Question: hello this is a long question please answer both A share of the ADR of a German firm represents three shares of that firm's stock

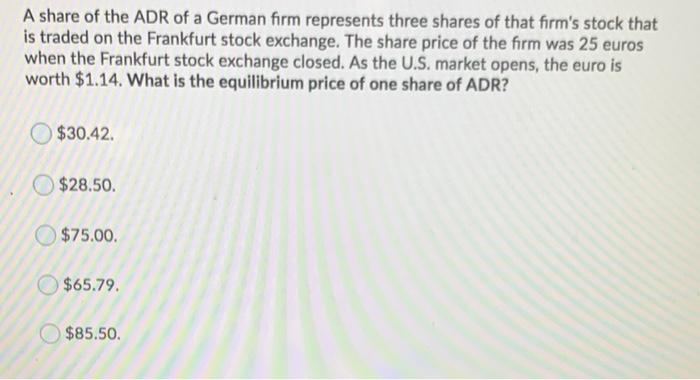

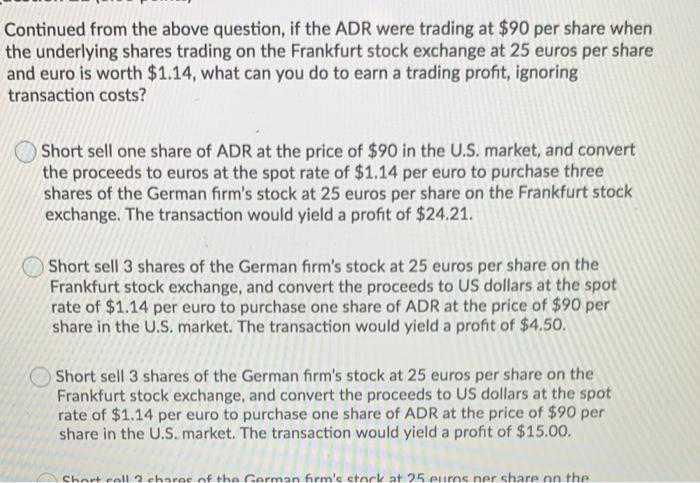

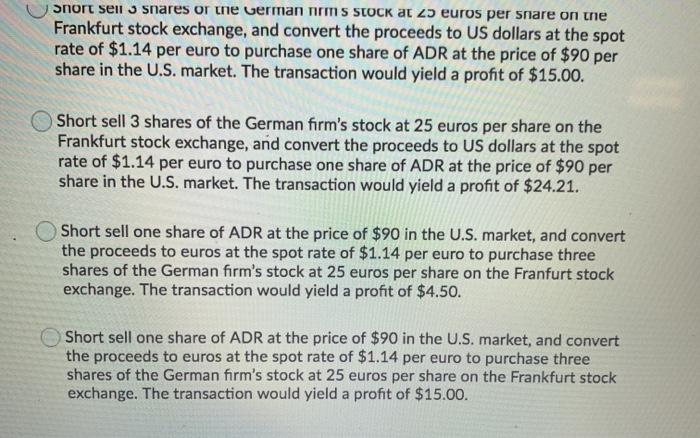

A share of the ADR of a German firm represents three shares of that firm's stock that is traded on the Frankfurt stock exchange. The share price of the firm was 25 euros when the Frankfurt stock exchange closed. As the U.S. market opens, the euro is worth $1.14. What is the equilibrium price of one share of ADR? $30.42. $28.50. $75.00. $65.79. $85.50 Continued from the above question, if the ADR were trading at $90 per share when the underlying shares trading on the Frankfurt stock exchange at 25 euros per share and euro is worth $1.14, what can you do to earn a trading profit, ignoring transaction costs? Short sell one share of ADR at the price of $90 in the U.S. market, and convert the proceeds to euros at the spot rate of $1.14 per euro to purchase three shares of the German firm's stock at 25 euros per share on the Frankfurt stock exchange. The transaction would yield a profit of $24.21. Short sell 3 shares of the German firm's stock at 25 euros per share on the Frankfurt stock exchange, and convert the proceeds to US dollars at the spot rate of $1.14 per euro to purchase one share of ADR at the price of $90 per share in the U.S. market. The transaction would yield a profit of $4.50. Short sell 3 shares of the German firm's stock at 25 euros per share on the Frankfurt stock exchange, and convert the proceeds to US dollars at the spot rate of $1.14 per euro to purchase one share of ADR at the price of $90 per share in the U.S. market. The transaction would yield a profit of $15.00. Chant call 2 charee of the German firm's stock at 25 euros ner share on the snort sell 3 snares or the German nrms StOCK at 25 euros per share on the Frankfurt stock exchange, and convert the proceeds to US dollars at the spot rate of $1.14 per euro to purchase one share of ADR at the price of $90 per share in the U.S. market. The transaction would yield a profit of $15.00. Short sell 3 shares of the German firm's stock at 25 euros per share on the Frankfurt stock exchange, and convert the proceeds to US dollars at the spot rate of $1.14 per euro to purchase one share of ADR at the price of $90 per share in the U.S. market. The transaction would yield a profit of $24.21. Short sell one share of ADR at the price of $90 in the U.S. market, and convert the proceeds to euros at the spot rate of $1.14 per euro to purchase three shares of the German firm's stock at 25 euros per share on the Franfurt stock exchange. The transaction would yield a profit of $4.50. Short sell one share of ADR at the price of $90 in the U.S. market, and convert the proceeds to euros at the spot rate of $1.14 per euro to purchase three shares of the German firm's stock at 25 euros per share on the Frankfurt stock exchange. The transaction would yield a profit of $15.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts