Question: Hello, My assignment requires me to enter the average historical data into the template below. The idea is to learn how to develop and interpret

Hello,

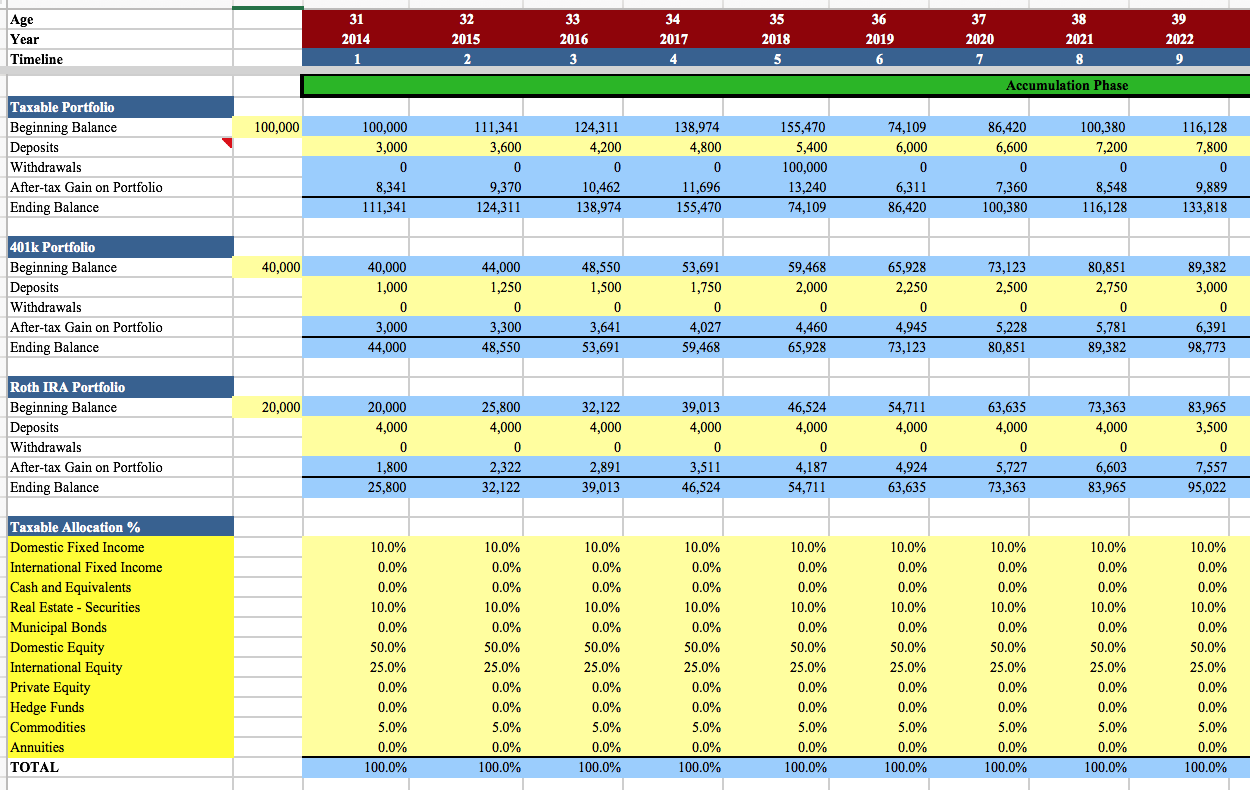

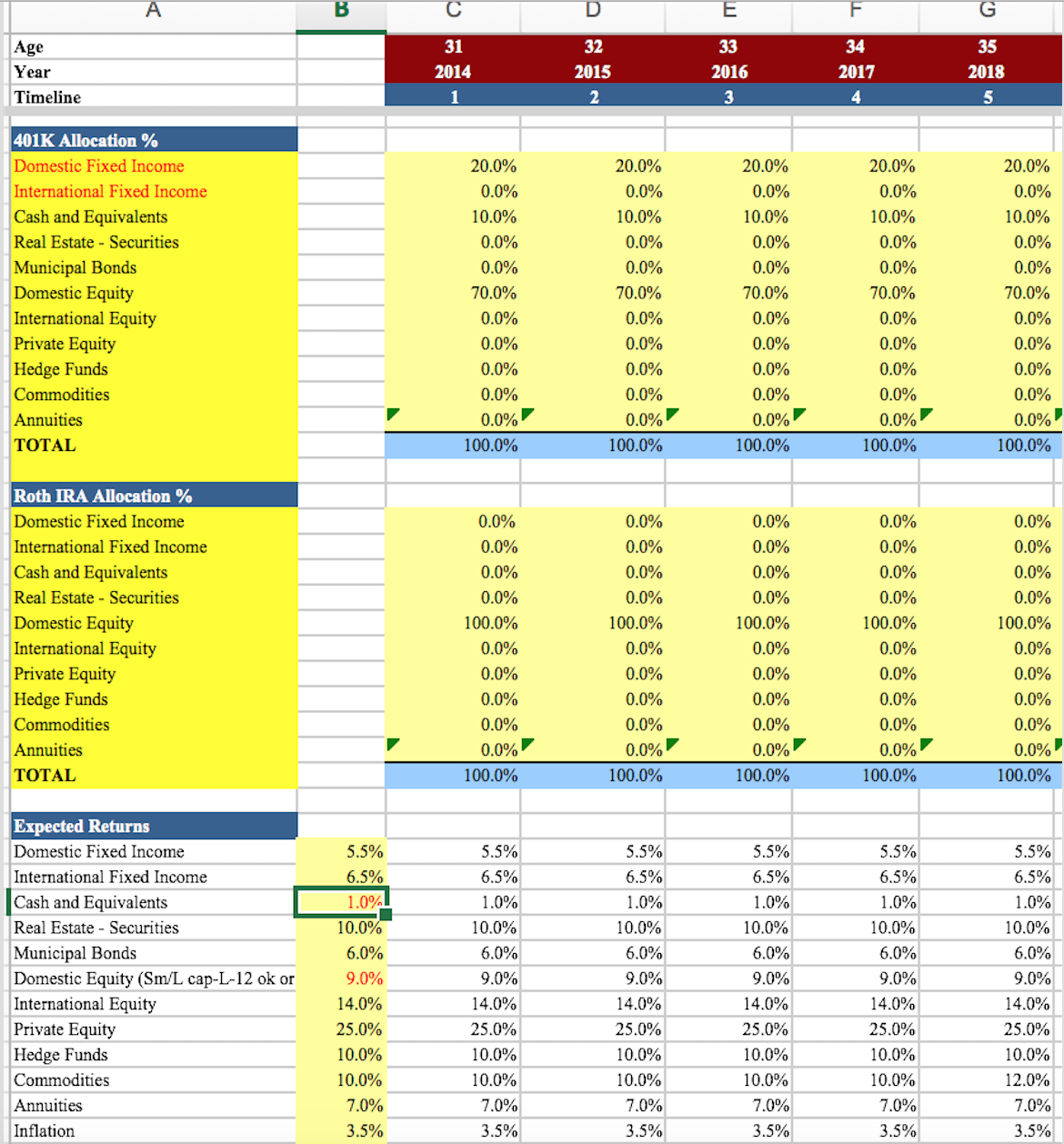

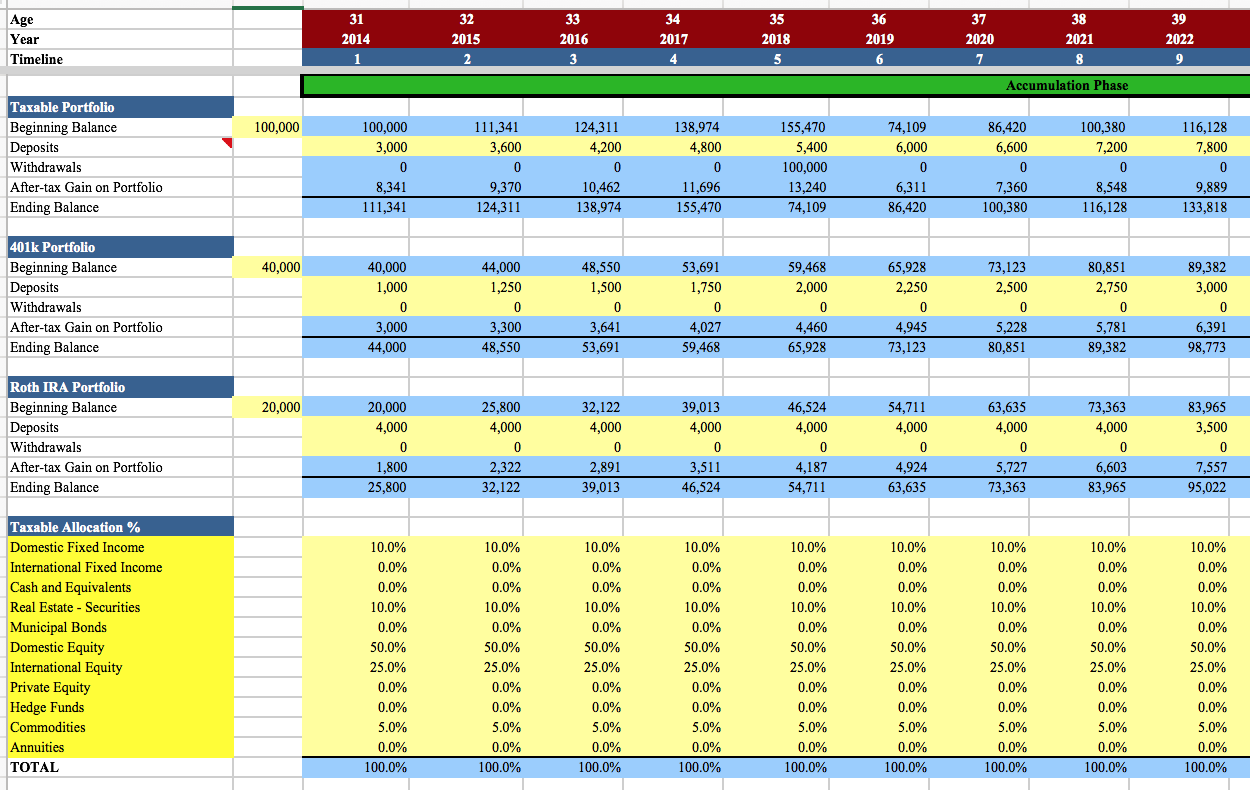

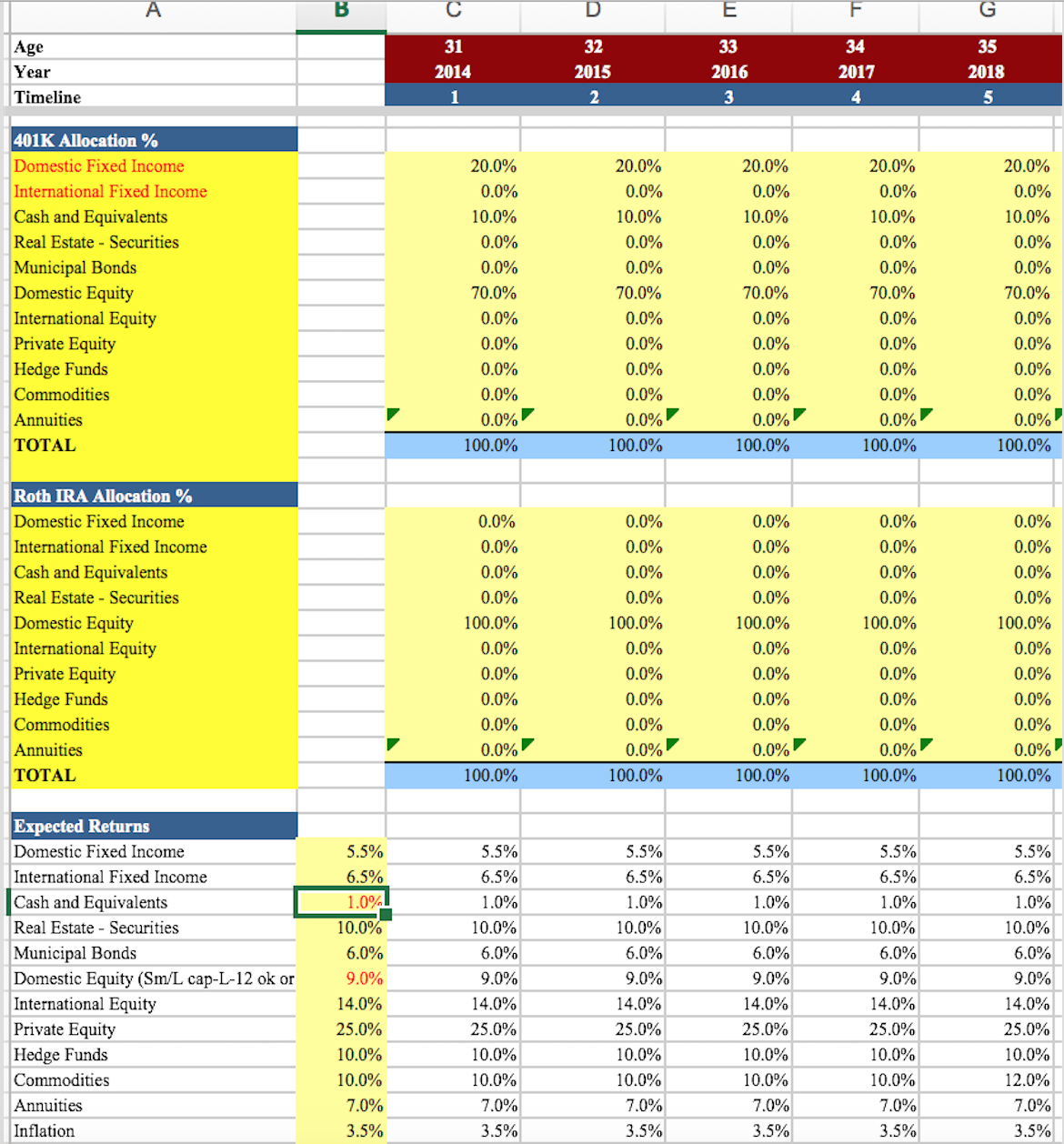

My assignment requires me to enter the average historical data into the template below. The idea is to learn how to develop and interpret the data. Do you know where can I find quality average historical data online that is easy to use? I need to include this average historical data in the portions highlighted in yellow. Under the sub title EXPECTED RETURNS is the main data needed.

_ _ _ .11 2014 1 {u to {u l..- l..- L 35 36 37 30 39 2017 2010 2019 2020 2021 2022 S 6 7 S 9 to a H 'J. N a H '3'. to I... h. Taxable Portfolio Beginning Balance 100,000 Deposits _ _ _ _ 3,000 3,600 4,200 4,800 5,400 6,000 6,600 7,200 7,800 401k Portfolio Beginning Balance 40,000 1,000 1,250 1,500 1,750 2,000 1,250 2,500 1,750 3,000 o o o o o o o o o _ _ _ Roth 1m Portfolio Beginning Balance 20,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 3,500 0 0 0 0 0 0 0 0 0 _ _ _ Taxable Allocation 'l-i: _ Ikmeec Fixed Income 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% Intaneunal Fixed Meme 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Cash and Equivalmtx 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Real Esme - Seem-idea 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% Municipal Bonds 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Domeee Equity 50.0% 50.0% 50.0% 50.0% 50.0% 50.0% 50.0% 50.0% 50.0% International Equity 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% Prim Equity 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Hedge Funds 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Commodities 5 .0% 5 .0% 5 .0% 5 .0% 5 .0% 5 .0% 5 .0% 5 .0% 5 .0% Annuities 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% TOTAL 401K Allocation % Domestic Fixed Income International Fixed Income Cash and Equivalents Real Estate - Securities Municipal Bonds Domestic Equity International Equity Private Equity Hedge Funds Commodities Annuities TUI'AL Roth IRA Allocation % Domestic Fixed Income International Fixed Income Cash and Equivalents Reel Emile - Secln'itiee Domestic Equity International Equity Private Equity Hedge Fluids Commodities Annuities TUI'AL Expected Returns Domestic Fixed Income International Fixed Income Cash and Equivalents Real Estate - Securities Municipal Bonds Domestic Equity (SnifL cap-L42 ok or International Equityr Private Equity Hedge Funds Commodities Annuities Ination 0.0% 10.0% 0.0% 0.0% 70.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% 5.5% 6.5% 1 3% 10A ' o 10.0% 0.0% 0.0% 70.0% 10.0% 0.0% 70.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 1 00.0% 0.0% 0.0% 10.0% 70.0% 0.0% 0.0% 0.0% 0.0% 100.0% 0.0% 0.0% 6.0% 9.0% 14.0% 25.0% 10.0% 10.0% 7.0% 3.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts