Question: Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much. Question

Hello. Please answer all questions and round to two decimal places. I will give like if you answer all questions. Thank you so much.

Question 1A

Question 1B

Question 1C

Question 1D

Question 1D

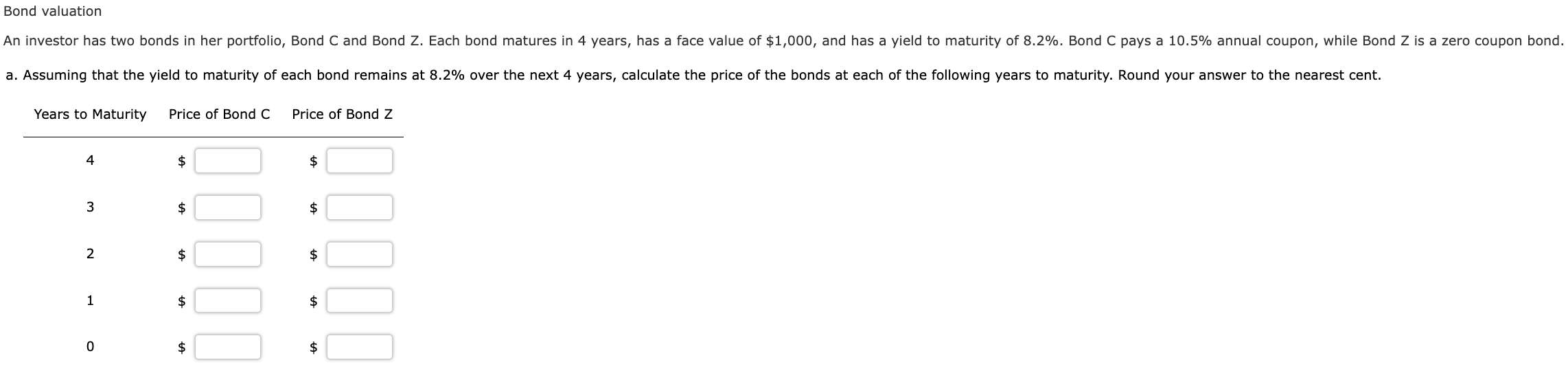

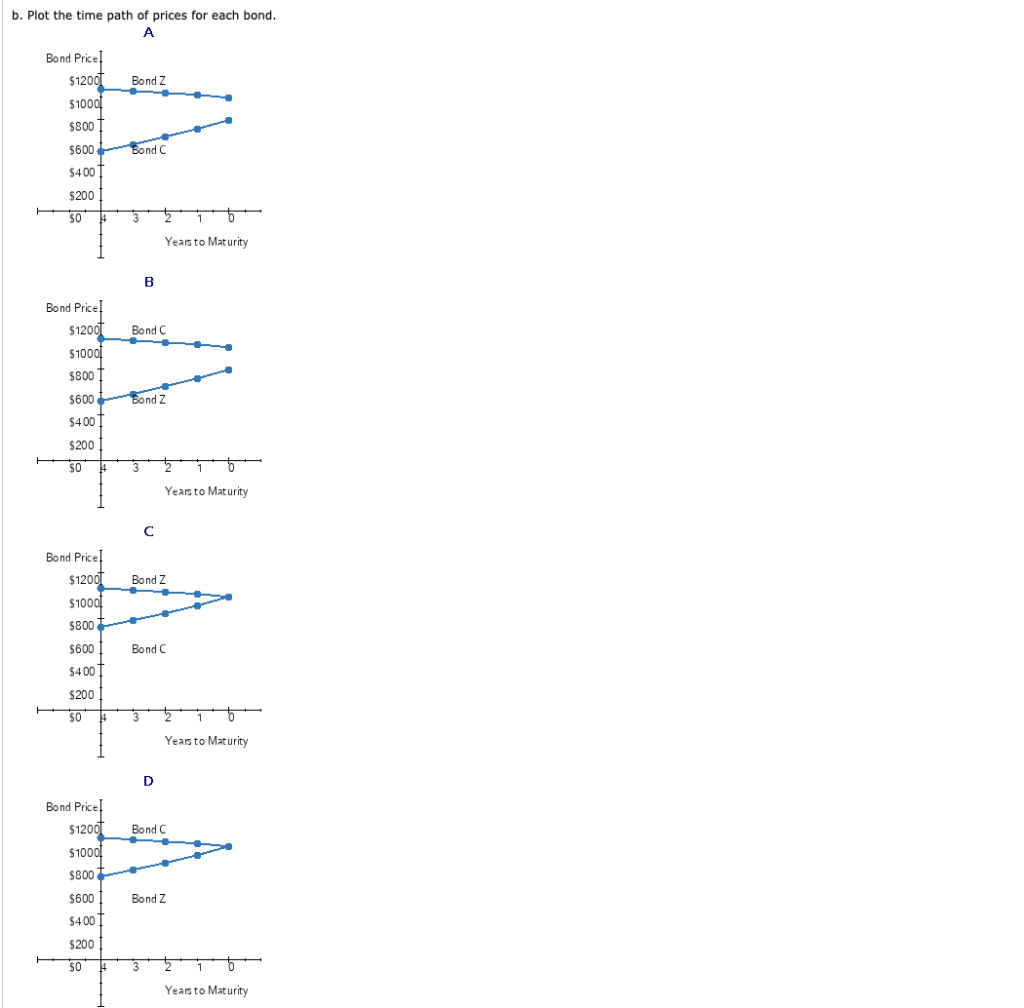

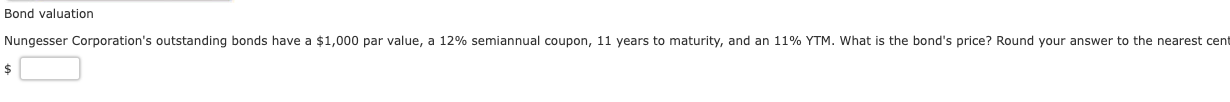

Bond valuation An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.2%. Bond C pays a 10.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.2% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answer to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ $ 3 $ $ 2 $ $ 1 $ $ 0 $ $ b. Plot the time path of prices for each bond. Bond Price $12001 Bond Z $1000 $800 $600 Bond C $400 $200 50 4 1 Years to Maturity B B Bond Price! $12001 Bond C $1000 $800 Bond Z $600 $400 $200 $0 4 1 Years to Maturity Bond Price! $12001 $1000! $800 Bond Z Bond C $600 $400 $200 SO 3 Years to Maturity D Bond Price! $12001 $1000! Bond C $800 Bond Z $600 $400 $200 $0 H 3 1 6 Years to Maturity Years to Maturity -Select- The correct sketch B B D 0 Icon Key Bond valuation Nungesser Corporation's outstanding bonds have a $1,000 par value, a 12% semiannual coupon, 11 years to maturity, and an 11% YTM. What is the bond's price? Round your answer to the nearest cent $ 9-3: Bond Valuation Problem Walk-Through Bond valuation Callaghan Motors' bonds have 12 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8.5%, and the yield to maturity is 11%. What is the bond's current market price? Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts