Question: Help me with this question. thank you. Question 1 Nopal Fabrics Trading received an order from a customer to produce 200 unit of customized corporate

Help me with this question. thank you.

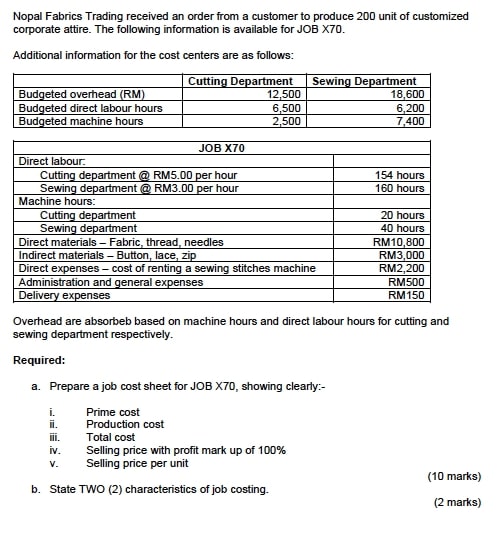

Question 1

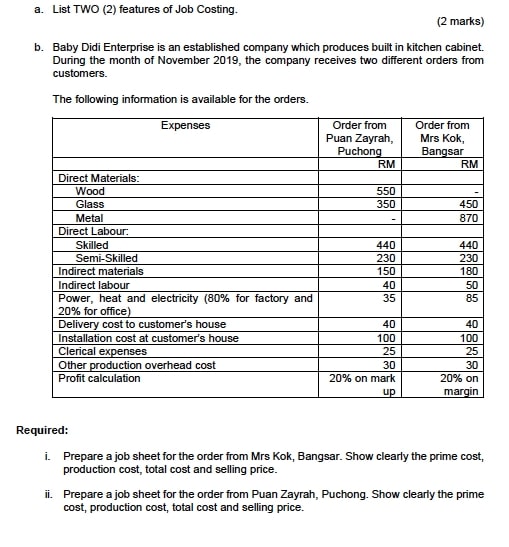

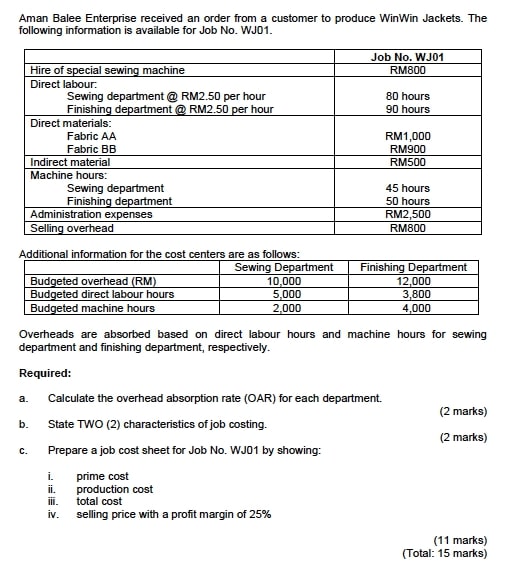

Nopal Fabrics Trading received an order from a customer to produce 200 unit of customized corporate attire. The following information is available for JOB X70. Additional information for the cost centers are as follows: Cutting Department Sewing Department Budgeted overhead (RM) 12,500 18,600 Budgeted direct labour hours 6,500 6,200 Budgeted machine hours 2,500 7,400 JOB X70 Direct labour. Cutting department @ RM5.00 per hour 154 hours Sewing department @ RM3.00 per hour 160 hours Machine hours: Cutting department 20 hours Sewing department 40 hours Direct materials - Fabric, thread, needles RM10,800 Indirect materials - Button, lace, zip RM3,000 Direct expenses cost of renting a sewing stitches machine RM2,200 Administration and general expenses RM500 Delivery expenses RM 150 Overhead are absorbeb based on machine hours and direct labour hours for cutting and sewing department respectively. Required: a. Prepare a job cost sheet for JOB X70, showing clearly:- Prime cost Production cost iii. Total cost iv . Selling price with profit mark up of 100% V. Selling price per unit (10 marks) b. State TWO (2) characteristics of job costing. (2 marks)a. List TWO (2) features of Job Costing. (2 marks) b. Baby Didi Enterprise is an established company which produces built in kitchen cabinet. During the month of November 2019, the company receives two different orders from customers. The following information is available for the orders. Expenses Order from Order from Puan Zayrah, Mrs Kok, Puchong Bangsar RM RM Direct Materials: Wood 550 Glass 350 150 Metal 870 Direct Labour. Skilled 440 140 Semi-Skilled 230 230 Indirect materials 150 180 Indirect labour 40 50 Power, heat and electricity (80% for factory and 35 85 20% for office) Delivery cost to customer's house 40 40 Installation cost at customer's house 100 100 Clerical expenses 25 25 Other production overhead cost 30 30 Profit calculation 20% on mark 20% on up margin Required: i. Prepare a job sheet for the order from Mrs Kok, Bangsar. Show clearly the prime cost, production cost, total cost and selling price. ii. Prepare a job sheet for the order from Puan Zayrah, Puchong. Show clearly the prime cost, production cost, total cost and selling price.Aman Balee Enterprise received an order from a customer to produce WinWin Jackets. The following information is available for Job No. WJ01. Job No. WJ01 Hire of special sewing machine RM800 Direct labour. Sewing department @ RM2.50 per hour 80 hours Finishing department @ RM2.50 per hour 90 hours Direct materials: Fabric AA RM1,000 Fabric BB RM900 Indirect material RM500 Machine hours: Sewing department 45 hours Finishing department 50 hours Administration expenses RM2,500 Selling overhead RM800 Additional information for the cost centers are as follows: Sewing Department Finishing Department Budgeted overhead (RM) 10,000 12,000 Budgeted direct labour hours 5.000 3,800 Budgeted machine hours 2.000 4,000 Overheads are absorbed based on direct labour hours and machine hours for sewing department and finishing department, respectively. Required: a. Calculate the overhead absorption rate (OAR) for each department. (2 marks) b. State TWO (2) characteristics of job costing. (2 marks) C. Prepare a job cost sheet for Job No. WJ01 by showing: prime cost production cost total cost iV. selling price with a profit margin of 25% (11 marks) (Total: 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts