Question: Hello, this is a three-step question. I need help with the whole question- if you are unable to answer all 3 requirements, please do not

Hello, this is a three-step question. I need help with the whole question- if you are unable to answer all 3 requirements, please do not respond. Thank you so much for helping.

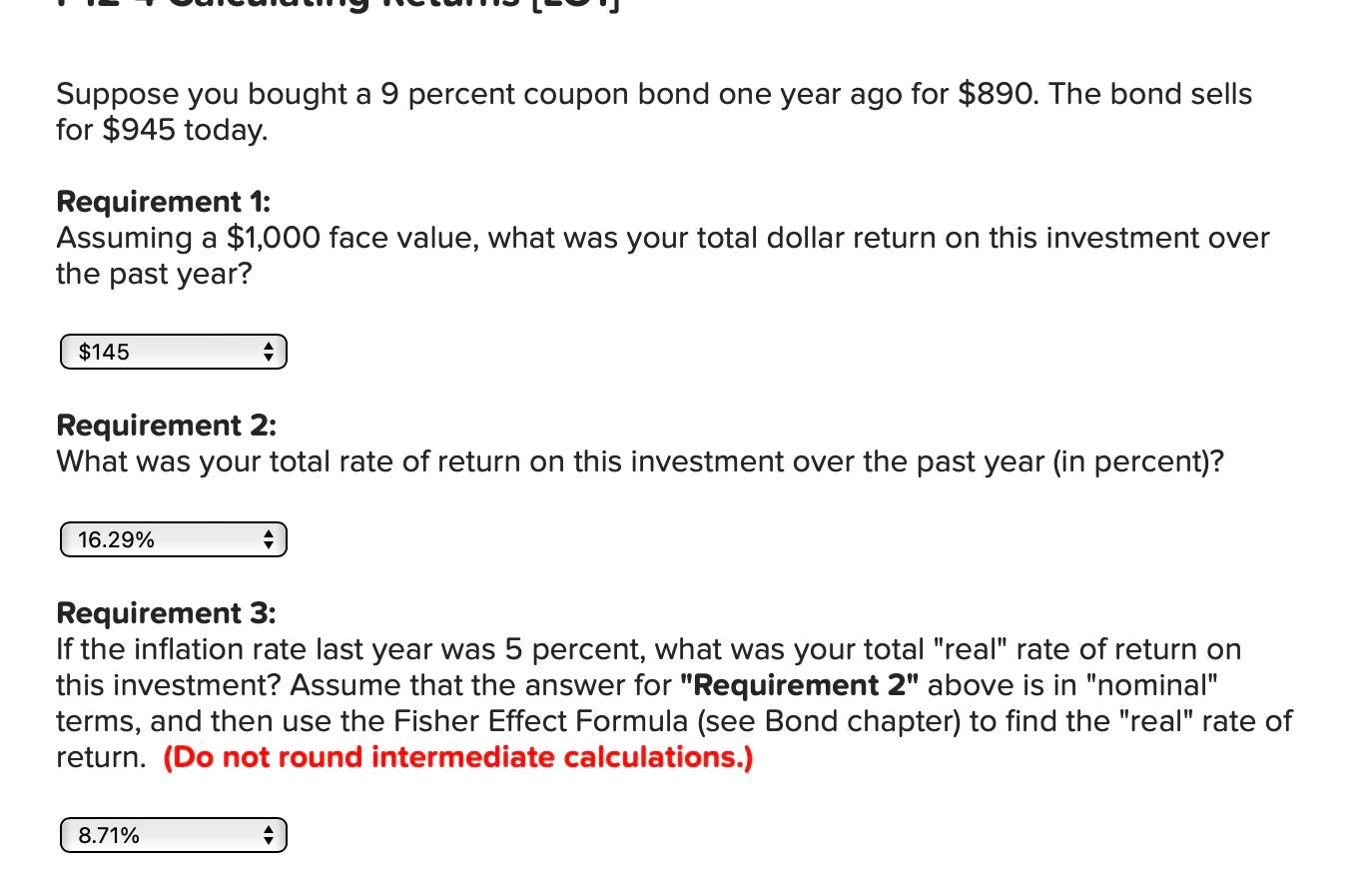

Suppose you bought a 9 percent coupon bond one year ago for $890. The bond sells for $945 today. Requirement 1: Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? $145 Requirement 2: What was your total rate of return on this investment over the past year (in percent)? 16.29% Requirement 3: If the inflation rate last year was 5 percent, what was your total "real" rate of return on this investment? Assume that the answer for "Requirement 2" above is in "nominal" terms, and then use the Fisher Effect Formula (see Bond chapter) to find the "real" rate of return. (Do not round intermediate calculations.) 8.71%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts