Question: URGENT: PLEASE, I NEED YOUR HELP! Hello, If you could please help me answer the following question, that would be much appreciated. This homework assignment

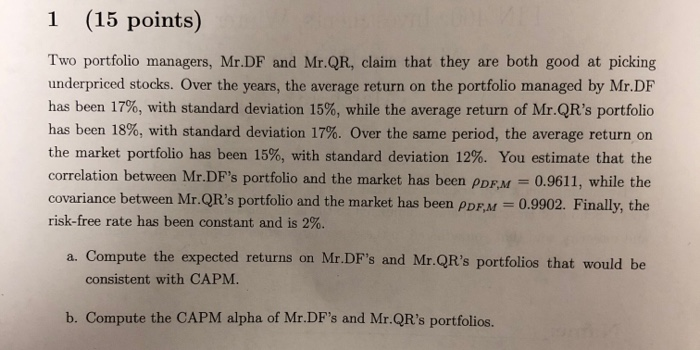

1 (15 points) Two portfolio managers, Mr.DF and Mr.QR, claim that they are both good at picking underpriced stocks. Over the years, the average return on the portfolio managed by Mr.DF has been 1796, with standard deviation 15%, while the average return of Mr.QR's portfolio has been 18%, with standard deviation 17%. Over the same period, the average return on the market portfolio has been 15%, with standard deviation 12%. You estimate that the correlation between Mr.DF's portfolio and the market has been pDFM 0.9611, while the covariance between Mr.QR's portfolio and the market has been pDF.M 0.9902. Finally, the risk-free rate has been constant and is 2%. a. Compute the expected returns on Mr.DF's and Mr.QR's portfolios that would be consistent with CAPM. b. Compute the CAPM alpha of Mr.DF's and Mr.QR's portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts