Question: Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much. Question

Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much.

Question 1 A

Question 1B

Question 1B

Question 1C

Question 1D

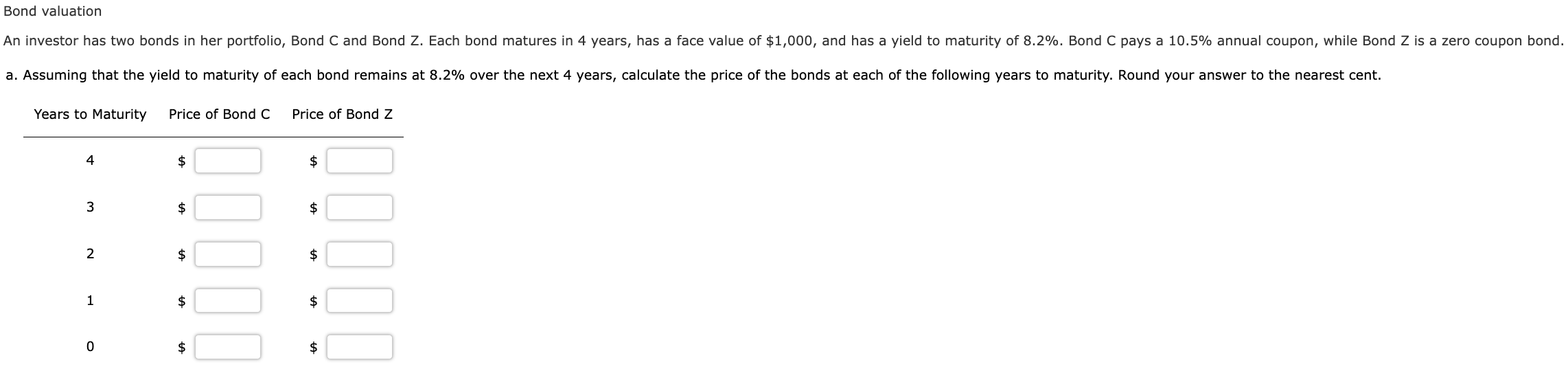

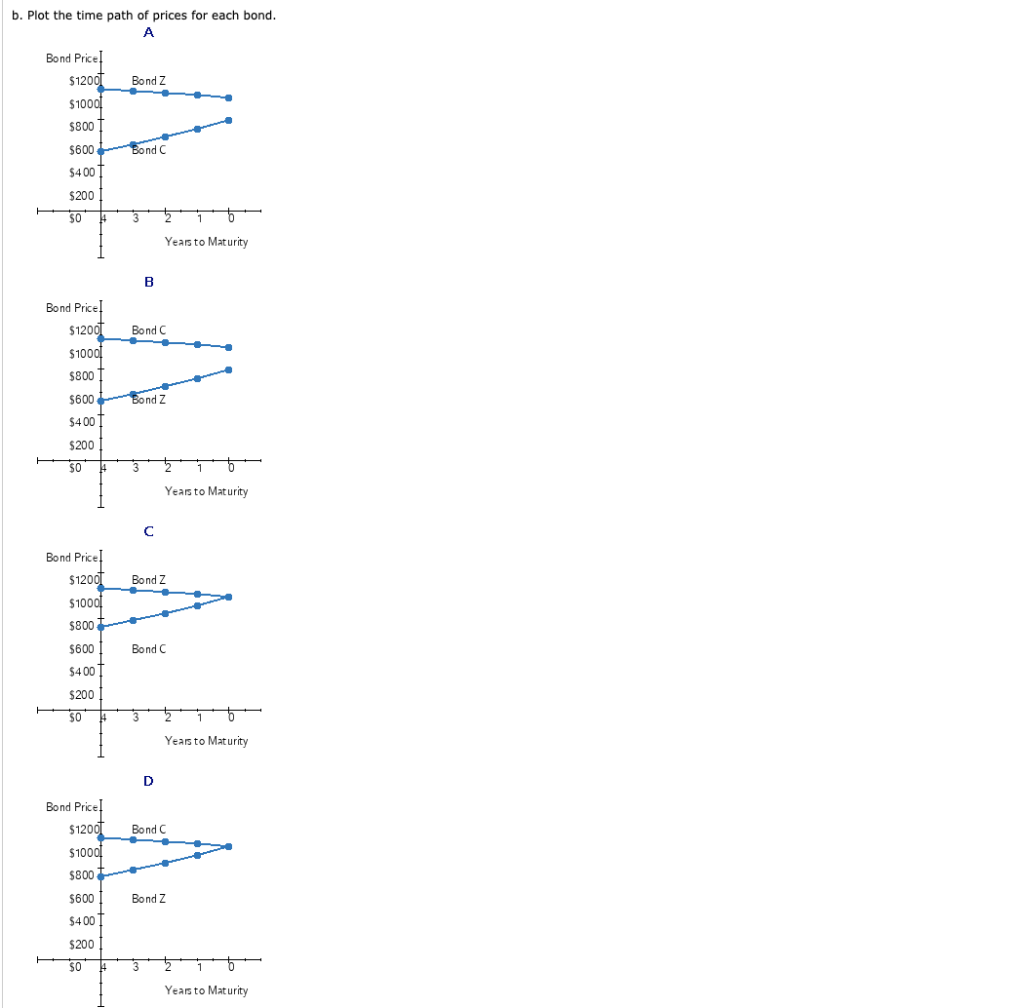

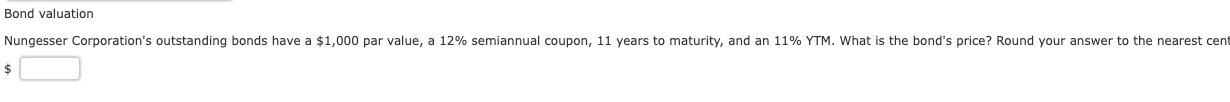

Bond valuation An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.2%. Bond C pays a 10.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.2% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answer to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ $ 3 $ $ 2 $ $ 1 $ $ 0 $ $ b. Plot the time path of prices for each bond. Bond Price $12001 Bond Z $1000 $800 $600 Bond C $400 $200 50 4 1 Years to Maturity B B Bond Price! $12001 Bond C $1000 $800 Bond Z $600 $400 $200 $0 4 1 Years to Maturity Bond Price! $12001 $1000! $800 Bond Z Bond C $600 $400 $200 SO 3 Years to Maturity D Bond Price! $12001 $1000! Bond C $800 Bond Z $600 $400 $200 $0 H 3 1 6 Years to Maturity Years to Maturity -Select- The correct sketch B B D 0 Icon Key Bond valuation Nungesser Corporation's outstanding bonds have a $1,000 par value, a 12% semiannual coupon, 11 years to maturity, and an 11% YTM. What is the bond's price? Round your answer to the nearest cent $ 9-3: Bond Valuation Problem Walk-Through Bond valuation Callaghan Motors' bonds have 12 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8.5%, and the yield to maturity is 11%. What is the bond's current market price? Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts