Question: Hello, please if you can't solve this question, please donot answer it, this will be 2nd time im posting. Thanks Programs Plus is a retall

Hello, please if you can't solve this question, please donot answer it, this will be 2nd time im posting. Thanks

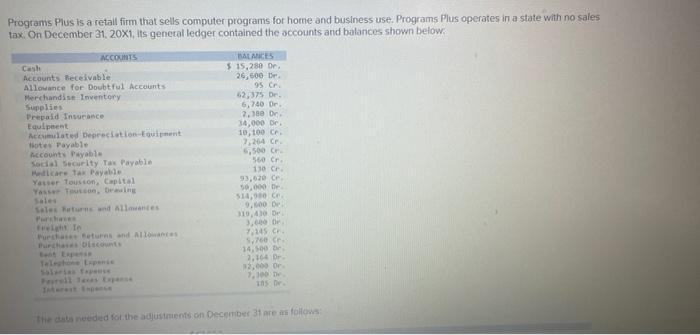

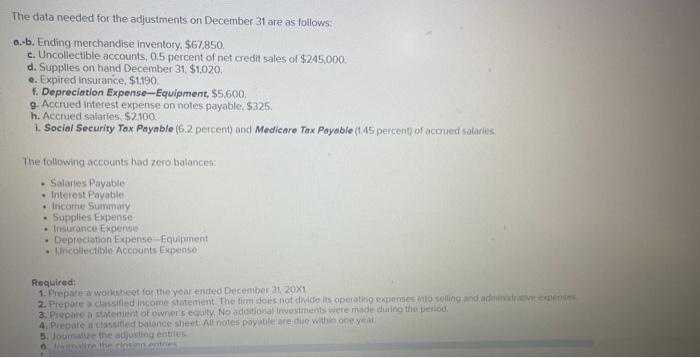

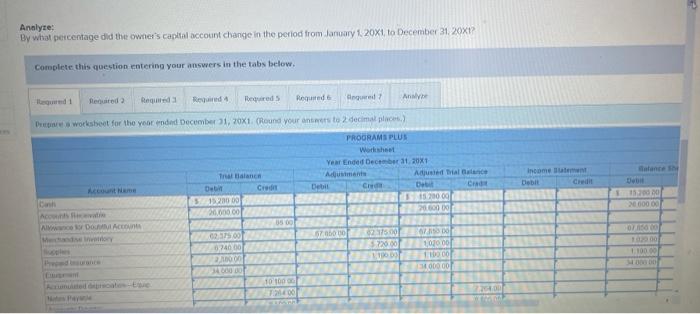

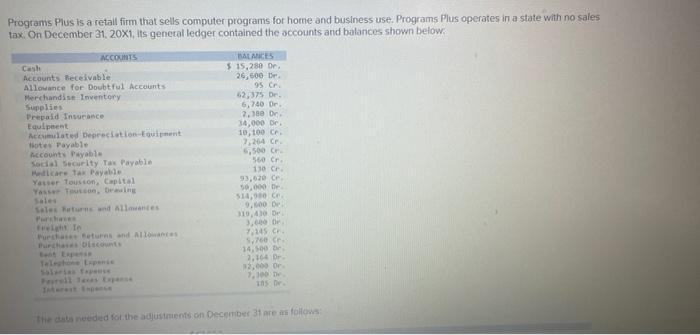

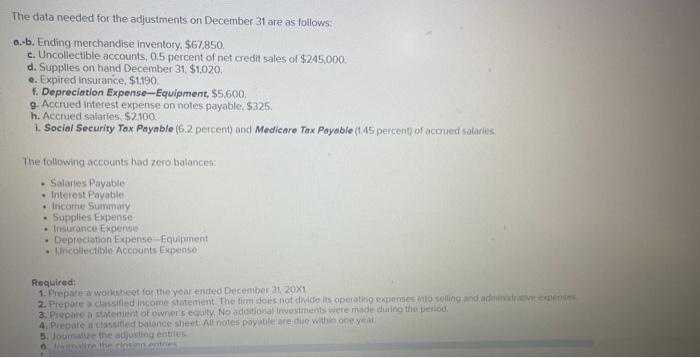

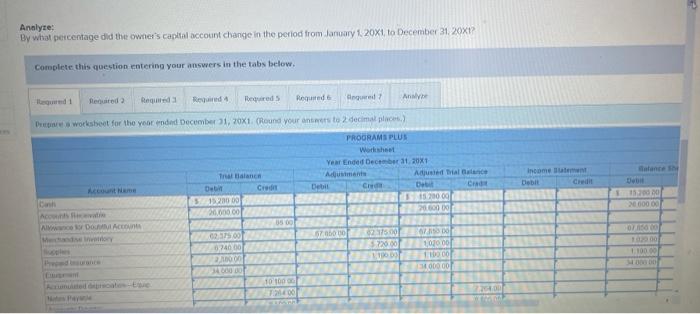

Programs Plus is a retall firm that sells computer programs for home and business use. Programs. Plus operates in a state with no sales tax. On December 31, 20x1, Its genetal ledger contained the sccounts and balances shown below. The arin needed for the adjustrients on December 31 gre an foltons: The data needed for the adjustments on December 31 are as follows: o.-b. Ending merchandise inventory. $67.850. c. Uncollectible accounts, 0.5 percent of net credit sales of $245,000. d. Supples on hand December 31, $1,020. e. Expired insurance, $1,190. f. Depreciation Expense-Equipment, $5,600. 9. Accrued interest expense on notes payable, $325. h. Accrued salaries. $2100. 1. Social Security Tax Payable (6.2 percent) and Medicare Tax Payable (1.45 percent) of accrued sataries: The following accounts had zero balances: - Salarles Payable - Interest Payable - income Suinmary - Supplies Expense - Insurance Expense - Depreciation Expense - Equipment - Uncollectible'Accounts Expenso Required: 1. Prepore ab woiksbeet for the year ended December it, 20X1 3. Prepare a statement of owner 5 equity. No idotional investments were made during the periad. 4. Prepare a classified balance sheet All notes payable are dise wathit ons yeari. 5. Lournalze the adjusung entriek Analyze: By what percentage did the owries's captial account change in the period from Jaruary 1,201, to December 31.201 ? Complete this question entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock