Question: Help Me How to do This. Show your Work. Your firm is a U.K-based Italian firm for 1,000,000 worth of bicycles. Payment from the Italian

Help Me How to do This. Show your Work.

Help Me How to do This. Show your Work.

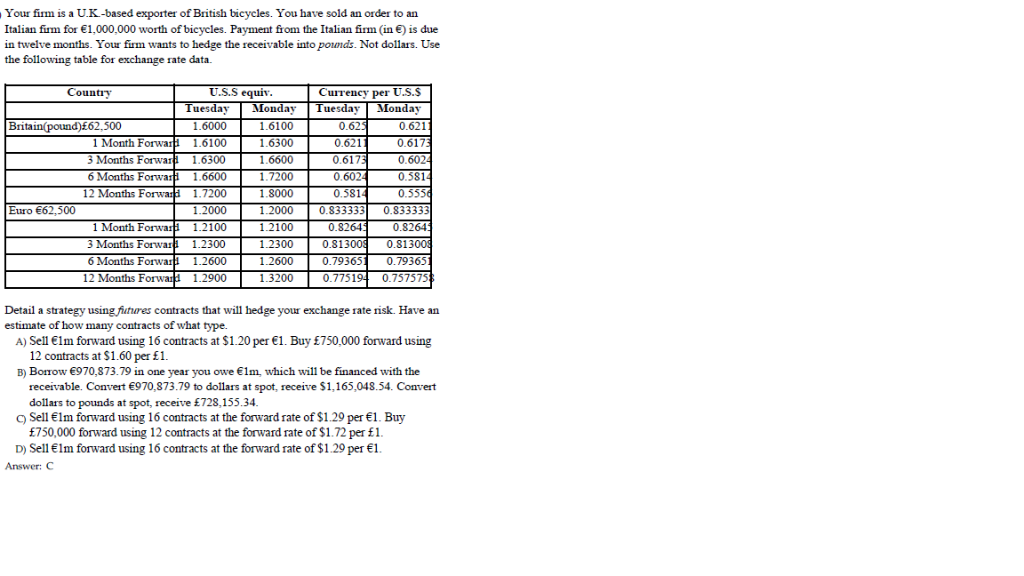

Your firm is a U.K-based Italian firm for 1,000,000 worth of bicycles. Payment from the Italian firm (in ) is due in twelve months. Your firm wants to hedge the receivable into pounds. Not dollars. Use the following exporter of British bieycles. You have sold an order to an table for exchange rate data Country U.S.S equiv Currency per U.S.S uesdayMonday uesdav 1.6000 Month Fora 1.6100 3 Months Forward 16300 6 Months Forward 1.6600 1.7200 1.2000 1.2100 3 Months Forwa 1.2300 6 Months Forwa 1.2600 0.62 0.621 0.617 0.602 Britain(pound)62,500 1.6100 1.6300 .6600 1.7200 1.8000 1.20000.833333 0.833333 1.2100 1.2300 1.2600 1.3200 0.621 0.617 0.602 0.581 0.58140.555 12 Months Forw Euro 62,500 1 Month Forwa 0.8264 0.8264 0.81300 0.813 0.793651 0.79365 12 Months Forw 1.2900 0.7751 0.757575 contracts that will hedge your exchange rate risk. Have an Detai estimate of how many contracts of what type. 1 a strategy using fuhures A) Sell 1m forward using 16 contracts at $1.20 per 1. Buy 750,000 forward using B) Borow 970,873.79 in one year you owe lm, which will be financed with the c) Sell lm forward using 16 contracts at the forward rate of $1.29 per l. Buy D) Sell lm forward using 16 contracts at the forward rate of $1.29 per l 12 contracts at $1.60 per 1 receivable. Convert 970,873.79 to dollars at spot, receive $1,165,048.54. Convert dollars to pounds at spot, receive 728,155.34. f750,000 forward using 12 contracts at the forward rate of $1.72 per f1 Answer: C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts