Question: Hello, please help me answer the questions. Please show work so I can understand the process. Thank you so much! Use the following table of

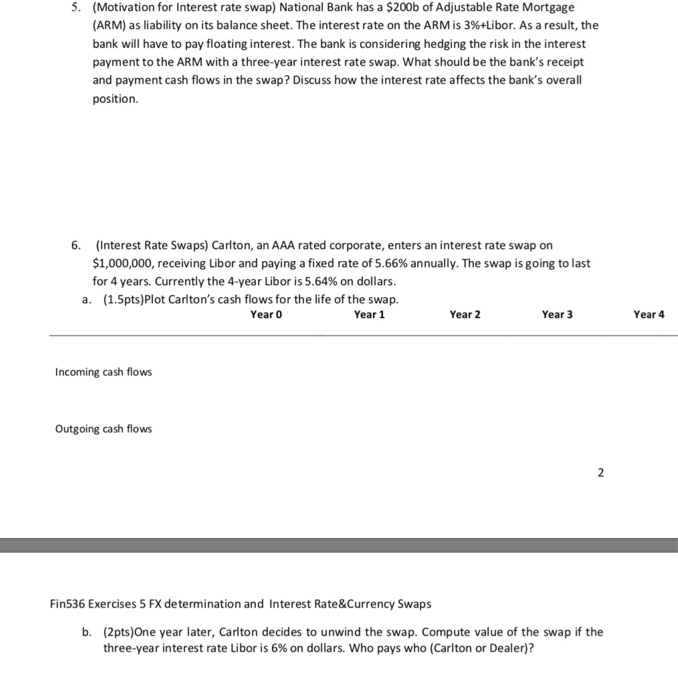

Use the following table of swap quotes for relevant questions in this exercise. Table 1 Interest Rate and Currency Swap Quotes Euro- Bid Swiss franc Bid Japanese yen Bid U.S. dollar Bid Years Ask Ask Ask Ask 2.99 3.02 3.12 47 5.24 5.26 0.23 0.26 1 1.43 2 3.08 1.68 1.76 5.43 5.46 0.36 0.39 3 3.24 3.28 1.93 2,01 5.56 5.59 0.56 0.59 4 3.44 3.48 2.15 2.23 5.65 5,68 0.82 0.85 5 3.63 3.67 2.35 2.43 5.73 5.76 1,09 1.12 6 3.83 3.87 2.54 2.62 5.80 5.83 1.33 .36 7 4.01 4.05 2.73 2.8 5.86 5.89 1.55 1.58 8 4.18 4.22 2.91 2.99 5.92 5.95 1,75 1,78 4.32 9 4.36 3.08 3.16 5.96 5.99 1.90 1.93 4.42 4.46 3.22 3.45 3.30 2.04 2.07 10 6.01 6.04 12 4.58 4.62 3.55 6.10 6.13 2.28 2.32 15 4.78 4.82 3.71 3.8 6.20 6.23 2.51 2.56 5.04 20 5,00 3.96 4.06 6.29 6.32 2.71 2.76 25 5.13 4.07 4.16 1.3125 1.4375 4.17 6.29 6.32 2.77 2.82 5.17 30 5.19 5.23 4.26 6.28 6.31 2.82 2.88 3.0313 3.0938 5.0625 0.1250 LIBOR 4.9375 0.2188 Note: Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. All quotes are against LIBOR 5. (Motivation for Interest rate swap) National Bank has a $200b of Adjustable Rate Mortgage (ARM) as liability on its balance sheet. The interest rate on the ARM is 3%+Libor. As a result, the bank will have to pay floating interest. The bank is considering hedging the risk in the interest payment to the ARM with a three-year interest rate swap. What should be the bank's receipt and payment cash flows in the swap? Discuss how the interest rate affects the bank's overall position. 6 (Interest Rate Swaps) Carlton, an AAA rated corporate, enters an interest rate swap on $1,000,000, receiving Libor and paying a fixed rate of 5.66 % annually. The swap is going to last for 4 years. Currently the 4-year Libor is S.64% on dollars. (1.5pts)Plot Carlton's cash flows for the life of the swap. Year 0 a. Year 1 Year 2 Year 3 Year 4 Incoming cash flows Outgoing cash flows 2 Fin536 Exercises 5 FX de termination and Interest Rate&Currency Swaps (2pts)One year later, Carlton decid es to unwind the swap. Compute value of the swap if the three-year interest rate Libor is 6% on dollars. Who pays who (Carlton or Dealer)? b. Use the following table of swap quotes for relevant questions in this exercise. Table 1 Interest Rate and Currency Swap Quotes Euro- Bid Swiss franc Bid Japanese yen Bid U.S. dollar Bid Years Ask Ask Ask Ask 2.99 3.02 3.12 47 5.24 5.26 0.23 0.26 1 1.43 2 3.08 1.68 1.76 5.43 5.46 0.36 0.39 3 3.24 3.28 1.93 2,01 5.56 5.59 0.56 0.59 4 3.44 3.48 2.15 2.23 5.65 5,68 0.82 0.85 5 3.63 3.67 2.35 2.43 5.73 5.76 1,09 1.12 6 3.83 3.87 2.54 2.62 5.80 5.83 1.33 .36 7 4.01 4.05 2.73 2.8 5.86 5.89 1.55 1.58 8 4.18 4.22 2.91 2.99 5.92 5.95 1,75 1,78 4.32 9 4.36 3.08 3.16 5.96 5.99 1.90 1.93 4.42 4.46 3.22 3.45 3.30 2.04 2.07 10 6.01 6.04 12 4.58 4.62 3.55 6.10 6.13 2.28 2.32 15 4.78 4.82 3.71 3.8 6.20 6.23 2.51 2.56 5.04 20 5,00 3.96 4.06 6.29 6.32 2.71 2.76 25 5.13 4.07 4.16 1.3125 1.4375 4.17 6.29 6.32 2.77 2.82 5.17 30 5.19 5.23 4.26 6.28 6.31 2.82 2.88 3.0313 3.0938 5.0625 0.1250 LIBOR 4.9375 0.2188 Note: Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. All quotes are against LIBOR 5. (Motivation for Interest rate swap) National Bank has a $200b of Adjustable Rate Mortgage (ARM) as liability on its balance sheet. The interest rate on the ARM is 3%+Libor. As a result, the bank will have to pay floating interest. The bank is considering hedging the risk in the interest payment to the ARM with a three-year interest rate swap. What should be the bank's receipt and payment cash flows in the swap? Discuss how the interest rate affects the bank's overall position. 6 (Interest Rate Swaps) Carlton, an AAA rated corporate, enters an interest rate swap on $1,000,000, receiving Libor and paying a fixed rate of 5.66 % annually. The swap is going to last for 4 years. Currently the 4-year Libor is S.64% on dollars. (1.5pts)Plot Carlton's cash flows for the life of the swap. Year 0 a. Year 1 Year 2 Year 3 Year 4 Incoming cash flows Outgoing cash flows 2 Fin536 Exercises 5 FX de termination and Interest Rate&Currency Swaps (2pts)One year later, Carlton decid es to unwind the swap. Compute value of the swap if the three-year interest rate Libor is 6% on dollars. Who pays who (Carlton or Dealer)? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts