Question: Please try to answer using Excel with formulas shown, Thank you You must complete your work in Excel using formulas. Please submit your Excel tile

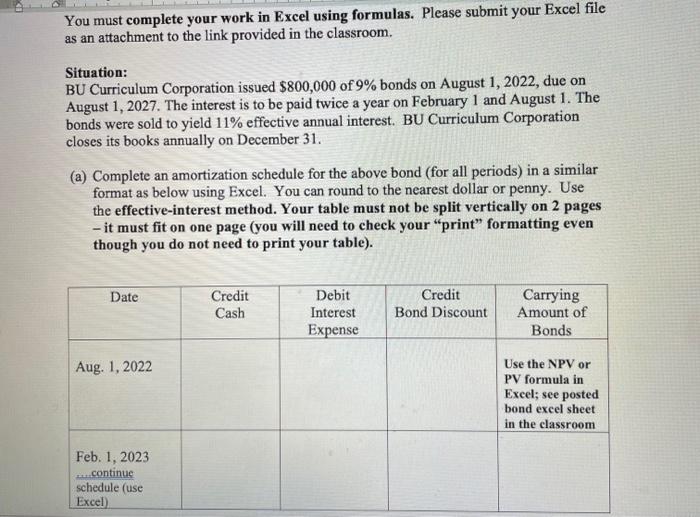

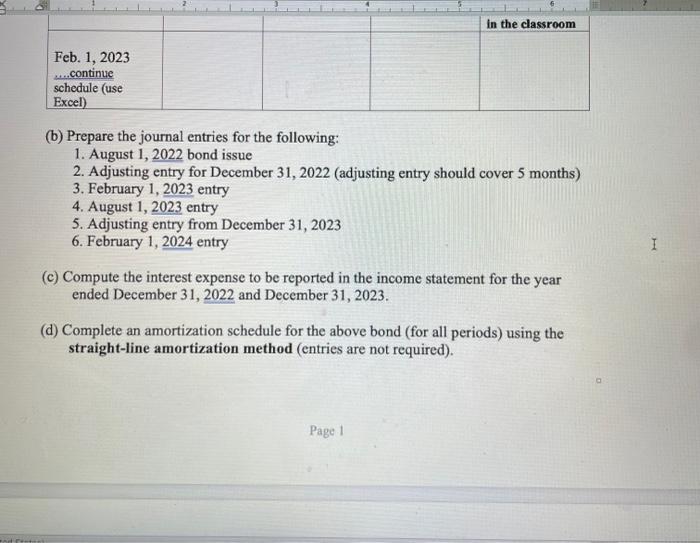

You must complete your work in Excel using formulas. Please submit your Excel tile as an attachment to the link provided in the classroom. Situation: BU Curriculum Corporation issued $800,000 of 9% bonds on August 1, 2022, due on August 1, 2027. The interest is to be paid twice a year on February 1 and August 1. The bonds were sold to yield 11% effective annual interest. BU Curriculum Corporation closes its books annually on December 31 . (a) Complete an amortization schedule for the above bond (for all periods) in a similar format as below using Excel. You can round to the nearest dollar or penny. Use the effective-interest method. Your table must not be split vertically on 2 pages - it must fit on one page (you will need to check your "print" formatting even though you do not need to print your table). (b) Prepare the journal entries for the following: 1. August 1, 2022 bond issue 2. Adjusting entry for December 31,2022 (adjusting entry should cover 5 months) 3. February 1, 2023 entry 4. August 1, 2023 entry 5. Adjusting entry from December 31,2023 6. February 1, 2024 entry (c) Compute the interest expense to be reported in the income statement for the year ended December 31, 2022 and December 31,2023. (d) Complete an amortization schedule for the above bond (for all periods) using the straight-line amortization method (entries are not required). You must complete your work in Excel using formulas. Please submit your Excel tile as an attachment to the link provided in the classroom. Situation: BU Curriculum Corporation issued $800,000 of 9% bonds on August 1, 2022, due on August 1, 2027. The interest is to be paid twice a year on February 1 and August 1. The bonds were sold to yield 11% effective annual interest. BU Curriculum Corporation closes its books annually on December 31 . (a) Complete an amortization schedule for the above bond (for all periods) in a similar format as below using Excel. You can round to the nearest dollar or penny. Use the effective-interest method. Your table must not be split vertically on 2 pages - it must fit on one page (you will need to check your "print" formatting even though you do not need to print your table). (b) Prepare the journal entries for the following: 1. August 1, 2022 bond issue 2. Adjusting entry for December 31,2022 (adjusting entry should cover 5 months) 3. February 1, 2023 entry 4. August 1, 2023 entry 5. Adjusting entry from December 31,2023 6. February 1, 2024 entry (c) Compute the interest expense to be reported in the income statement for the year ended December 31, 2022 and December 31,2023. (d) Complete an amortization schedule for the above bond (for all periods) using the straight-line amortization method (entries are not required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts