Question: Hello, please show calculations step by step with explanation when necessary. The image shows correct answers and wrong answers. I need help figuring out the

Hello, please show calculations step by step with explanation when necessary. The image shows correct answers and wrong answers. I need help figuring out the wrong answers and why the correct answer is correct as well. Please show where are getting the numbers from. Thank you and I appreciate your help :)

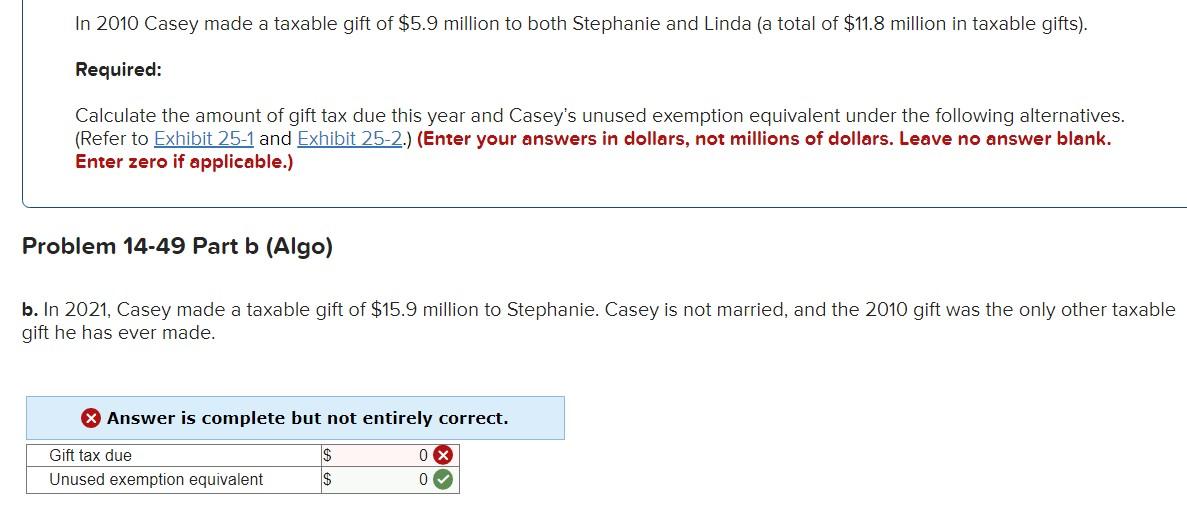

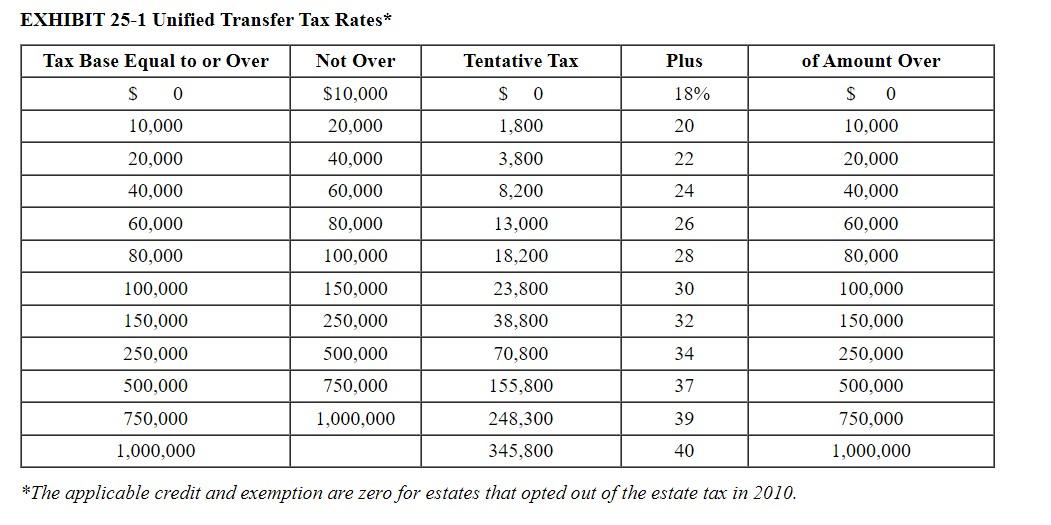

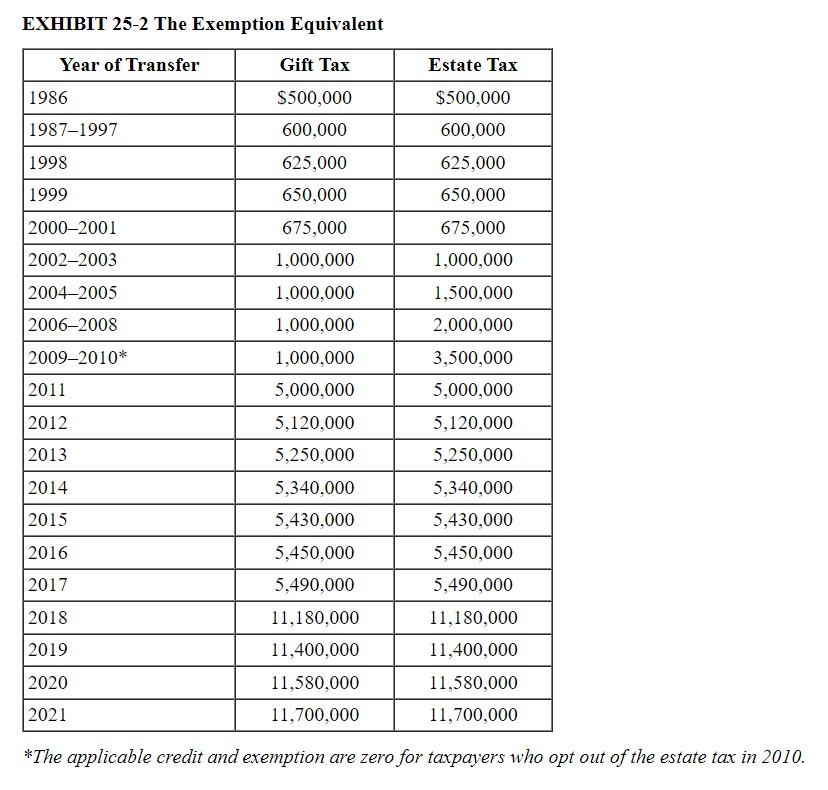

In 2010 Casey made a taxable gift of $5.9 million to both Stephanie and Linda (a total of $11.8 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) Problem 14-49 Part b (Algo) o. In 2021, Casey made a taxable gift of $15.9 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Answer is complete but not entirely correct. EXHIBIT 25-1 Unified Transfer Tax Rates* *The applicable credit and exemption are zero for estates that opted out of the estate tax in 2010. EXHIBIT 25-2 The Exemption Equivalent *The applicable credit and exemption are zero for taxpayers who opt out of the estate tax in 2010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts