Question: Hello there, We need to put together a DCF one-pager to brief Bob on the potential enterprise value range for the M&A target you identified.

Hello there,

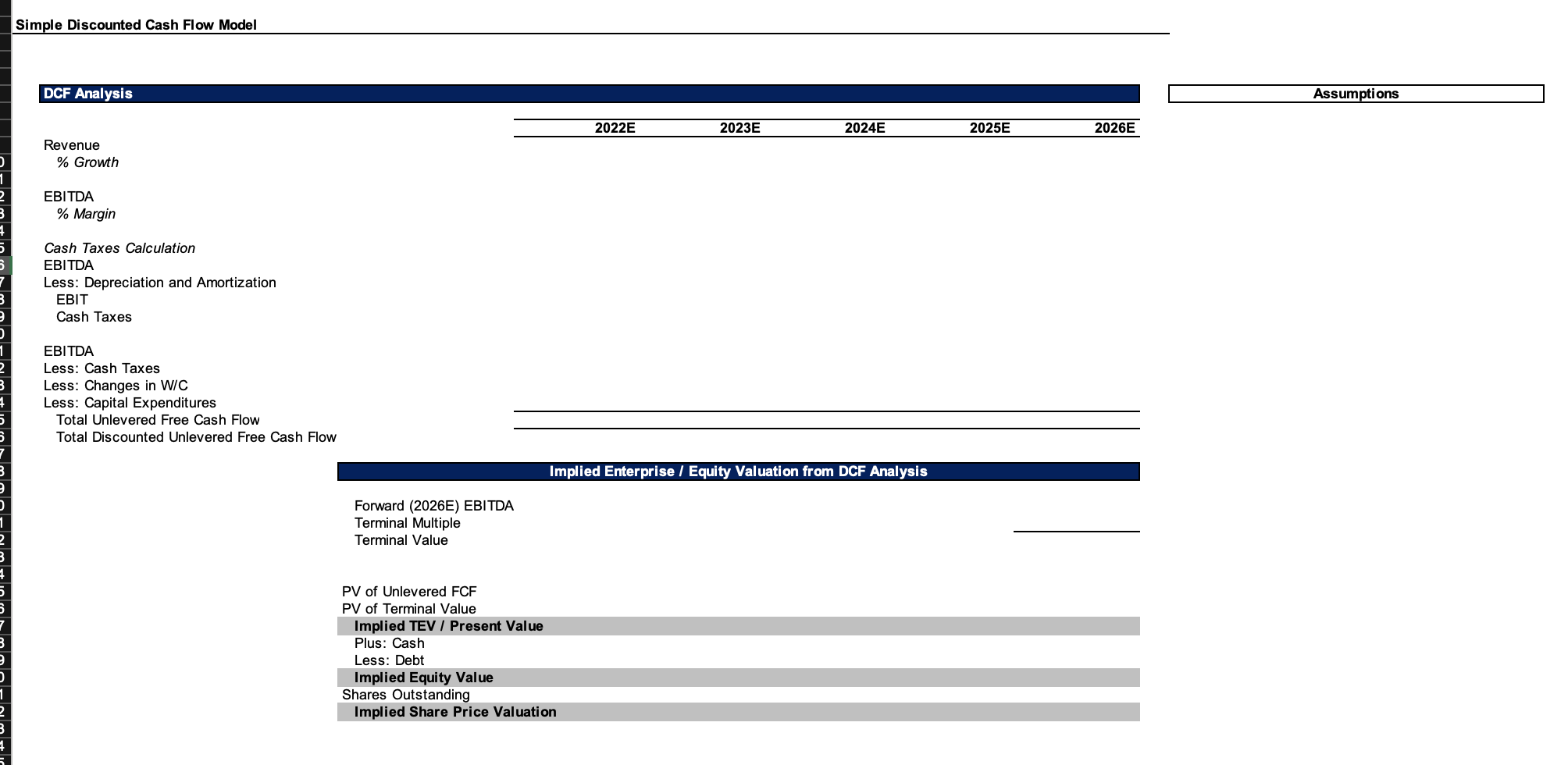

We need to put together a DCF one-pager to brief Bob on the potential enterprise value range for the M&A target you identified. Because this is an urgent matter, Ive attached a basic template from a previous deal which you may leverage as you build out your calculations. In terms of inputs, please use the following operating assumptions below: (show formulas)

Year 1 Revenue: $13.6 billion

Year 1 EBITDA: $5.4 billion

Year 5 EBITDA margin: 42%

YoY Revenue Growth: 5%

Depreciation & Amortization as % Revenue: 0.7% (assume constant)

Year 1 Net Working Capital: 0

Net Working Capital as % of Revenue: 5% (assume constant)

Capital Expenditures as % Revenue: 0.5% (assume constant)

Cash: $9.2 billion

Debt: $50 million

Shares Outstanding: 1 billion

Tax Rate: 40%

WACC: 8.5%

WACC step-up: 0.50%

Terminal Multiple: 12.0x

Terminal Multiple step-up: 0.5x

Use NPV based on terminal multiple method

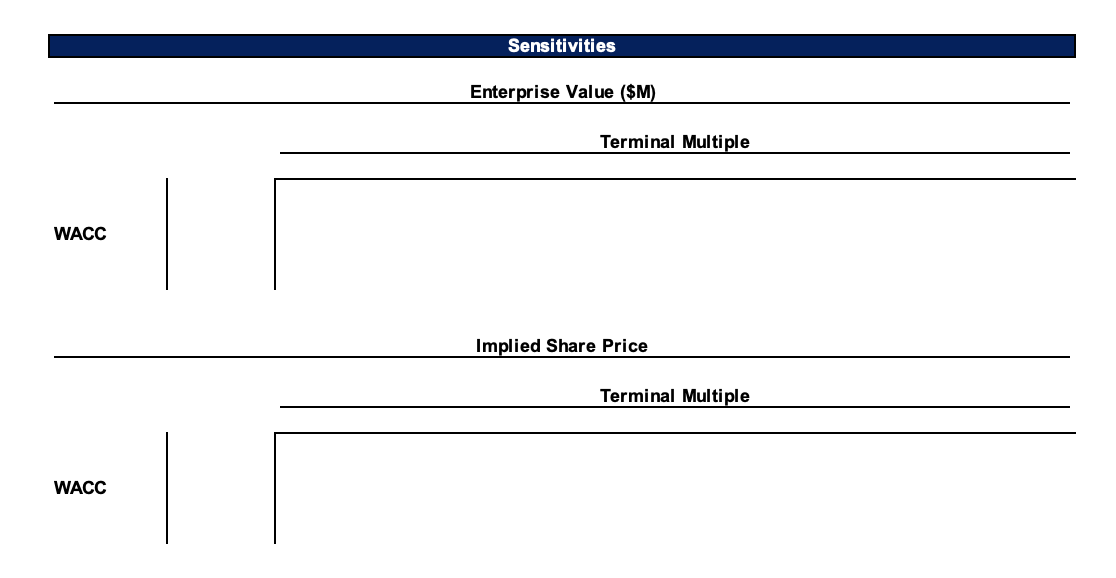

Sensitivity Analysis: Create two tables sensitizing Enterprise Value and Share Price for WACC and Terminal Multiple

Simple Discounted Cash Flow Model Sensitivities Enterprise Value ($M) \begin{tabular}{l|l} \hline & Terminal Multiple \\ WACC & \\ & \\ & \\ Implied Share Price \end{tabular} Simple Discounted Cash Flow Model Sensitivities Enterprise Value ($M) \begin{tabular}{l|l} \hline & Terminal Multiple \\ WACC & \\ & \\ & \\ Implied Share Price \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts