Question: Hello, need help solving this question using the formulas as shown in the second picture. please show work, will rate. Thank you. second picture is

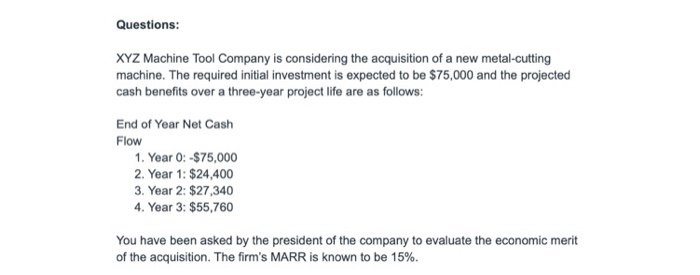

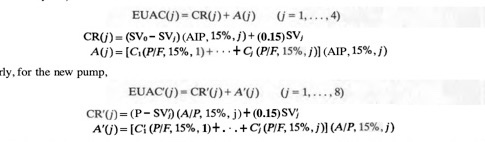

Questions: XYZ Machine Tool Company is considering the acquisition of a new metal-cutting machine. The required initial investment is expected to be $75,000 and the projected cash benefits over a three-year project life are as follows: End of Year Net Cash Flow 1. Year 0:-$75,000 2. Year 1: $24.400 3. Year 2: $27,340 4. Year 3: $55,760 You have been asked by the president of the company to evaluate the economic merit of the acquisition. The firm's MARR is known to be 15%. EUACU) - CR(1) + A() (-1,...,4) CRC)-(SV - SV) (AIP, 15%,])+ (0.15) SV, A()= [C(P/F, 15%, 1)+...+ (P/F, 15%./) (AIP, 15%, j) mly, for the new pump. EUACU) - CR'() + A'U') (-1,..., 8) CRO)=(P-SV) (A/P, 15%, j)+ (0.15)SV) A'C)=[C(P/F, 15%,1)+...+ C(P/F, 15%.;)] (A/P, 15%.;)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts