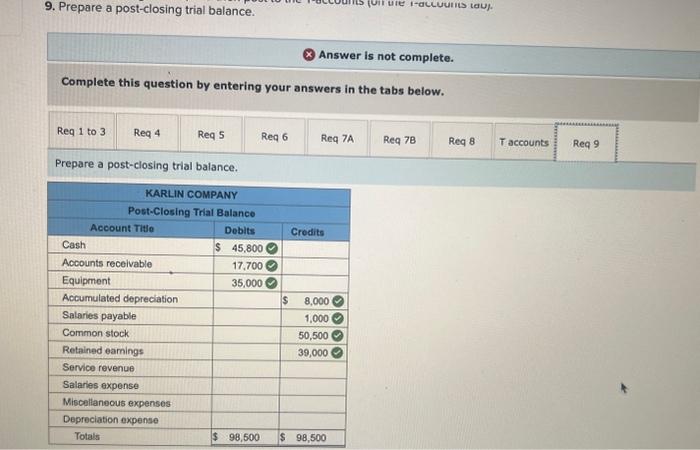

The following is a summary of the transactions for the year: a. Provided services, $100,000, of which $30,000 was on account and the balance was received in cash, b. Collected on accounts receivable, $27,300. c. Issued shares of common stock in exchange for $10,000 in cash. d. Paid salaries, $50,000 (of which $9,000 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $24,000. f. Purchased equipment for $15,000 in cash. g. Paid $2,500 in cash dividends to shareholders. Additional information: h. Accrued salaries at year-end amounted to $1,000. 1. Depreciation for the year on the equipment is $2,000. Required: 1 to 3. Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the T-accounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024 . 7-b. Prepare a balance sheet as of December 31, 2024 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance. 9. Prepare a post-closing trial balance. Answer is not complete. Complete this question by entering your answers in the tabs below. Using the adjusted T-account balances, prepare an adjusted trial balance. X Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a transaction/event, select "No journal entry required" in the fir Post the transactions, adjusting and closing entries into the appropriate T-accounts. Note: Enter the letter of the transaction in the column next to the amount. \begin{tabular}{|l|l|l|l|} \hline Beginning balance & & 9,000 & \\ \hline & 9,000 & 1,000 & \\ \hline & & & \\ \hline & & & \\ \hline Ending balance & & 1,000 & \\ \hline & \multicolumn{3}{|l|}{} \\ \hline & & \\ \hline Beginning balance & & 9,500 & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending balance & & 9,500 & \\ \hline & & \\ \hline \end{tabular} 9. Prepare a post-closing trial balance. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts