Question: Hello, If you could please help me answer the following question, that would be much appreciated. The homework assignment is due within the next hour,

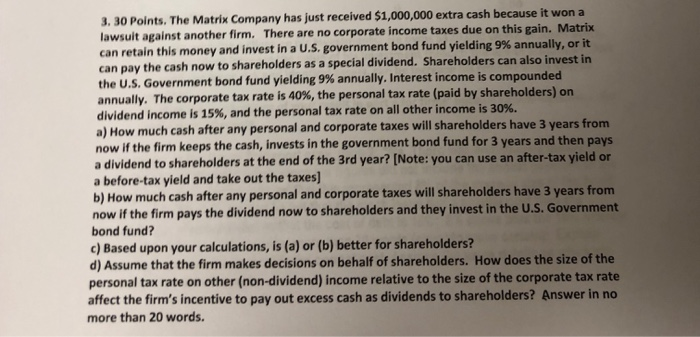

3. 30 Points. The Matrix Company has just received $1,000,000 extra cash because it won a lawsuit against another firm. There are no corporate i can retain this money and invest in a U.S. government bond fund yielding 9% can pay the cash now to the U.S. Government bond fund yielding 9% annually. Interest income is compounded annually. The corporate tax rate is 40%, the personal tax rate (paid by shareholders) on dividend income is 15%, and the personal tax rate on all other income is 30%. a) How much cash after any personal and corporate taxes will shareholders have 3 years from now if the firm keeps the cash, invests in the government bond fund for 3 years and then pays a dividend to shareholders at the end of the 3rd year? [Note: you can use an after-tax yield or a before-tax yield and take out the taxes] b) How much cash after any personal and corporate taxes will shareholders have 3 years from now if the firm pays the dividend now to shareholders and they invest in the U.S. Government ncome taxes due on this gain. Matrix annually, or it shareholders as a special dividend. Shareholders can also invest in bond fund? c) Based upon your calculations, is (a) or (b) better for shareholders? d) Assume that the firm makes decisions on behalf of shareholders. How does the size of the personal tax rate on other (non-dividend) income relative to the size of the corporate tax rate affect the firm's incentive to pay out excess cash as dividends to shareholders? Answer in no more than 20 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts