Question: hello i need hello with these 20 multiple choice accounting questions TB 11-01 For a business to be considered a corporation.. For a business to

hello i need hello with these 20 multiple choice accounting questions

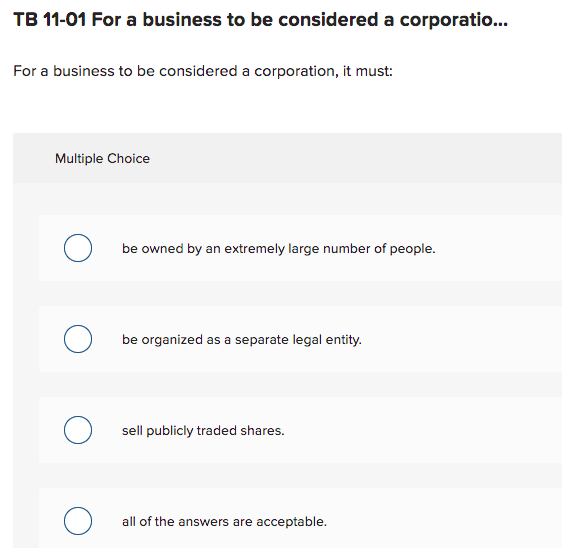

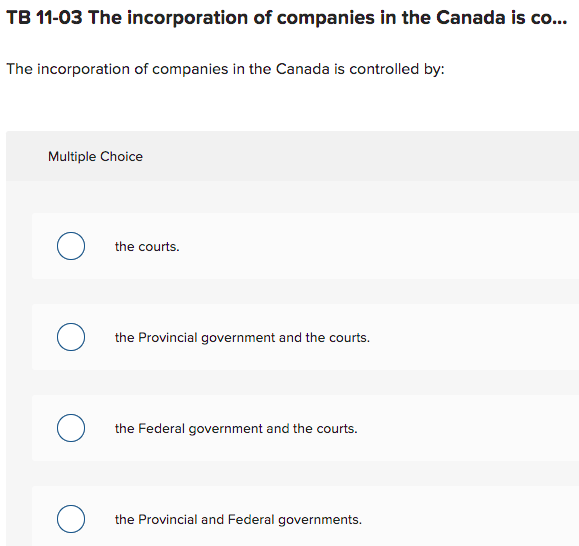

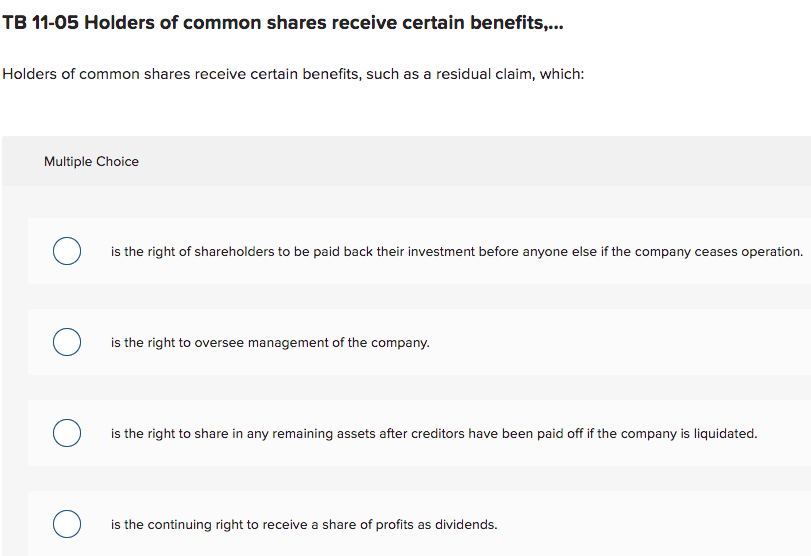

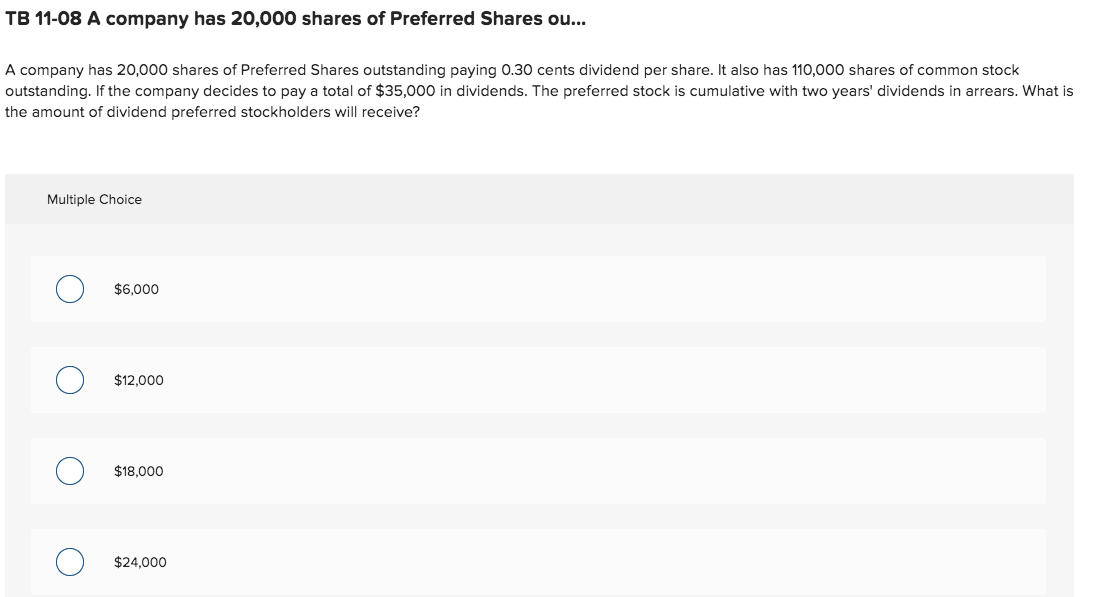

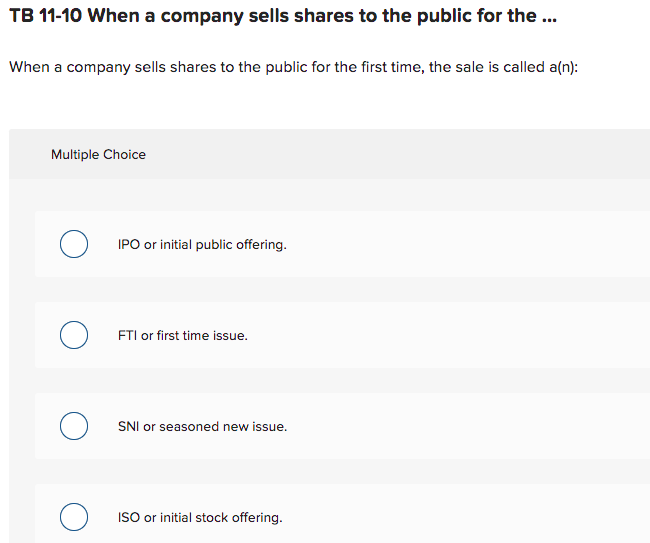

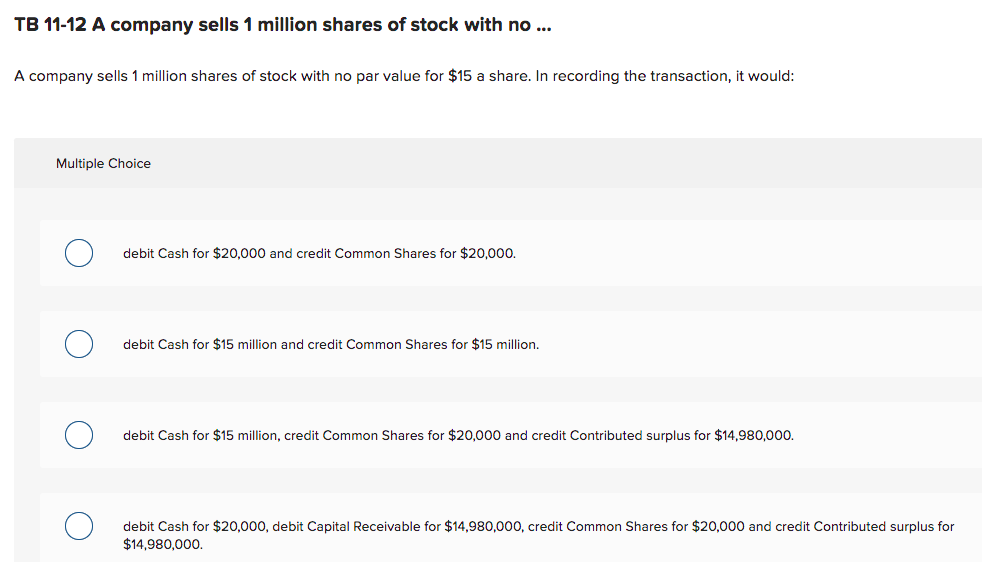

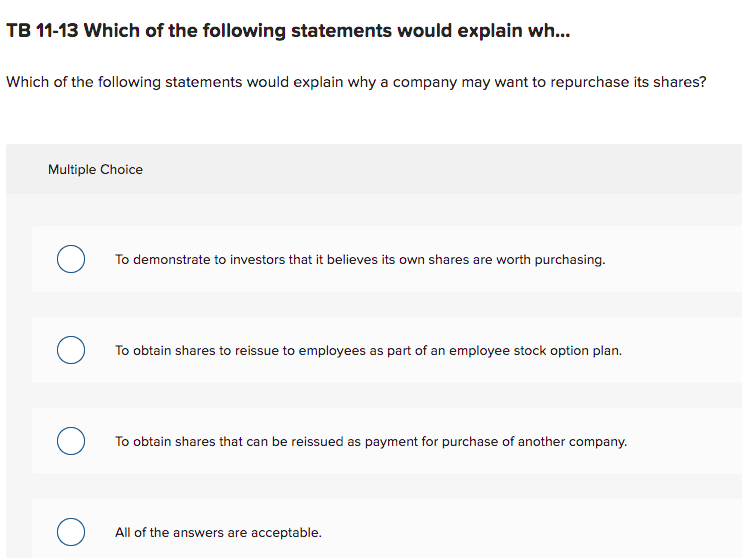

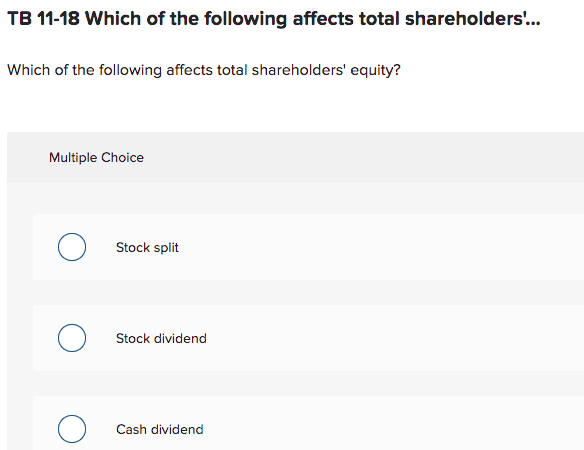

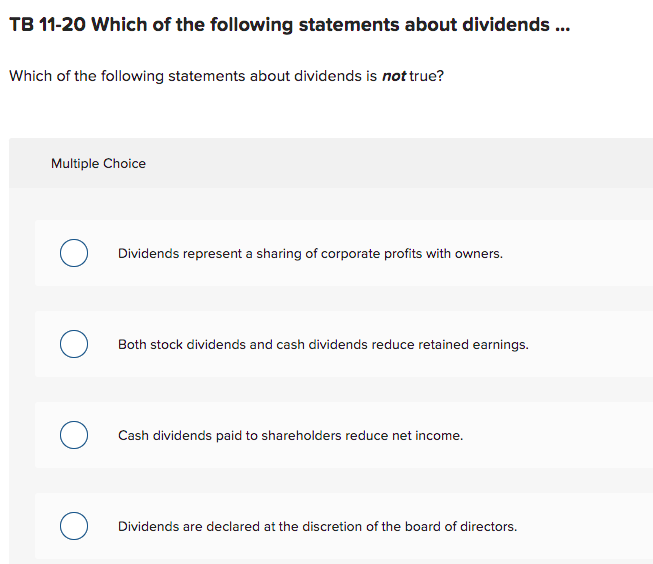

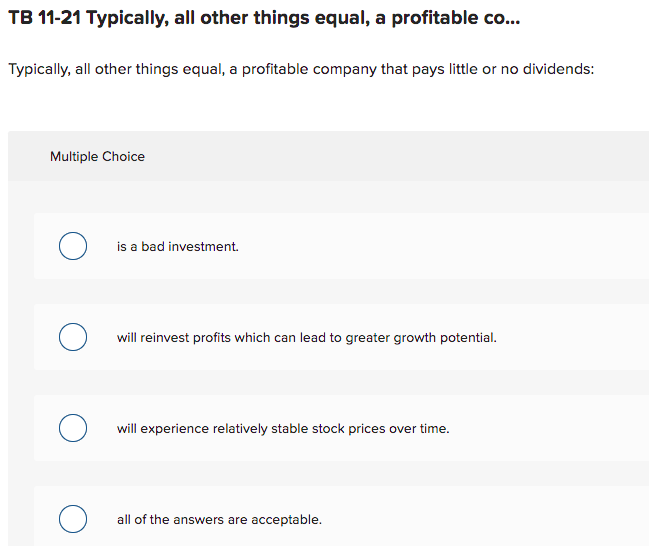

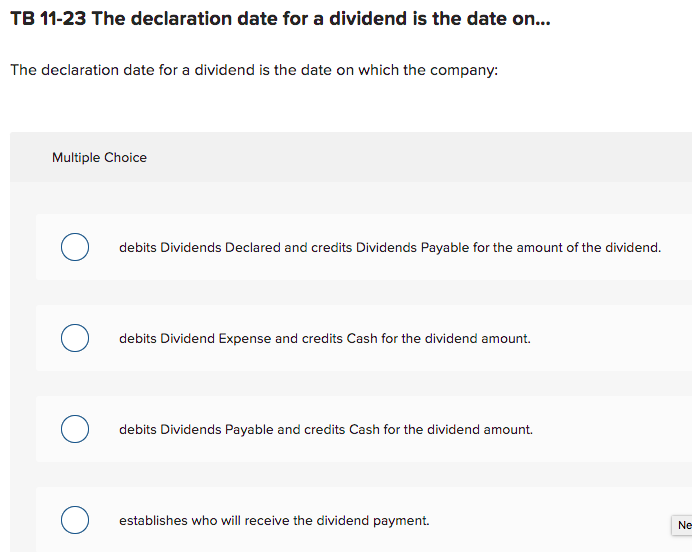

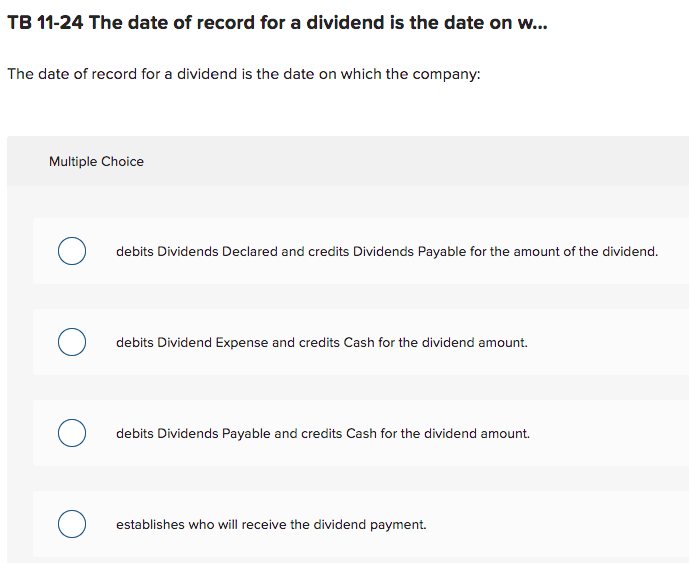

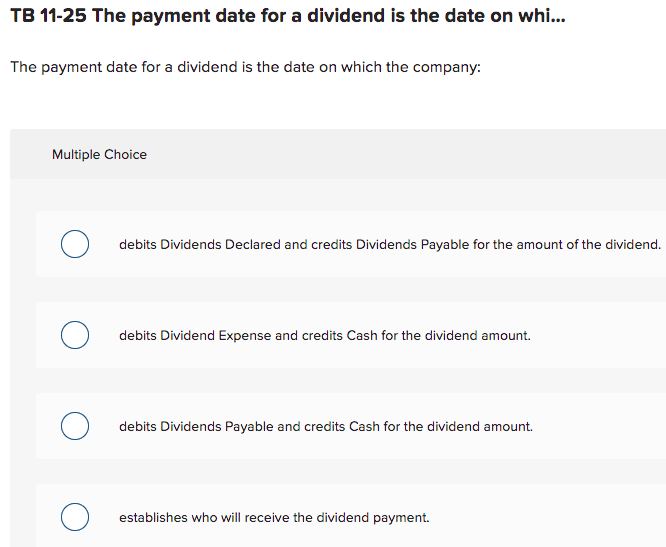

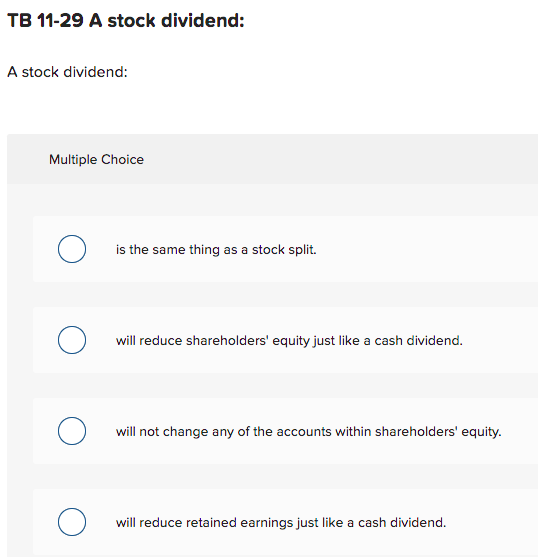

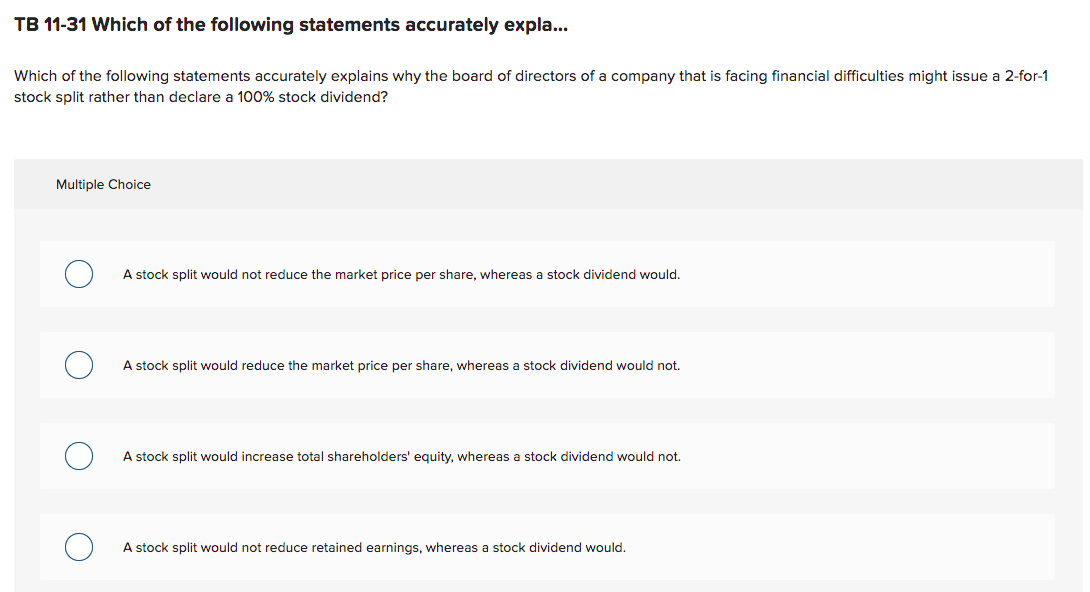

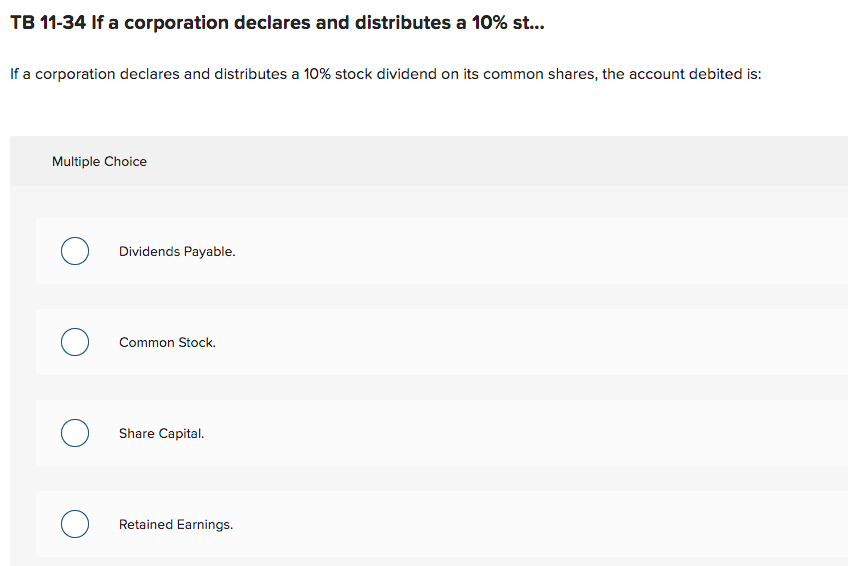

TB 11-01 For a business to be considered a corporation.. For a business to be considered a corporation, it must: Multiple Choice O be owned by an extremely large number of people. O be organized as a separate legal entity. O sell publicly traded shares. O all of the answers are acceptable.TB 11-03 The incorporation of companies in the Canada is co... The incorporation of companies in the Canada is controlled by: Multiple Choice O the courts. O the Provincial government and the courts. O the Federal government and the courts. O the Provincial and Federal governments.TB 11-05 Holders of common shares receive certain benefits,... Holders of common shares receive certain benefits, such as a residual claim, which: Multiple Choice O is the right of shareholders to be paid back their investment before anyone else if the company ceases operation. O is the right to oversee management of the company. O is the right to share in any remaining assets after creditors have been paid off if the company is liquidated. O is the continuing right to receive a share of profits as dividends.TB 11-08 A company has 20,000 shares of Preferred Shares ou... A company has 20,000 shares of Preferred Shares outstanding paying 0.30 cents dividend per share. It also has 110,000 shares of common stock outstanding. If the company decides to pay a total of $35,000 in dividends. The preferred stock is cumulative with two years' dividends in arrears. What is the amount of dividend preferred stockholders will receive? Multiple Choice O $6,000 O $12,000 O $18,000 O $24,000TB 11-10 When a company sells shares to the public for the ... When a company sells shares to the public for the first time, the sale is called a(n): Multiple Choice O IPO or initial public offering. O FTI or first time issue. O SNI or seasoned new issue. O ISO or initial stock offering.TB 11-12 A company sells 1 million shares of stock with no A company sells 1 million shares of stock with no par value for $15 a share. In recording the transaction. it would: Mu itiple Choice 0 debit Cash for $20,000 and credit Common Shares for 520.0001 0 debit Cash for $15 million and credit Common Shares for $15 million. 0 debit Cash for $15 million. credit Common Shares for $20,000 and credit Contributed surplus for $14,980.000. O debit Cash for $2 0.000, debit Capital Receivable for $14,980.00 0. credit Common Shares for $20,000 and credit Contributed surplus for 514330000. TB 11-13 Which of the following statements would explain wh... 1Which of the following statements would explain why a company may want to repurchase its shares? Multiple Choice 0 To demonstrate to investors that it believes its own shares are worth purchasing. To obtain shares to reissue to employees as part of an employee stock option plan. 0 To obtain shares that can be reissued as payment for purchase of another company. 0 All of the answers are acceptable. TB 11-18 Which of the following affects total shareholders... Which of the following affects total shareholders' equity? Multiple Choice O Stock split O Stock dividend O Cash dividendTB 11-20 Which of the following statements about dividends ... Which of the following statements about dividends is not true? Multiple Choice O Dividends represent a sharing of corporate profits with owners. O Both stock dividends and cash dividends reduce retained earnings. O Cash dividends paid to shareholders reduce net income. O Dividends are declared at the discretion of the board of directors.TB 11-21 Typically, all other things equal, a protable co... Typically, all other things equal, a protable company that pays little or no dividends: Multiple Choice 0 is a had investment. 0 will reinvest prots which can lead to greater growth potential. 0 will experience relatively stable stock prices overtime. 0 all of the answers are acceptable. TB 11-23 The declaration date for a dividend is the date an... The declaration date for a dividend is the date cm which the company: Multiple Chbice O debits Dividends Declared and credits Dividends Payable fer the amount bf the dividend. debits Dividend Expense and credits Cash fer the dividend amount. 0 debits Dividends Payable and credits Cash fer the dividend ambunt 0 establishes when will receive the dividend payment. | s TB 11-24 The date of record for a dividend is the date on W... The date of record for a dividend is the date on which the company: Multiple Choice O debits Dividends Declared and credits Dividends Payable for the amount of the dividend. O debits Dividend Expense and credits Cash for the dividend amount. O debits Dividends Payable and credits Cash for the dividend amount. O establishes who will receive the dividend payment.TB 11-25 The payment date for a dividend is the date on whi... The payment date for a dividend is the date on which the company: Multiple Choice 0 debits Dividends Declared and credits Dividends Payable for the amount of the dividend. debits Dividend Expense and credits Cash for the dividend amount. 0 debits Dividends Payable and credits Cash for the dividend amount. 0 establishes who will receive the dividend payment. TB 11-29 A stock dividend: A stock dividend: Multiple Choice O is the same thing as a stock split. O will reduce shareholders' equity just like a cash dividend. O will not change any of the accounts within shareholders' equity. O will reduce retained earnings just like a cash dividend.TB 11-31 Which of the following statements accurately expla Which of the following statements accurately explains why the board of directors of a company that is facing financial difficulties might issue a 2-for-1 stock split rather than declare a 100% stock dividend? Multiple Choice O A stock split would not reduce the market price per share, whereas a stock dividend would. O A stock split would reduce the market price per share, whereas a stock dividend would not. O A stock split would increase total shareholders' equity, whereas a stock dividend would not. O A stock split would not reduce retained earnings, whereas a stock dividend would.TB 11-34 If a corporation declares and distributes a 10% st... If a corporation declares and distributes a 10% stock dividend on its common shares, the account debited is: Multiple Choice O Dividends Payable. O Common Stock. O Share Capital. O Retained Earnings.TB 11-39 Preferred shares differ from common shares in that... Preferred shares differ from common shares in that preferred shares: Multiple Choice O have more voting power and, as such, greater control over the management of the company. O because preferred shareholders are paid dividends before common shareholders. O receive a tax-free dividend. O all of the answers are acceptable.TB 11-41 A current dividend preference means that: A current dividend preference means that: Multiple Choice 0 preferred shareholders are paid dividends before common shareholders are paid dividends. unpaid dividends to preferred shareholders accumulate and must be paid before common shareholders receive dividends. 0 preferred shareholders are paid their full fixed dividend rate each period as long as the company is in operation. 0 unpaid cash dividends to preferred shareholders must be replaced with stock dividends during the current period. TB 11-42 A cumulative dividend preference means that: A cumulative dividend preference means that: Multiple Choice 0 preferred shareholders are paid dividends before common shareholders are paid dividends for the current year only. 0 unpaid dividends to preferred shareholders accumulate and must be paid before common shareholders receive dividends. 0 preferred shareholders are paid their full fixed dividend rate each period as long as the company is in operation. 0 unpaid cash dividends to preferred shareholders must be replaced with stock dividends during the current period. TB 11-76 Equity financing Equity financing Multiple Choice O never has to be repaid. O mustal ways be repaid. O usually has to be repaid. O answer depends on company's use of IFRS or ASPE