Question: Hello, this is a three-step question. I need help with the whole question- if you are unable to answer all 3 requirements, please do not

Hello, this is a three-step question. I need help with the whole question- if you are unable to answer all 3 requirements, please do not respond. Thank you so much for helping.

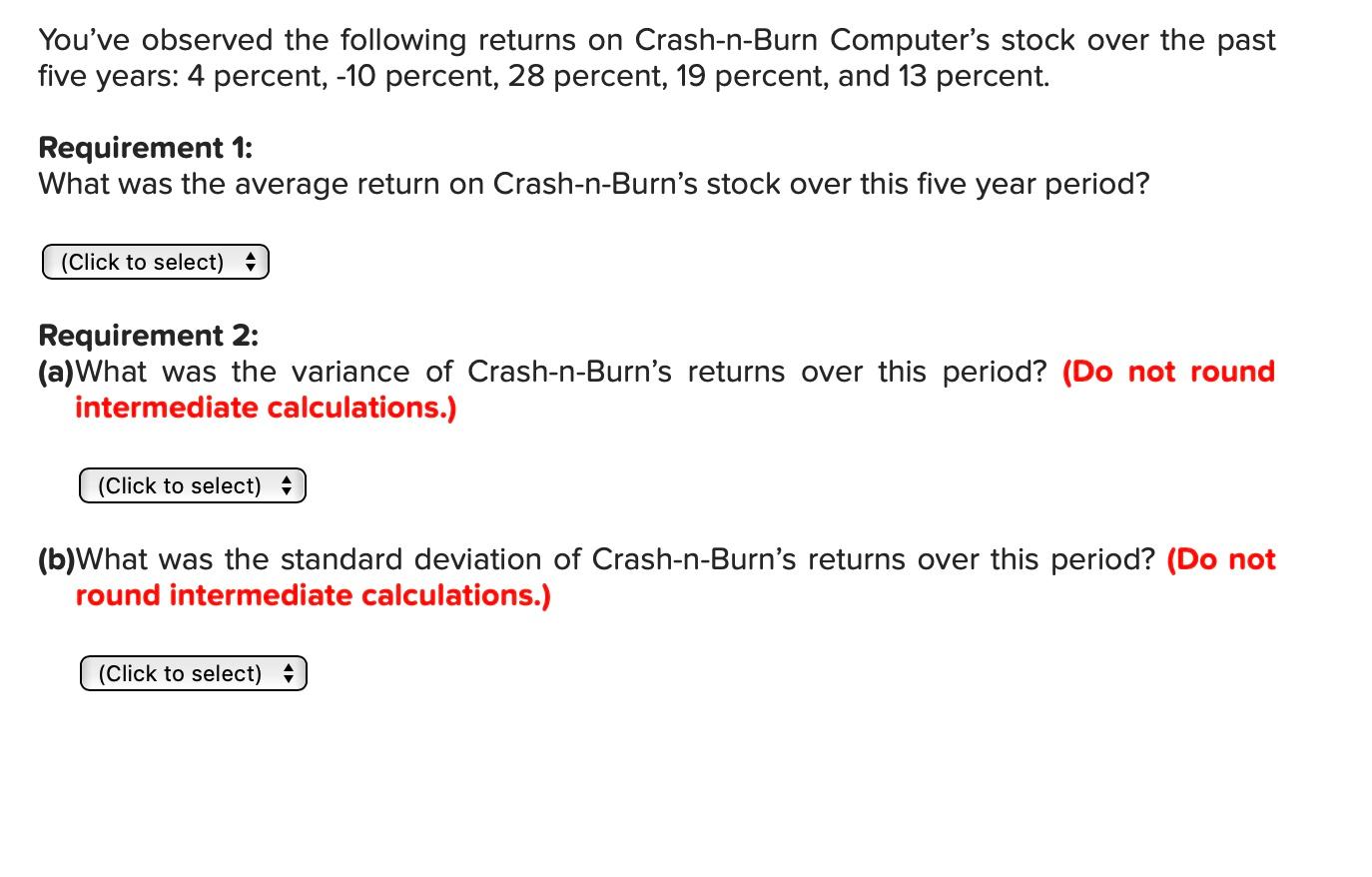

You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 4 percent, -10 percent, 28 percent, 19 percent, and 13 percent. Requirement 1: What was the average return on Crash-n-Burn's stock over this five year period? (Click to select) Requirement 2: (a)What was the variance of Crash-n-Burn's returns over this period? (Do not round intermediate calculations.) (Click to select) (b)What was the standard deviation of Crash-n-Burn's returns over this period? (Do not round intermediate calculations.) (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts