Question: Hello, Please Assist Me With This. Utilize The Charts Given. Problem 1: Problem 2: Problem 3: Problem 1) Brimberg Production is a small firm focused

Hello, Please Assist Me With This. Utilize The Charts Given.

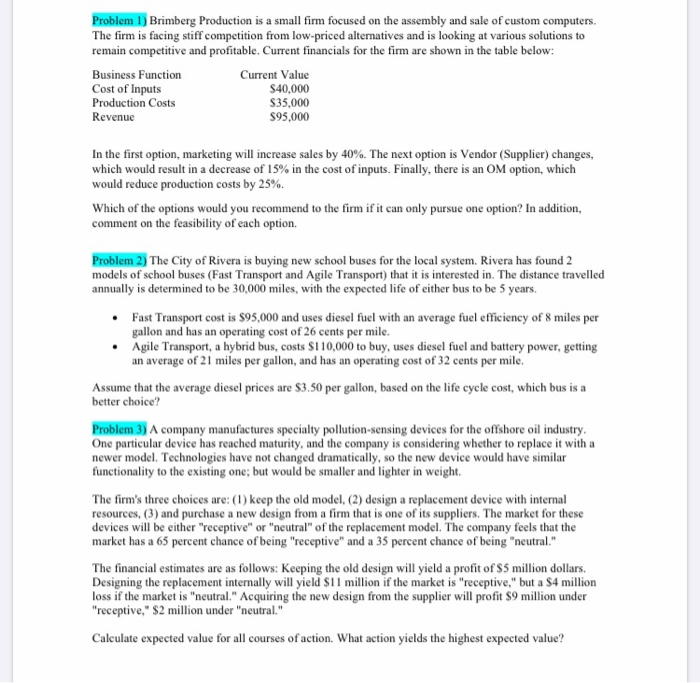

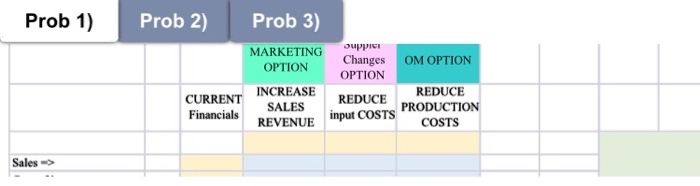

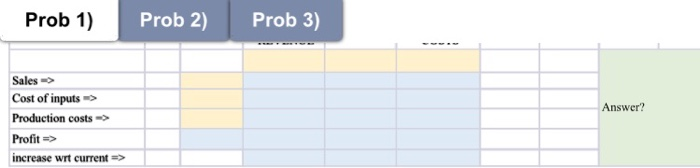

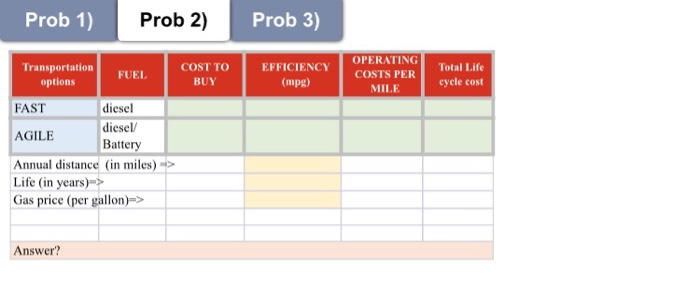

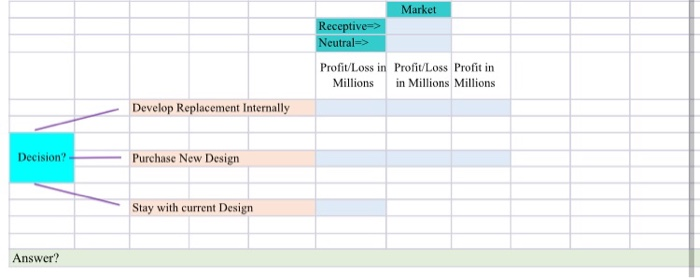

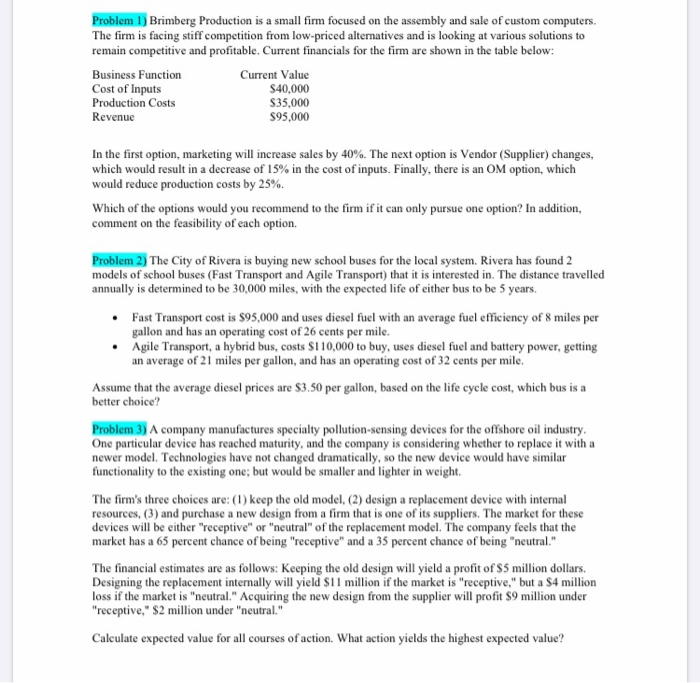

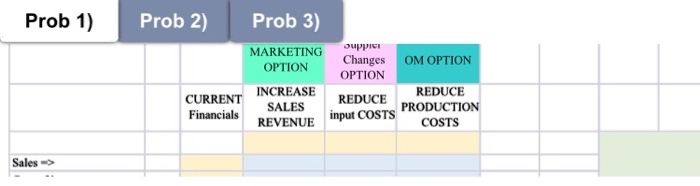

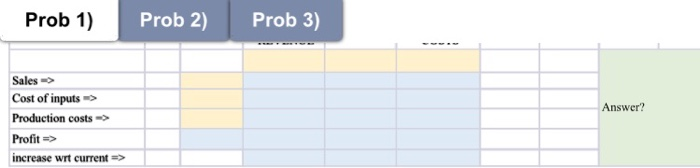

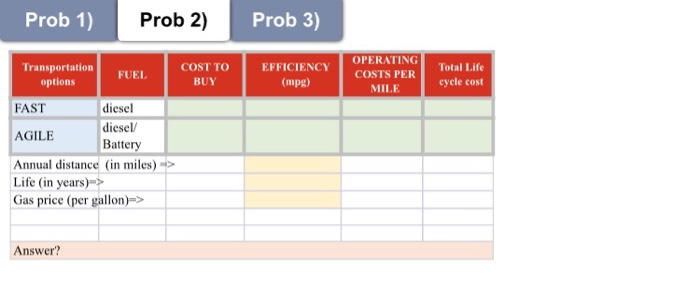

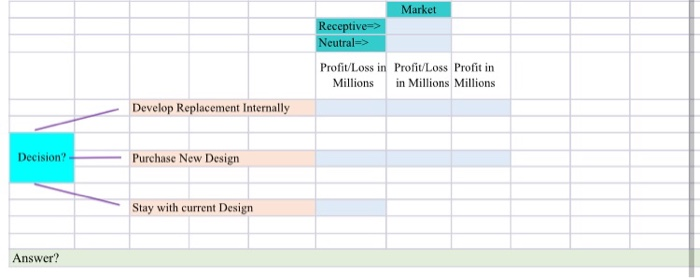

Problem 1) Brimberg Production is a small firm focused on the assembly and sale of custom computers The firm is facing stiff competition from low-priced alternatives and is looking at various solutions to remain competitive and profitable. Current financials for the firm are shown in the table below: Business Function Cost of Inputs Production Costs Revenue Current Value $40,000 S35,000 $95,000 In the first option, marketing will increase sales by 40%. The next option is Vendor (Supplier) changes, which would result in a decrease of 15% in the cost of inputs. Finally, there is an OM option, which would reduce production costs by 25%. Which of the options would you recommend to the firm if it can only pursue one option? In addition, comment on the feasibility of each option. Problem 2) The City of Rivera is buying new school buses for the local system. Rivera has found 2 models of school buses (Fast Transport and Agile Transport) that it is interested in. The distance travelled annually is determined to be 30,000 miles, with the expected life of either bus to be 5 years. Fast Transport cost is $95,000 and uses diesel fuel with an average fuel efficiency of 8 miles per gallon and has an operating cost of 26 cents per mile. Agile Transport, a hybrid bus, costs $110,000 to buy, uses diesel fuel and battery power, getting an average of 21 miles per gallon, and has an operating cost of 32 cents per mile. Assume that the average diesel prices are $3.50 per gallon, based on the life cycle cost, which bus is a better choice? Problem 3) A company manufactures specialty pollution-sensing devices for the offshore oil industry, One particular device has reached maturity, and the company is considering whether to replace it with a newer model. Technologies have not changed dramatically, so the new device would have similar functionality to the existing one; but would be smaller and lighter in weight The firm's three choices are: (1) keep the old model. (2) design a replacement device with internal resources, (3) and purchase a new design from a firm that is one of its suppliers. The market for these devices will be either "receptive" or "neutral" of the replacement model. The company feels that the market has a 65 percent chance of being "receptive" and a 35 percent chance of being "neutral." The financial estimates are as follows: Keeping the old design will yield a profit of $5 million dollars. Designing the replacement internally will yield $11 million if the market is "receptive," but a S4 million loss if the market is "neutral." Acquiring the new design from the supplier will profit $9 million under "receptive," $2 million under "neutral." Calculate expected value for all courses of action. What action yields the highest expected value? Prob 1) Prob 2) Prob 3) MARKETING OPTION SuppICI Changes OPTION OM OPTION CURRENT INCREASE REDUCE PRODUCTION REDUCE Financials SALES REVENUE input COSTS" COSTS Sales > Prob 1) Prob 1) Prob 2) Prob 2) Prob 3 Prob 3) Answer? Sales > Cost of inputs > Production costs Profit => increase wrt current => Prob 1) Prob 2) Prob 3) Transportation options FUEL COST TO BUY EFFICIENCY (mpg) OPERATING COSTS PER MILE Total Life cycle cost FAST diesel diesel AGILE Battery Annual distance (in miles) Life in years) Gas price (per gallon)-> Answer? Market Receptive-> Neutral=> Profit/Loss in Profit/Loss Profit in Millions in Millions Millions Develop Replacement Internally Decision? Purchase New Design Stay with current Design

Problem 1:

Problem 2:

Problem 3:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock