Question: help me with this task!! please read carefully and take all the figures into consideration 5. As a financial manager of Mango PLC your task

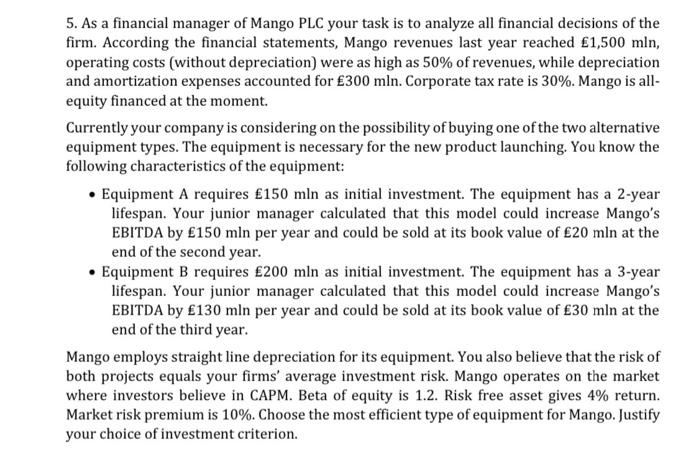

5. As a financial manager of Mango PLC your task is to analyze all financial decisions of the firm. According the financial statements, Mango revenues last year reached 1,500mln, operating costs (without depreciation) were as high as 50% of revenues, while depreciation and amortization expenses accounted for 300mln. Corporate tax rate is 30%. Mango is allequity financed at the moment. Currently your company is considering on the possibility of buying one of the two alternative equipment types. The equipment is necessary for the new product launching. You know the following characteristics of the equipment: - Equipment A requires 150mln as initial investment. The equipment has a 2-year lifespan. Your junior manager calculated that this model could increase Mango's EBITDA by 150mln per year and could be sold at its book value of 20mln at the end of the second year. - Equipment B requires 200mln as initial investment. The equipment has a 3-year lifespan. Your junior manager calculated that this model could increase Mango's EBITDA by 130mln per year and could be sold at its book value of 30mln at the end of the third year. Mango employs straight line depreciation for its equipment. You also believe that the risk of both projects equals your firms' average investment risk. Mango operates on the market where investors believe in CAPM. Beta of equity is 1.2 . Risk free asset gives 4% return. Market risk premium is 10%. Choose the most efficient type of equipment for Mango. Justify your choice of investment criterion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts