Question: Hello, I can't find how to solve this question. I am stuck and other questions are based on this answer. Can you please help me.

Hello,

I can't find how to solve this question. I am stuck and other questions are based on this answer.

Can you please help me.

Thanks.

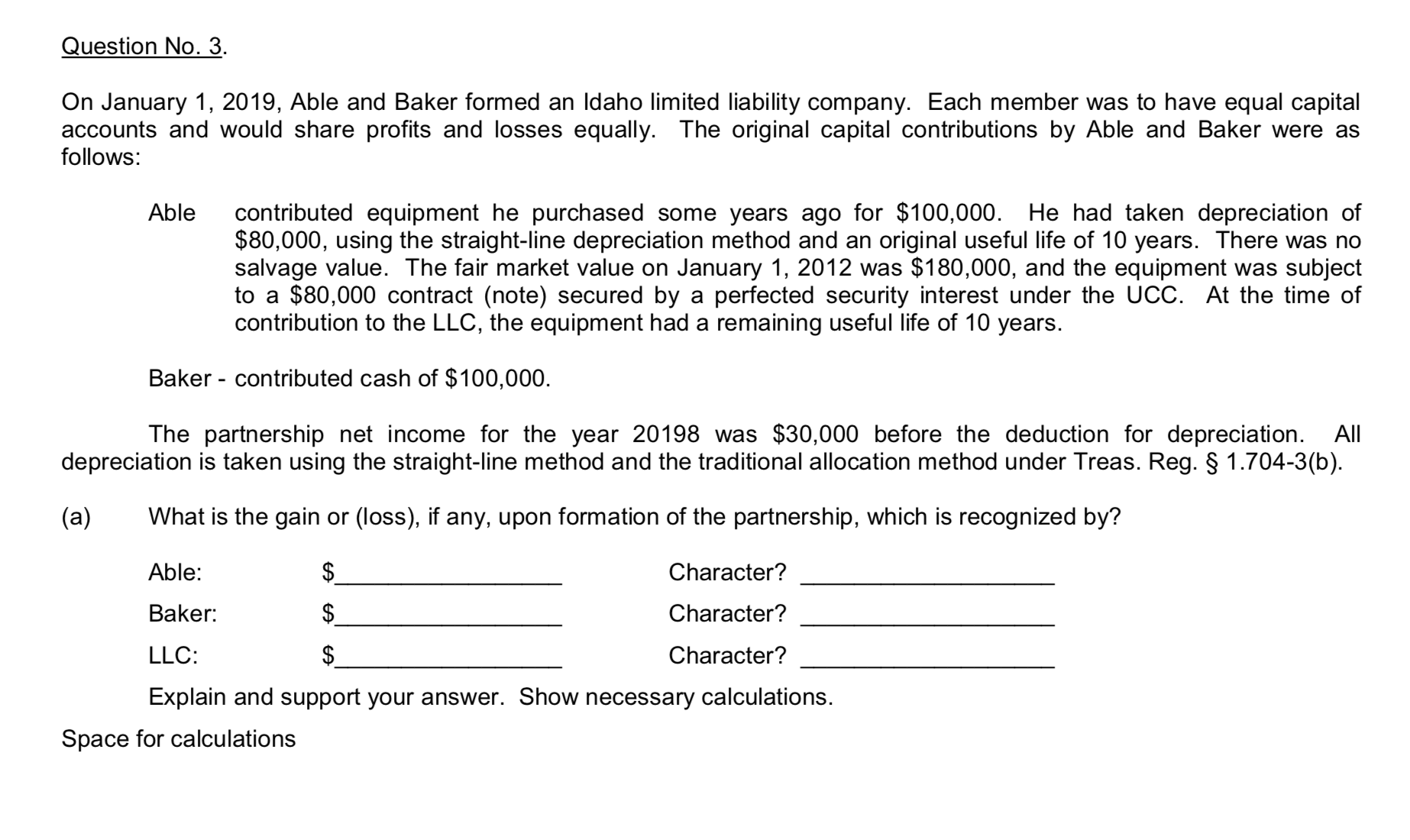

Question No. 3. On January 1, 2019, Able and Baker formed an Idaho limited liability company. Each member was to have equal capital accounts and would share profits and losses equally. The original capital contributions by Able and Baker were as follows: Able contributed equipment he purchased some years ago for $100,000. He had taken depreciation of $80,000, using the straight-line depreciation method and an original useful life of 10 years. There was no salvage value. The fair market value on January 1, 2012 was $180,000, and the equipment was subject to a $80,000 contract (note) secured by a perfected security interest under the UCC. At the time of contribution to the LLC, the equipment had a remaining useful life of 10 years. Baker - contributed cash of $100,000. The partnership net income for the year 20198 was $30,000 before the deduction for depreciation. All depreciation is taken using the straight-line method and the traditional allocation method under Treas. Reg. 1.704-3(b). (a) What is the gain or (loss), if any, upon formation of the partnership, which is recognized by? Able: $ Character? Baker: $ Character? LLC: $ Character? Explain and support your answer. Show necessary calculations. Space for calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts