Question: Hello! I really need help with this. I already did from question 1-5, but I need help from question 6-10. I would rate you and

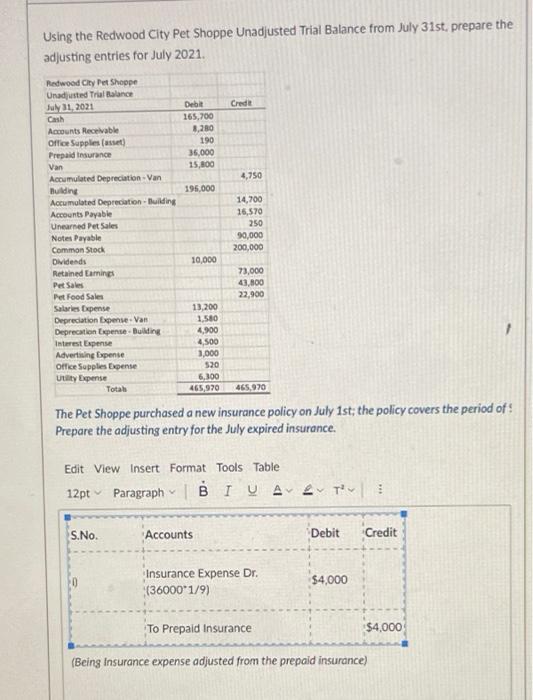

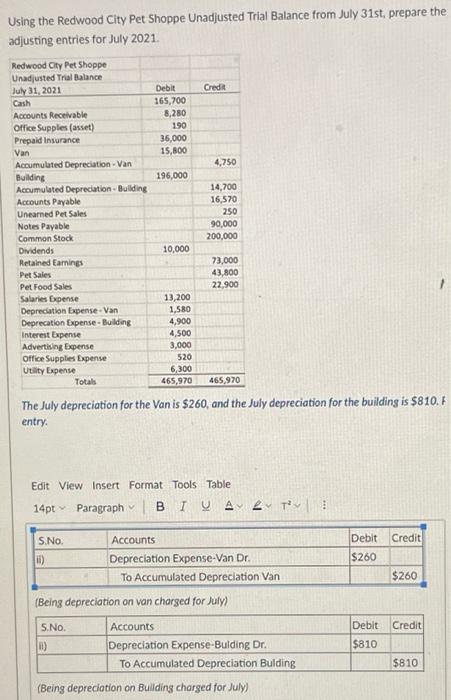

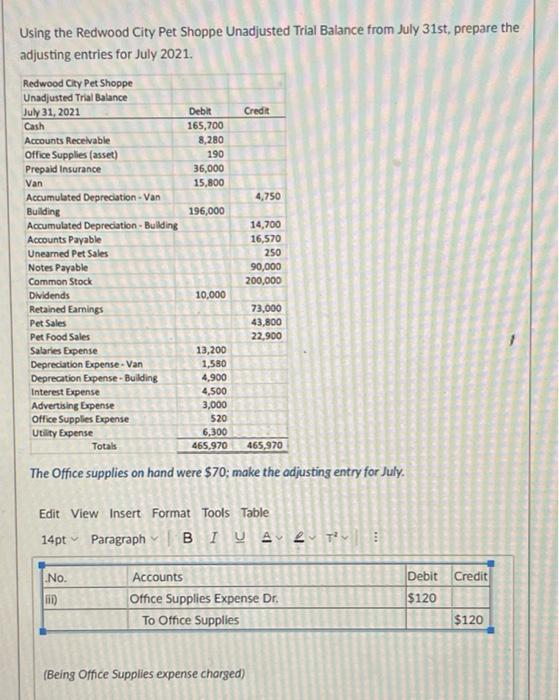

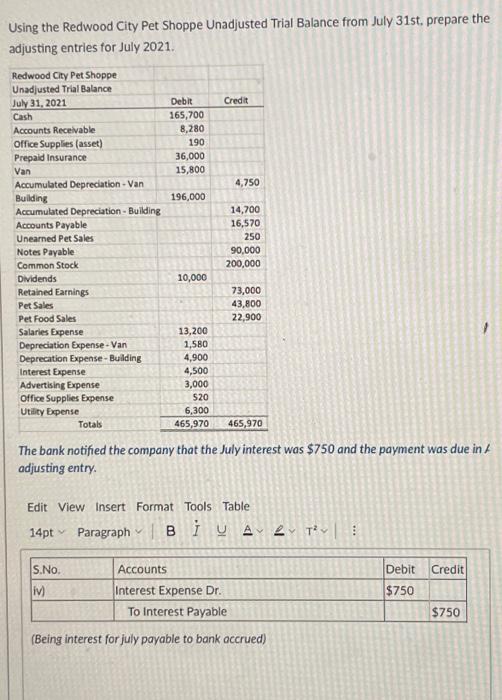

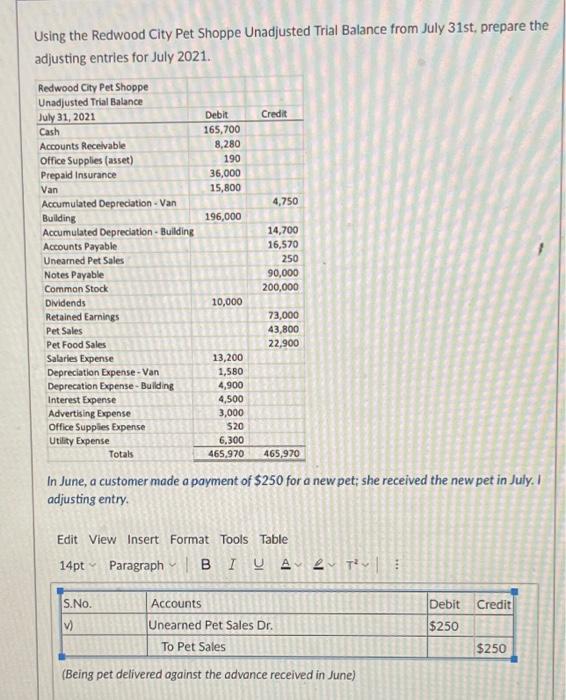

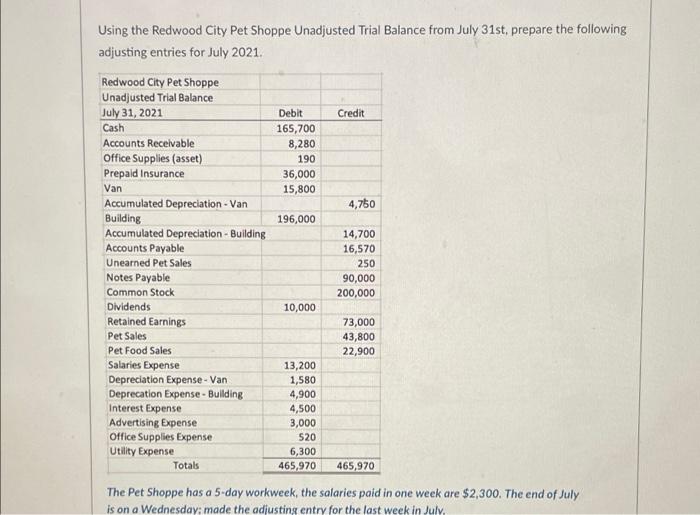

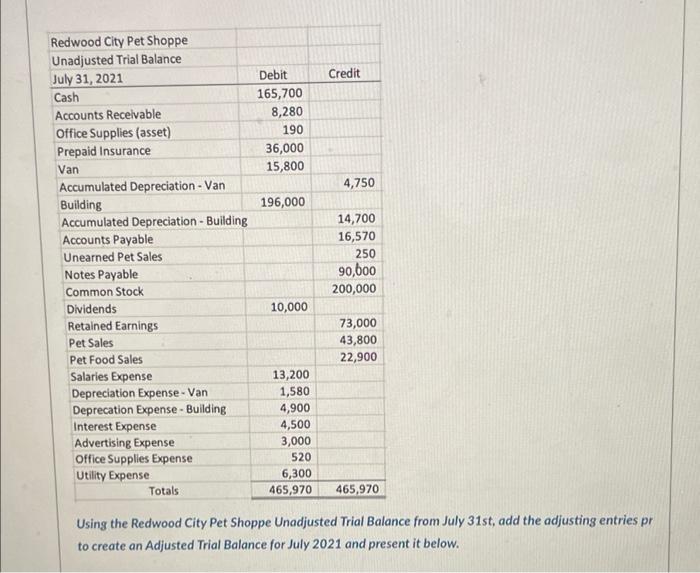

Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the adjusting entries for July 2021. Credit Debit 165,700 8,280 190 36,000 15,800 4,750 195,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 21, 2021 Cash Accounts Receivable Office Supplies (asset) Prepaid insurance Van Accumulated Depreciation Van Building Accumulated Depreciation - Bluding Accounts Payable Unearned Pet Sales Notes Payable Common Stock Dividends Retained Earnings Pet Sales Pet Food Sales Salaries Expense Depreciation Expense. Van Deprecation Expense - Building Interest Expense Advertising Expense Office Supplies Expense Utility Lipense Total 14.700 16,570 250 90,000 200,000 10,000 73,000 43.800 22,900 13,200 1.580 4,900 4,500 1.000 520 6,300 465,970 465,970 The Pet Shoppe purchased a new insurance policy on July 1st; the policy covers the period of Prepare the adjusting entry for the July expired insurance. Edit View Insert Format Tools Table 12pt Paragraph BI VALT S.No Accounts Debit Credit 0 Insurance Expense Dr. (36000*1/9) $4,000 To Prepaid Insurance $4,000 (Being Insurance expense adjusted from the prepaid insurance) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the adjusting entries for July 2021. Redwood Cty Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation Building 14,700 Accounts Payable 16,570 Uneamed Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22.900 Salaries Expense 13,200 Depreciation Expense. Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Epense 3,000 Office Supplies Dxpense 520 Utility Expense 6,300 Totals 465,970 465,970 The July depreciation for the Van is $260, and the July depreciation for the building is $810. entry Edit View Insert Format Tools Table 14pt Paragraph BIUA 2 TY S.No Debit Credit $260 Accounts 10) Depreciation Expense Van Dr. To Accumulated Depreciation Van (Being depreciation on van charged for July) $260 Debit Credit $810 S.No. Accounts 1) Depreciation Expense-Bulding Dr. To Accumulated Depreciation Bulding (Being depreciation on Building charged for July) $810 Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Unearned Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 The Office supplies on hand were $70; make the adjusting entry for July. Edit View Insert Format Tools Table 14pt Paragraph | BI VALTY No. 10 Accounts Office Supplies Expense Dr. To Office Supplies Debit Credit $120 $120 (Being Office Supplies expense charged) Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Unearned Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense-Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 The bank notified the company that the July interest was $750 and the payment was due in adjusting entry Edit View Insert Format Tools Table 14pt Paragraph B i U ALT: Debit Credit $750 S.No. Accounts iv) Interest Expense Dr. To Interest Payable (Being interest for july payable to bank accrued) $750 Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the adjusting entries for July 2021. Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Debit Credit Cash 165,700 Accounts Receivable 8,280 Office Supplies (asset) 190 Prepaid Insurance 36,000 Van 15,800 Accumulated Depreciation - Van 4,750 Building 196,000 Accumulated Depreciation - Building 14,700 Accounts Payable 16,570 Uneared Pet Sales 250 Notes Payable 90,000 Common Stock 200,000 Dividends 10,000 Retained Earnings 73,000 Pet Sales 43,800 Pet Food Sales 22,900 Salaries Expense 13,200 Depreciation Expense - Van 1,580 Deprecation Expense - Building 4,900 Interest Expense 4,500 Advertising Expense 3,000 Office Supplies Expense 520 Utility Expense 6,300 Totals 465,970 465,970 In June, a customer made a payment of $250 for a new pet; she received the new pet in July. I adjusting entry Edit View Insert Format Tools Table 14pt Paragraph BIU A e Tv Debit Credit $250 S.No. Accounts Unearned Pet Sales Dr. To Pet Sales (Being pet delivered against the advance received in June) $250 Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the following adjusting entries for July 2021. Credit Debit 165,700 8,280 190 36,000 15,800 4,750 196,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Cash Accounts Receivable Office Supplies (asset) Prepaid Insurance Van Accumulated Depreciation - Van Building Accumulated Depreciation - Building Accounts Payable Unearned Pet Sales Notes Payable Common Stock Dividends Retained Earnings Pet Sales Pet Food Sales Salaries Expense Depreciation Expense - Van Deprecation Expense - Building Interest Expense Advertising Expense Office Supplies Expense Utility Expense Totals 14,700 16,570 250 90,000 200,000 10,000 73,000 43,800 22,900 13,200 1,580 4,900 4,500 3,000 520 6,300 465,970 465,970 The Pet Shoppe has a 5-day workweek, the salaries paid in one week are $2,300. The end of July is on a Wednesday: made the adjusting entry for the last week in July, Credit Debit 165,700 8,280 190 36,000 15,800 4,750 196,000 Redwood City Pet Shoppe Unadjusted Trial Balance July 31, 2021 Cash Accounts Receivable Office Supplies (asset) Prepaid Insurance Van Accumulated Depreciation - Van Building Accumulated Depreciation - Building Accounts Payable Unearned Pet Sales Notes Payable Common Stock Dividends Retained Earnings Pet Sales Pet Food Sales Salaries Expense Depreciation Expense - Van Deprecation Expense - Building Interest Expense Advertising Expense Office Supplies Expense Utility Expense Totals 14,700 16,570 250 90,600 200,000 10,000 73,000 43,800 22,900 13,200 1,580 4,900 4,500 3,000 520 6,300 465,970 465,970 Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, add the adjusting entries pr to create an Adjusted Trial Balance for July 2021 and present it below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts