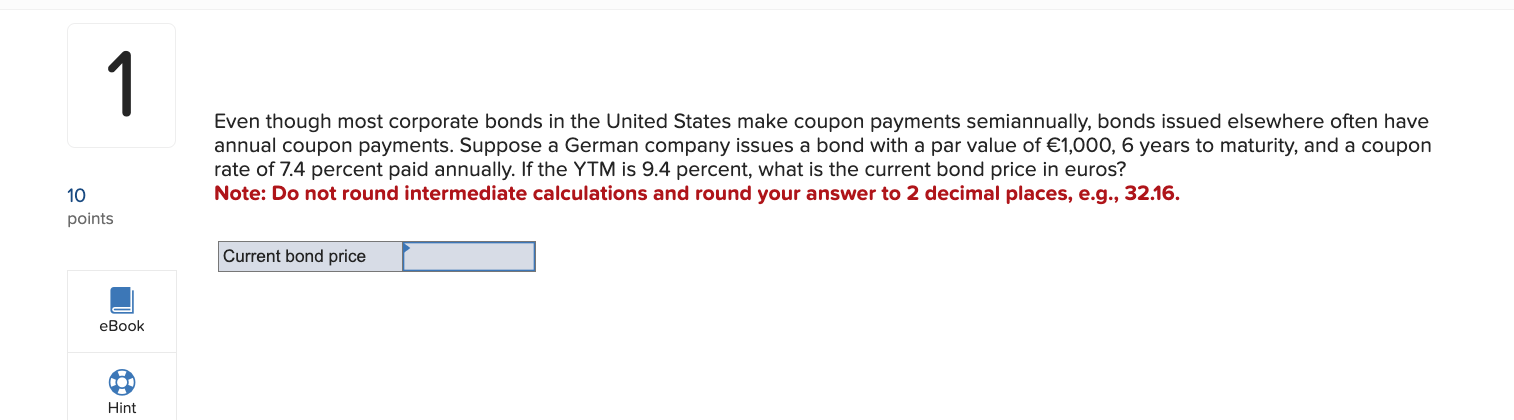

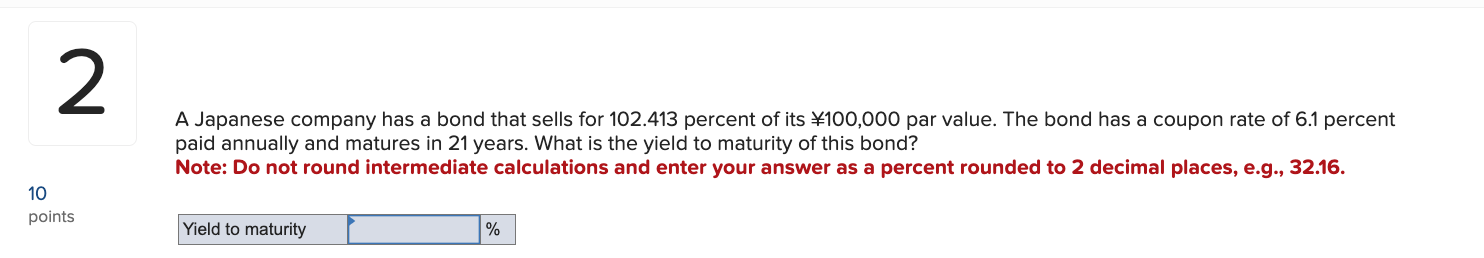

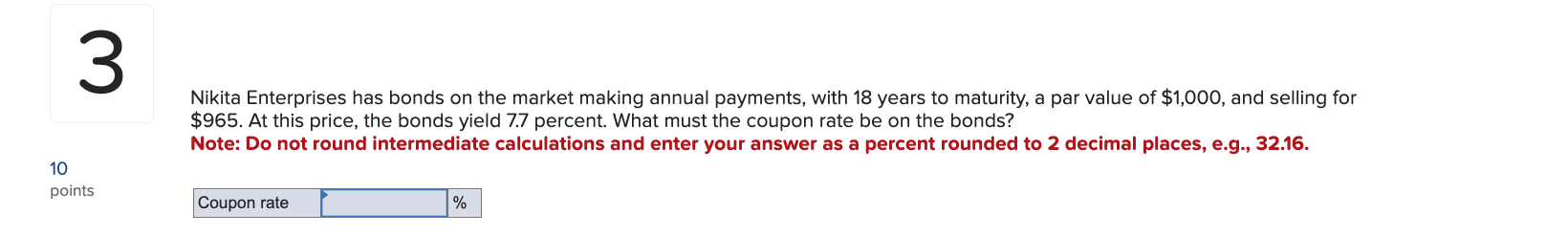

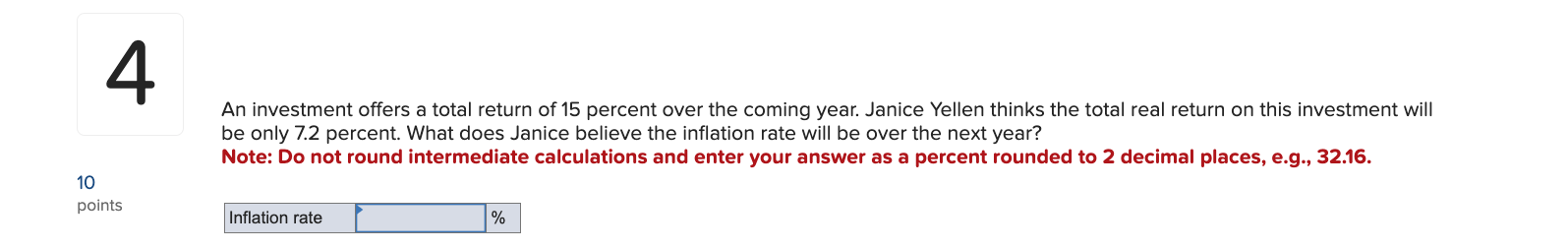

Question: Hello. I could really use help answering these 5 questions below for my homework practice assignment for Financial Management Principles that I am struggling with.

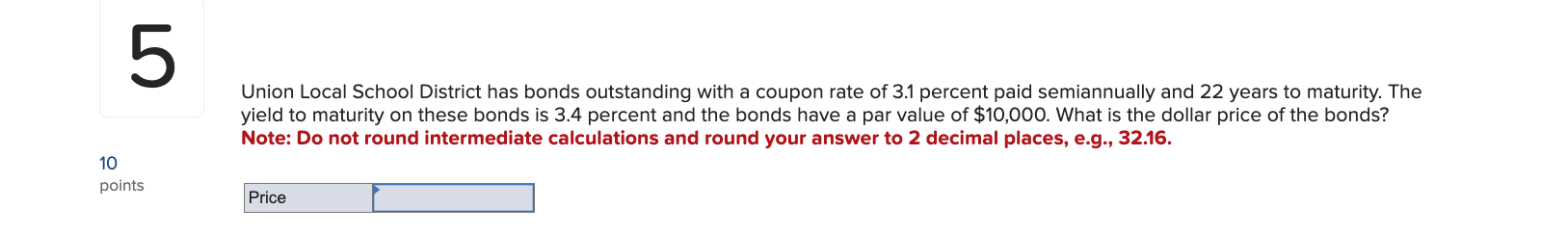

Hello. I could really use help answering these 5 questions below for my homework practice assignment for Financial Management Principles that I am struggling with. Any help answering the questions so I can understand for future reference would be a great help. Book reference if needed: Essentials of Corporate Finance, 11th edition, McGraw Hill, Author: Ross. These questions cover Chapter 6.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock