Question: help on (a), (b) & (c) please Shown below are the T-accounts relating to equipment that was purchased for cash by a company on the

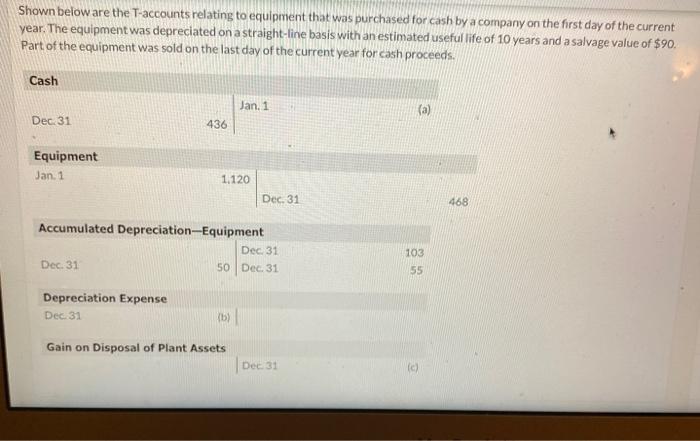

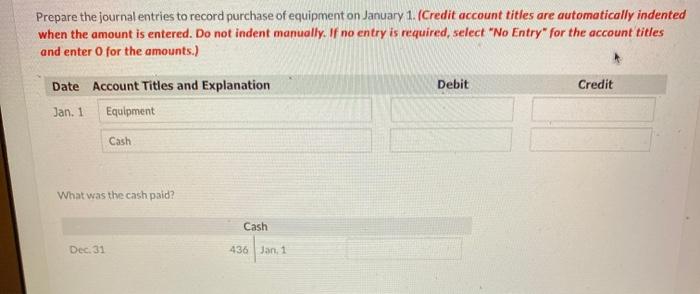

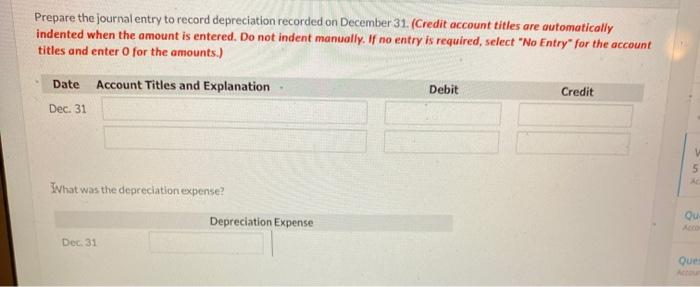

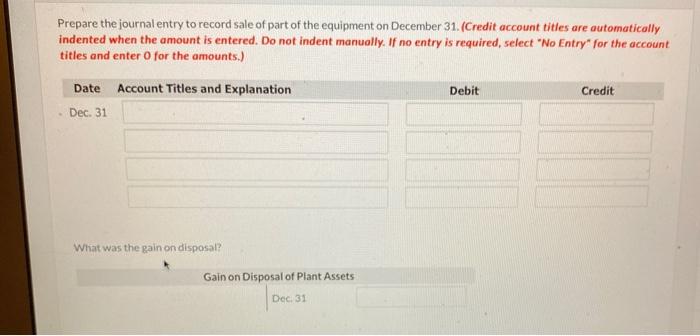

Shown below are the T-accounts relating to equipment that was purchased for cash by a company on the first day of the current year. The equipment was depreciated on a straight-line basis with an estimated useful life of 10 years and a salvage value of $90. Part of the equipment was sold on the last day of the current year for cash proceeds. Cash Jan. 1 (a) Dec 31 436 Equipment Jan. 1 1.120 Dec. 31 468 Accumulated Depreciation--Equipment Dec 31 Dec. 31 50 Dec 31 103 55 Depreciation Expense Dec. 31 (b) Gain on Disposal of Plant Assets Dec 31 Prepare the journal entries to record purchase of equipment on January 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation Jan. 1 Equipment Cash What was the cash paid? Cash Dec. 31 436 Jan, 1 Prepare the journal entry to record depreciation recorded on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 What was the depreciation expense? Depreciation Expense Qu ACO Dec. 31 Que Prepare the journal entry to record sale of part of the equipment on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31 What was the gain on disposal? Gain on Disposal of Plant Assets Dec 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts