Question: Hello, I really need help with this problem Thank you! :) PROBLEM 9-11 MINI-CASE APV VALUATION 11 Flowmaster Forge Inc. is a designer and manufacturer

Hello, I really need help with this problem

Thank you! :)

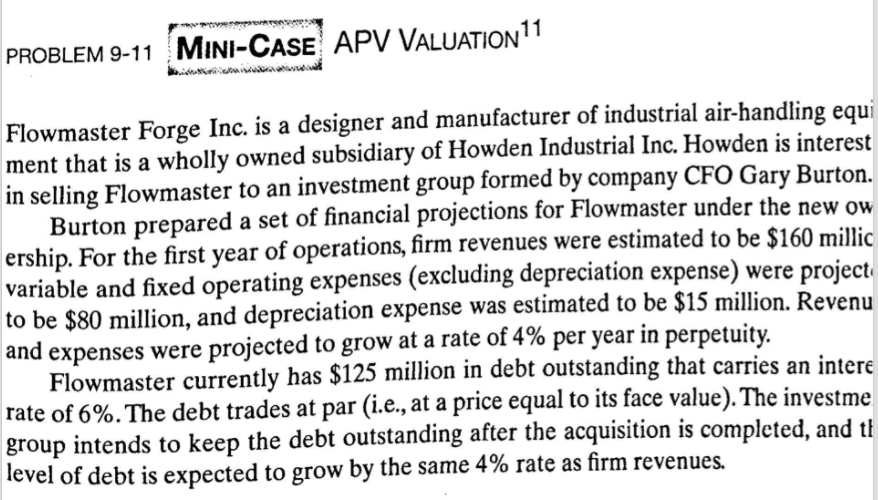

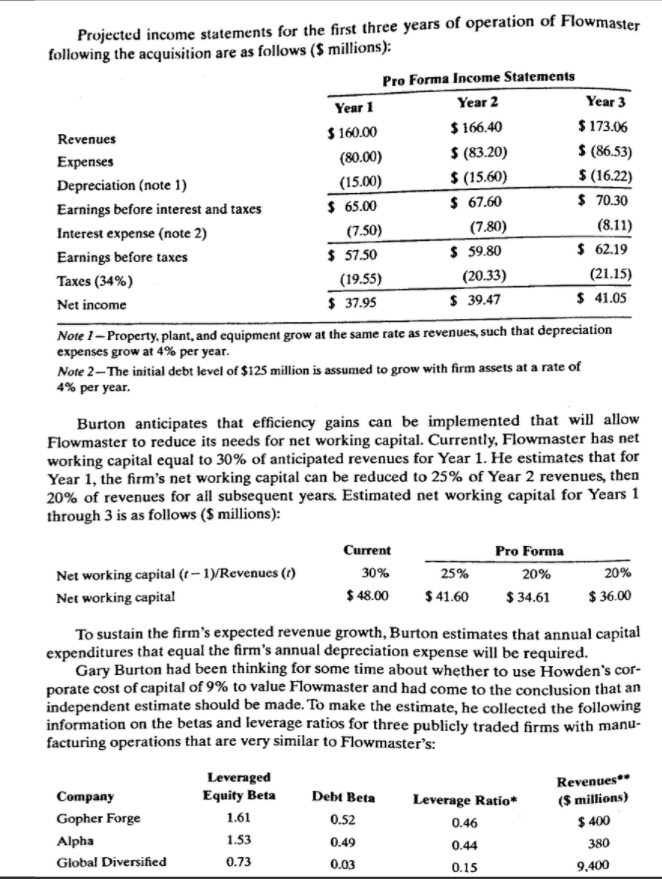

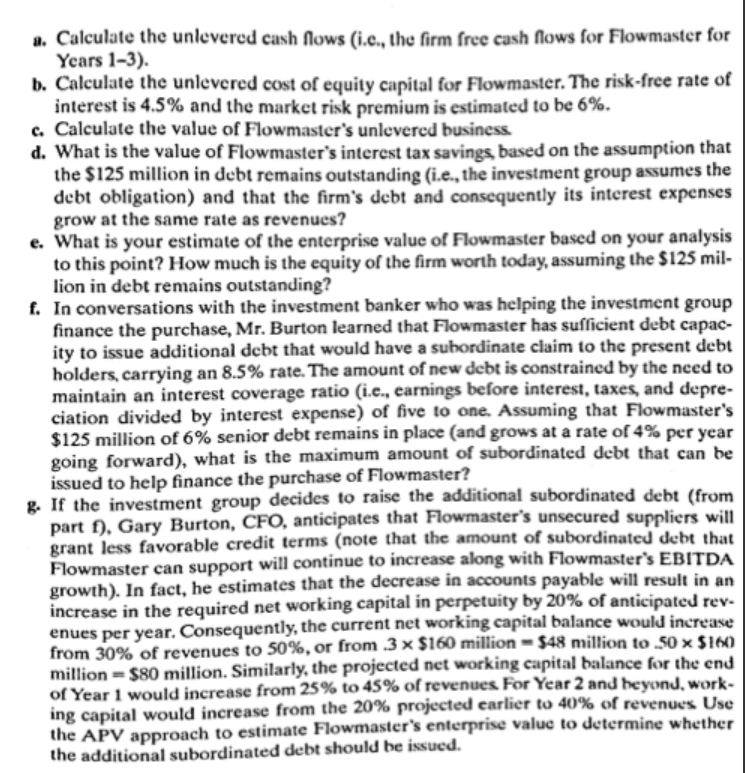

PROBLEM 9-11 MINI-CASE APV VALUATION 11 Flowmaster Forge Inc. is a designer and manufacturer of industrial air-handling equi ment that is a wholly owned subsidiary of Howden Industrial Inc. Howden is interest in selling Flowmaster to an investment group formed by company CFO Gary Burton. Burton prepared a set of financial projections for Flowmaster under the new ow ership. For the first year of operations, firm revenues were estimated to be $160 millic variable and fixed operating expenses (excluding depreciation expense) were project to be $80 million, and depreciation expense was estimated to be $15 million. Revenu and expenses were projected to grow at a rate of 4% per year in perpetuity. Flowmaster currently has $125 million in debt outstanding that carries an intere rate of 6%. The debt trades at par (i.e., at a price equal to its face value). The investme group intends to keep the debt outstanding after the acquisition is completed, and th level of debt is expected to grow by the same 4% rate as firm revenues. (80.00) (15.00) Projected income statements for the first three years of operation of Flowmaster following the acquisition are as follows (5 millions): Pro Forma Income Statements Year 1 Year 2 Year 3 $ 160.00 Revenues $ 166.40 $ 173.06 Expenses S (83.20) S (86.53) Depreciation (note 1) $ (15.60) $ (16.22) Earnings before interest and taxes $ 65.00 $ 67.60 $ 70.30 Interest expense (note 2) (7.50) (7.80) (8.11) Earnings before taxes $ 57.50 $ 59.80 $ 62.19 Taxes (34%) (19.55) (20.33) (21.15) Net income $ 37.95 $ 39.47 $ 41.05 Note 1 - Property, plant, and equipment grow at the same rate as revenues, such that depreciation expenses grow at 4% per year. Note 2-The initial debt level of $125 million is assumed to grow with firm assets at a rate of 4% per year. Burton anticipates that efficiency gains can be implemented that will allow Flowmaster to reduce its needs for net working capital. Currently, Flowmaster has net working capital equal to 30% of anticipated revenues for Year 1. He estimates that for Year 1, the firm's net working capital can be reduced to 25% of Year 2 revenues, then 20% of revenues for all subsequent years. Estimated net working capital for Years 1 through 3 is as follows (5 millions): Current 30% $ 48.00 Net working capital (1-1)Revenues (1) Net working capital 25% Pro Forma 20% $ 34.61 20% $36.00 $41.60 To sustain the firm's expected revenue growth, Burton estimates that annual capital expenditures that equal the firm's annual depreciation expense will be required. Gary Burton had been thinking for some time about whether to use Howden's cor- porate cost of capital of 9% to value Flowmaster and had come to the conclusion that an independent estimate should be made. To make the estimate, he collected the following information on the betas and leverage ratios for three publicly traded firms with manu- facturing operations that are very similar to Flowmaster's: Company Gopher Forge Alpha Global Diversified Leveraged Equity Beta 1.61 1.53 0.73 Debt Beta 0.52 0.49 0.03 Leverage Ratio* 0.46 0.44 0.15 Revenues** (5 millions) $ 400 380 9,400 a. Calculate the unlevered cash flows (i.c., the firm free cash flows for Flowmaster for Years 1-3). b. Calculate the unlevered cost of equity capital for Flowmaster. The risk-free rate of interest is 4.5% and the market risk premium is estimated to be 6%. c. Calculate the value of Flowmaster's unlevered business d. What is the value of Flowmaster's interest tax savings, based on the assumption that the $125 million in debt remains outstanding (i.e., the investment group assumes the debt obligation) and that the firm's debt and consequently its interest expenses grow at the same rate as revenues? e. What is your estimate of the enterprise value of Flowmaster based on your analysis to this point? How much is the equity of the firm worth today, assuming the $125 mil- lion in debt remains outstanding? f. In conversations with the investment banker who was helping the investment group finance the purchase, Mr. Burton learned that Flowmaster has sufficient debt capac- ity to issue additional debt that would have a subordinate claim to the present debt holders, carrying an 8.5% rate. The amount of new debt is constrained by the need to maintain an interest coverage ratio (i.e., earnings before interest, taxes, and depre- ciation divided by interest expense) of five to one. Assuming that Flowmaster's $125 million of 6% senior debt remains in place (and grows at a rate of 4% per year going forward), what is the maximum amount of subordinated debt that can be issued to help finance the purchase of Flowmaster? g. If the investment group decides to raise the additional subordinated debt (from part f), Gary Burton, CFO, anticipates that Flowmaster's unsecured suppliers will grant less favorable credit terms (note that the amount of subordinated debt that Flowmaster can support will continue to increase along with Flowmaster's EBITDA growth). In fact, he estimates that the decrease in accounts payable will result in an increase in the required net working capital in perpetuity by 20% of anticipated rev. enues per year. Consequently, the current net working capital balance would increase from 30% of revenues to 50%, or from 3 x $160 million - 548 million to 50 x 5160 million $80 million. Similarly, the projected net working capital balance for the end of Year 1 would increase from 25% to 45% of revenues For Year 2 and beyond, work- ing capital would increase from the 20% projected earlier to 40% of revenues Use the APV approach to estimate Flowmaster's enterprise value to determine whether the additional subordinated debt should be issued. PROBLEM 9-11 MINI-CASE APV VALUATION 11 Flowmaster Forge Inc. is a designer and manufacturer of industrial air-handling equi ment that is a wholly owned subsidiary of Howden Industrial Inc. Howden is interest in selling Flowmaster to an investment group formed by company CFO Gary Burton. Burton prepared a set of financial projections for Flowmaster under the new ow ership. For the first year of operations, firm revenues were estimated to be $160 millic variable and fixed operating expenses (excluding depreciation expense) were project to be $80 million, and depreciation expense was estimated to be $15 million. Revenu and expenses were projected to grow at a rate of 4% per year in perpetuity. Flowmaster currently has $125 million in debt outstanding that carries an intere rate of 6%. The debt trades at par (i.e., at a price equal to its face value). The investme group intends to keep the debt outstanding after the acquisition is completed, and th level of debt is expected to grow by the same 4% rate as firm revenues. (80.00) (15.00) Projected income statements for the first three years of operation of Flowmaster following the acquisition are as follows (5 millions): Pro Forma Income Statements Year 1 Year 2 Year 3 $ 160.00 Revenues $ 166.40 $ 173.06 Expenses S (83.20) S (86.53) Depreciation (note 1) $ (15.60) $ (16.22) Earnings before interest and taxes $ 65.00 $ 67.60 $ 70.30 Interest expense (note 2) (7.50) (7.80) (8.11) Earnings before taxes $ 57.50 $ 59.80 $ 62.19 Taxes (34%) (19.55) (20.33) (21.15) Net income $ 37.95 $ 39.47 $ 41.05 Note 1 - Property, plant, and equipment grow at the same rate as revenues, such that depreciation expenses grow at 4% per year. Note 2-The initial debt level of $125 million is assumed to grow with firm assets at a rate of 4% per year. Burton anticipates that efficiency gains can be implemented that will allow Flowmaster to reduce its needs for net working capital. Currently, Flowmaster has net working capital equal to 30% of anticipated revenues for Year 1. He estimates that for Year 1, the firm's net working capital can be reduced to 25% of Year 2 revenues, then 20% of revenues for all subsequent years. Estimated net working capital for Years 1 through 3 is as follows (5 millions): Current 30% $ 48.00 Net working capital (1-1)Revenues (1) Net working capital 25% Pro Forma 20% $ 34.61 20% $36.00 $41.60 To sustain the firm's expected revenue growth, Burton estimates that annual capital expenditures that equal the firm's annual depreciation expense will be required. Gary Burton had been thinking for some time about whether to use Howden's cor- porate cost of capital of 9% to value Flowmaster and had come to the conclusion that an independent estimate should be made. To make the estimate, he collected the following information on the betas and leverage ratios for three publicly traded firms with manu- facturing operations that are very similar to Flowmaster's: Company Gopher Forge Alpha Global Diversified Leveraged Equity Beta 1.61 1.53 0.73 Debt Beta 0.52 0.49 0.03 Leverage Ratio* 0.46 0.44 0.15 Revenues** (5 millions) $ 400 380 9,400 a. Calculate the unlevered cash flows (i.c., the firm free cash flows for Flowmaster for Years 1-3). b. Calculate the unlevered cost of equity capital for Flowmaster. The risk-free rate of interest is 4.5% and the market risk premium is estimated to be 6%. c. Calculate the value of Flowmaster's unlevered business d. What is the value of Flowmaster's interest tax savings, based on the assumption that the $125 million in debt remains outstanding (i.e., the investment group assumes the debt obligation) and that the firm's debt and consequently its interest expenses grow at the same rate as revenues? e. What is your estimate of the enterprise value of Flowmaster based on your analysis to this point? How much is the equity of the firm worth today, assuming the $125 mil- lion in debt remains outstanding? f. In conversations with the investment banker who was helping the investment group finance the purchase, Mr. Burton learned that Flowmaster has sufficient debt capac- ity to issue additional debt that would have a subordinate claim to the present debt holders, carrying an 8.5% rate. The amount of new debt is constrained by the need to maintain an interest coverage ratio (i.e., earnings before interest, taxes, and depre- ciation divided by interest expense) of five to one. Assuming that Flowmaster's $125 million of 6% senior debt remains in place (and grows at a rate of 4% per year going forward), what is the maximum amount of subordinated debt that can be issued to help finance the purchase of Flowmaster? g. If the investment group decides to raise the additional subordinated debt (from part f), Gary Burton, CFO, anticipates that Flowmaster's unsecured suppliers will grant less favorable credit terms (note that the amount of subordinated debt that Flowmaster can support will continue to increase along with Flowmaster's EBITDA growth). In fact, he estimates that the decrease in accounts payable will result in an increase in the required net working capital in perpetuity by 20% of anticipated rev. enues per year. Consequently, the current net working capital balance would increase from 30% of revenues to 50%, or from 3 x $160 million - 548 million to 50 x 5160 million $80 million. Similarly, the projected net working capital balance for the end of Year 1 would increase from 25% to 45% of revenues For Year 2 and beyond, work- ing capital would increase from the 20% projected earlier to 40% of revenues Use the APV approach to estimate Flowmaster's enterprise value to determine whether the additional subordinated debt should be issued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts