Question: Help me with this Problem 7. Pepin Company is considering replacing a machine that has the following characteristics. Book value P100,000 Remaining useful life 5

Help me with this

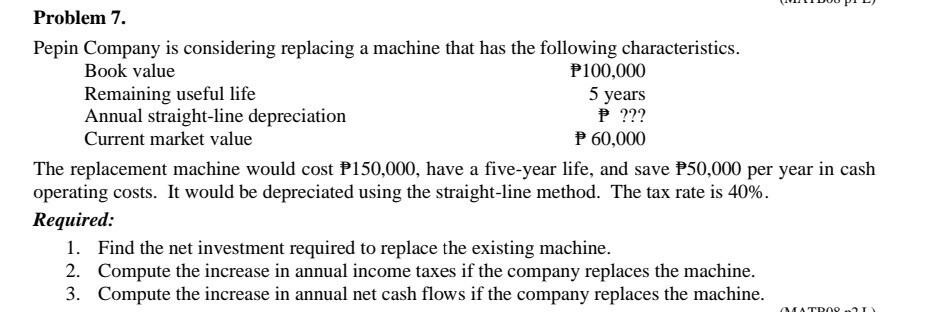

Problem 7. Pepin Company is considering replacing a machine that has the following characteristics. Book value P100,000 Remaining useful life 5 years Annual straight-line depreciation P ??? Current market value P 60,000 The replacement machine would cost P150,000, have a five-year life, and save P50,000 per year in cash operating costs. It would be depreciated using the straight-line method. The tax rate is 40%. Required: 1. Find the net investment required to replace the existing machine. 2. Compute the increase in annual income taxes if the company replaces the machine. 3. Compute the increase in annual net cash flows if the company replaces the machine. ATROO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts