Question: Help help help ASAP please please please please Clarke Publishing is considering investing in a new printing press. The initial costs will be $250,000. After-tax

Help help help ASAP please please please please

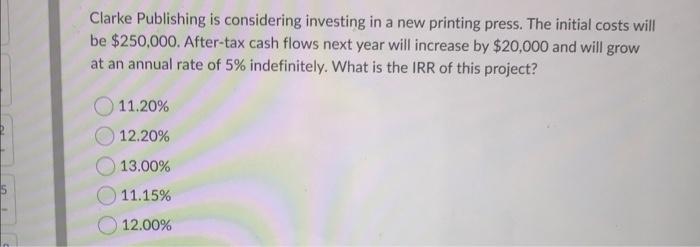

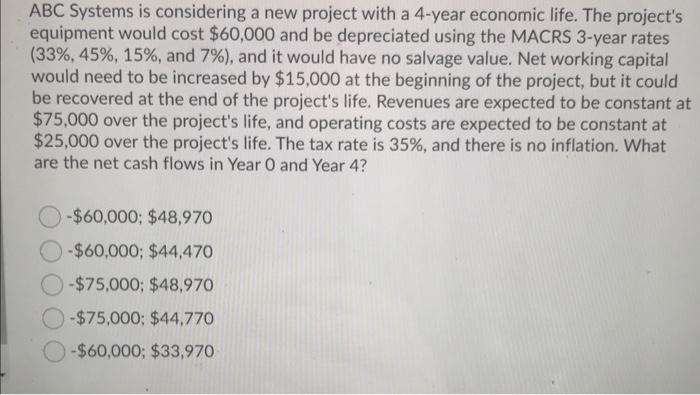

Clarke Publishing is considering investing in a new printing press. The initial costs will be $250,000. After-tax cash flows next year will increase by $20,000 and will grow at an annual rate of 5% indefinitely. What is the IRR of this project? 11.20% 12.20% 13.00% 11.15% 12.00% ABC Systems is considering a new project with a 4-year economic life. The project's equipment would cost $60,000 and be depreciated using the MACRS 3-year rates (33%, 45%, 15%, and 7%), and it would have no salvage value. Net working capital would need to be increased by $15,000 at the beginning of the project, but it could be recovered at the end of the project's life. Revenues are expected to be constant at $75,000 over the project's life, and operating costs are expected to be constant at $25,000 over the project's life. The tax rate is 35%, and there is no inflation. What are the net cash flows in Year 0 and Year 4? -$60,000; $48,970 -$60,000; $44,470 -$75,000: $48,970 -$75,000: $44,770 -$60,000; $33,970

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts