Question: Hello! I really need help with this. I already did frok question 1-6. I hope is right (if is possible could you please check them)

| Using the Redwood City Pet Shoppe Adjusted Trial Balance for July 31st, which you created; | ||

| Prepare A Statement of Retained Earnings for the Redwood City Pet Shoppe as of July 31, Question 10: | Using the Redwood City Pet Shoppe Adjusted Trial Balance for July 31st, which you created; | Prepare A Balance Sheet for the Redwood City Pet Shoppe as of July 31, 2021. |

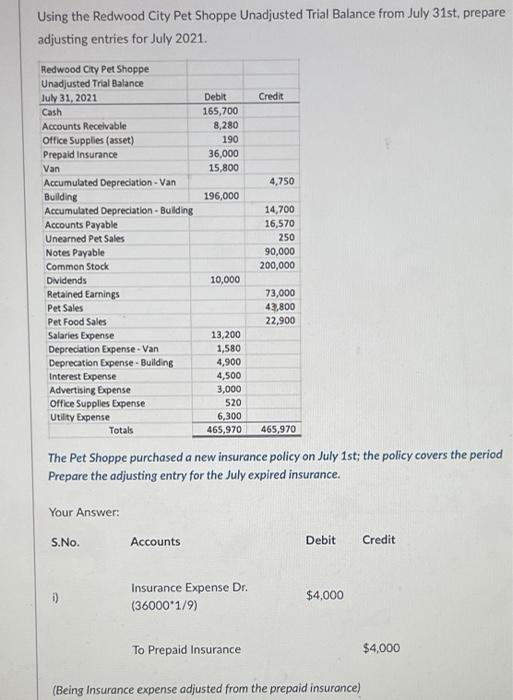

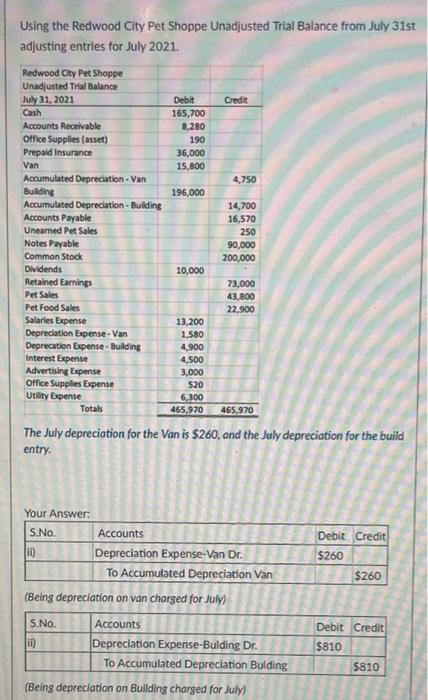

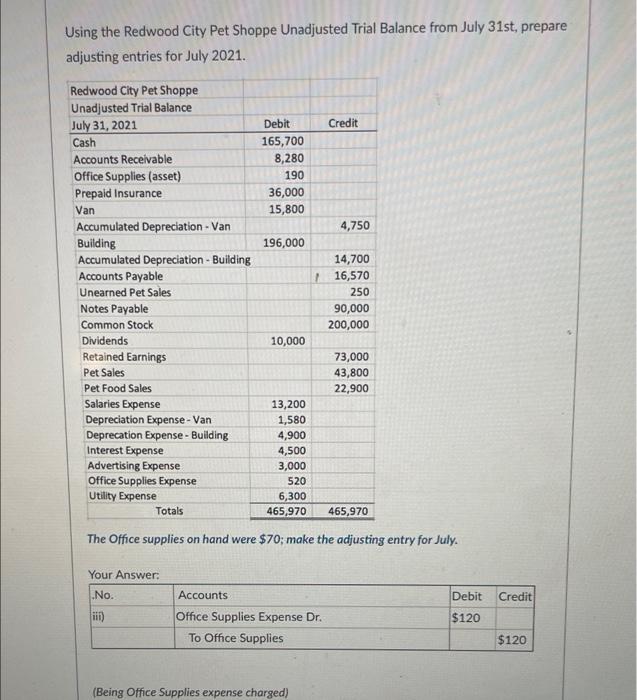

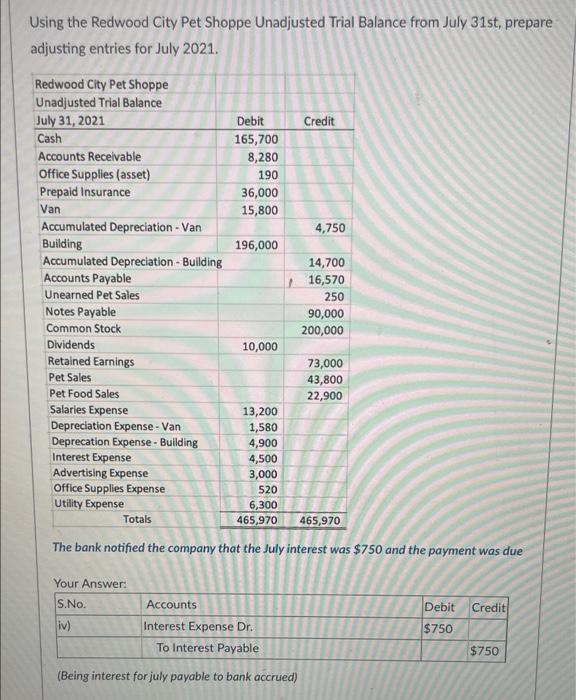

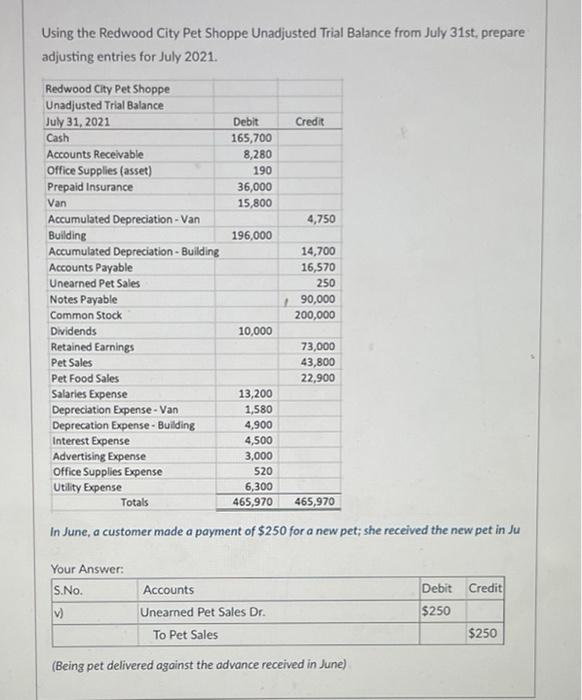

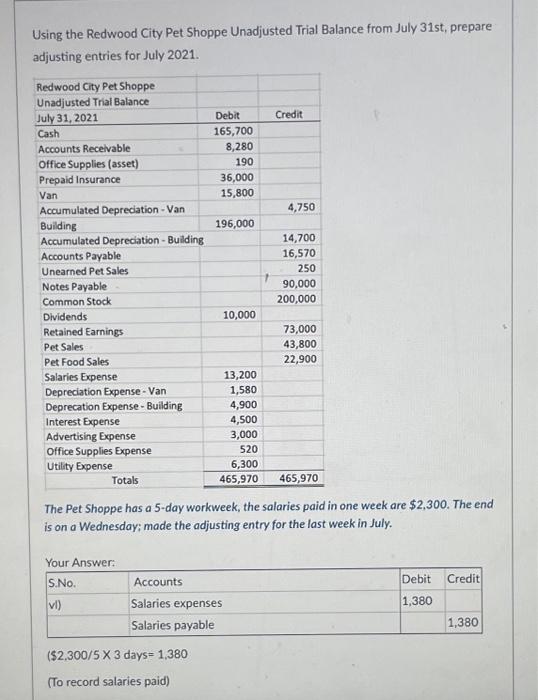

Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare adjusting entries for July 2021. Credit Debit 165,700 8,280 190 36,000 15,800 4,750 196,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Cash Accounts Receivable Office Supplies (asset) Prepaid Insurance Van Accumulated Depreciation - Van Building Accumulated Depreciation - Building Accounts Payable Unearned Pet Sales Notes Payable Common Stock Dividends Retained Earnings Pet Sales Pet Food Sales Salaries Expense Depreciation Expense - Van Deprecation Expense - Building Interest Expense Advertising Expense Office Supplies Expense Utility Expense Totals 14,700 16,570 250 90,000 200,000 10,000 73,000 43,800 22,900 13,200 1,580 4,900 4,500 3,000 520 6,300 465,970 465,970 The Pet Shoppe purchased a new insurance policy on July 1st; the policy covers the period Prepare the adjusting entry for the July expired insurance. Your Answer: S.No. Accounts Debit Credit 1) Insurance Expense Dr. (36000*1/9) $4,000 To Prepaid Insurance $4,000 (Being Insurance expense adjusted from the prepaid insurance) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Unearned Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22.900 Salaries Expense 13,200 Depreciation Expense - Van 1.580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 The July depreciation for the Van is $260, and the July depreciation for the build entry. Debit Credit $260 $260 Your Answer: S.No. Accounts Depreciation Expense-Van Dr. To Accumulated Depreciation Van (Being depreciation on van charged for July S.No. Accounts Depreciation Expense-Bulding Dr. To Accumulated Depreciation Bulding (Being depreciation on Building charged for July) Debit Credit wile $810 $810 Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare adjusting entries for July 2021. Credit Debit 165,700 8,280 190 36,000 15,800 4,750 196,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Cash Accounts Receivable Office Supplies (asset) Prepaid Insurance Van Accumulated Depreciation - Van Building Accumulated Depreciation - Building Accounts Payable Unearned Pet Sales Notes Payable Common Stock Dividends Retained Earnings Pet Sales Pet Food Sales Salaries Expense Depreciation Expense - Van Deprecation Expense - Building Interest Expense Advertising Expense Office Supplies Expense Utility Expense Totals 14,700 16,570 250 90,000 200,000 10,000 73,000 43,800 22,900 13,200 1,580 4,900 4,500 3,000 520 6,300 465,970 465,970 The Office supplies on hand were $70; make the adjusting entry for July. Your Answer: .No. Debit Credit in) Accounts Office Supplies Expense Dr. To Office Supplies $120 $120 (Being Office Supplies expense charged) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 116,570 Unearned Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 The bank notified the company that the July interest was $750 and the payment was due Your Answer: S.No. iv) Credit Accounts Interest Expense Dr. To Interest Payable Debit $750 $750 (Being interest for july payable to bank accrued) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare adjusting entries for July 2021. 90,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Unearned Pet Sales 250 Notes Payable Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 In June, a customer made a payment of $250 for a new pet; she received the new pet in Ju Your Answer: S.No. Accounts Unearned Pet Sales Dr. To Pet Sales Debit Credit $250 $250 (Being pet delivered against the advance received in June) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Unearned Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 The Pet Shoppe has a 5-day workweek, the salaries paid in one week are $2,300. The end is on a Wednesday: made the adjusting entry for the last week in July. Your Answer: S.No. Debit Credit vi) Accounts Salaries expenses Salaries payable 1,380 1,380 ($2,300/5 X 3 days= 1,380 (To record salaries paid)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts