Question: Hello, I am struggling with this homework problem for my accounting class. Thank you for the help! Continental Railroad Company is evaluating three capital investment

Hello, I am struggling with this homework problem for my accounting class. Thank you for the help!

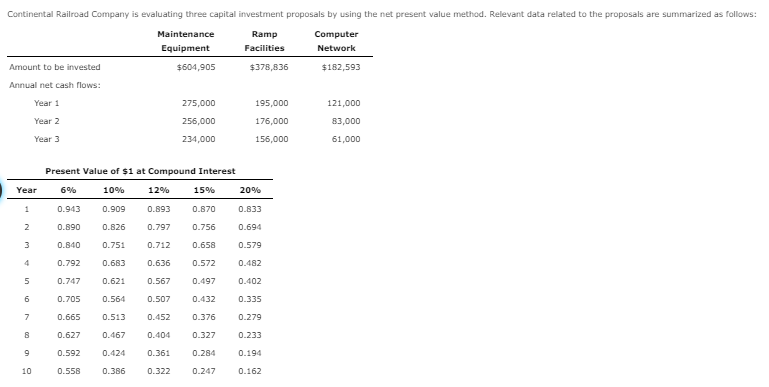

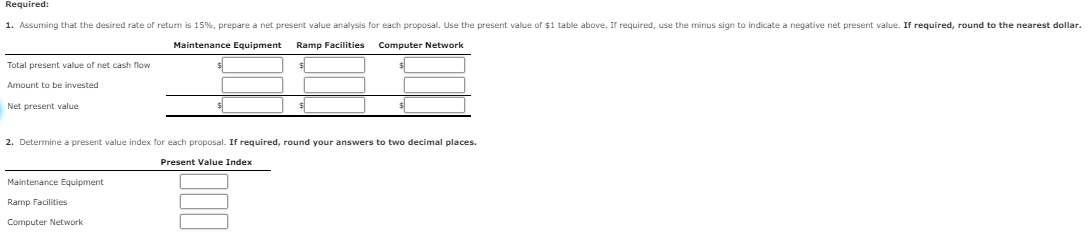

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Maintenance Equipment Ramp Facilities Computer Network $604,905 $378,836 $182,593 Amount to be invested Annual net cash flows: Year 1 Year 2 275,000 256,000 234,000 195,000 176,000 156,000 121,000 83,000 61,000 Year 3 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0 .893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.658 0.579 0.572 0.482 0.402 0.840 0.792 0.747 0.705 0.665 0.627 0.592 .558 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.712 0.636 0.567 0.507 0.452 0.404 0.404 0.361 0.322 0.335 0.279 0.432 0.376 0.327 0.284 0.247 0.233 0.194 0.162 10 0 Required: 1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each proposal. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar. Maintenance Equipment Ramp Facilities Computer Network Total present value of net cash flow Amount to be invested Net present value 2. Determine a present value index for each proposal. If required, round your answers to two decimal places. Present Value Index Maintenance Equipment Ramp Facilities Computer Network

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts