Question: Help! Help! A certain mutual fund invests in both U.S. and foreign markets. Let x be a random variable that represents the monthly percentage return

Help! Help!

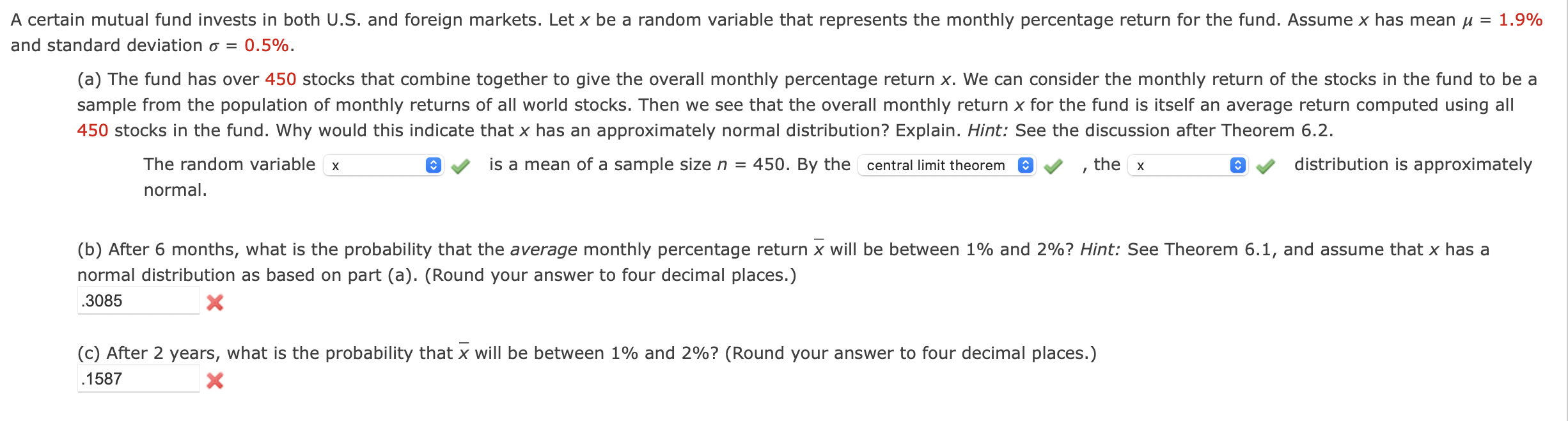

A certain mutual fund invests in both U.S. and foreign markets. Let x be a random variable that represents the monthly percentage return for the fund. Assume x has mean u = 1.9% and standard deviation 0- = 0.5%. (a) The fund has over 450 stocks that combine together to give the overall monthly percentage return x. We can consider the monthly return of the stocks in the fund to be a sample from the population of monthly returns of all world stocks. Then we see that the overall monthly return X for the fund is itself an average return computed using all 450 stocks in the fund. Why would this indicate thatx has an approximately normal distribution? Explain. Hint: See the discussion after Theorem 6.2. The random variable x is a mean of a sample size n = 450. By the central limit theorem y , the x a 4 distribution is approximately normal. (b) After 6 months, what is the probability that the average monthly percentage return )7 will be between 1% and 2%? Hint: See Theorem 6.1, and assume thatx has a normal distribution as based on part (a). (Round your answer to four decimal places.) .3085 x (c) After 2 years, what is the probability that )7 will be between 1% and 2%? (Round your answer to four decimal places.) .1537 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts