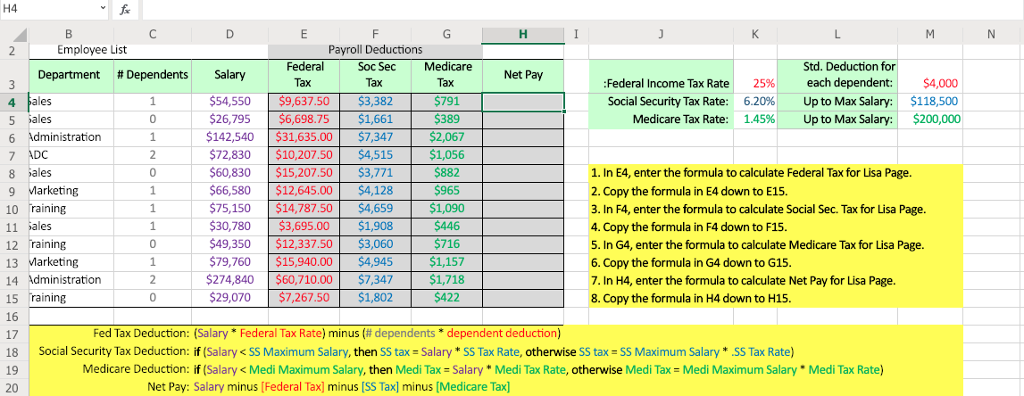

Question: Hello, I need help with cell H4. To get the answer, the hint is at the bottom. The answer NEEDS to be $40,739 but for

Hello, I need help with cell H4. To get the answer, the hint is at the bottom. The answer NEEDS to be $40,739 but for some reason I keep getting $54,400. Please show me the formula you use to get the answer which is $40,739. Thanks!

H4 fe Employee List Payroll Deductions Soc Sec Tax Medicare Net Pay Std. Deduction for each dependent: up to Max Salary: Up to Max Salary: Federal Tax Department # Dependents Salary Tax $791 $389 Federal Income Tax Rate Social Security Tax Rate: Medicare Tax Rate: 25% 6.20% 1.45% $4,000 $118,500 $200,000 4 ales $54,550$9,637.50 $3,382 $26,795 $6,698.75 $1,661 inistration 142,540 $31,635.00 $7,347 2,067 72,830 $10,207.50 $4,515 $1,056 $60,830 $15,207.50 $3,771 1. In E4, enter the formula to calculate Federal Tax for Lisa Page. 2. Copy the formula in E4 down to E15 3. In F4, enter the formula to calculate Social Sec. Tax for Lisa Page 4. Copy the formula in F4 down to F15. 5. In G4, enter the formula to calculate Medicare Tax for Lisa Page. 6. Copy the formula in G4 down to G15 7. In H4, enter the formula to calculate Net Pay for Lisa Page. 8. Copy the formula in H4 down to H15. 9 Marketing 10 Training $66,580 $12,645.00 4,128 75,150 $14,787.50 $4,659 $1,090 $965 $30,780 $3,695 30,780 $3,695.00 $1,908 3 Marketing 14 Administration 15 raining 49,350$12,337.50 $3,060 79,760 $15,940.00 $4,945 $1,157 274,840 $60,710.00 7,347$1,718 29,070$7,267.50 $1,802 Fed Tax Deduction: (Salary * Federal Tax Rate) minus (# dependents* dependent deduction) 18 Social Security Tax Deduction: if (Salary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts