Question: help please and thank you Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows in millions) shown below. 4 Year 1 2 3

help please and thank you

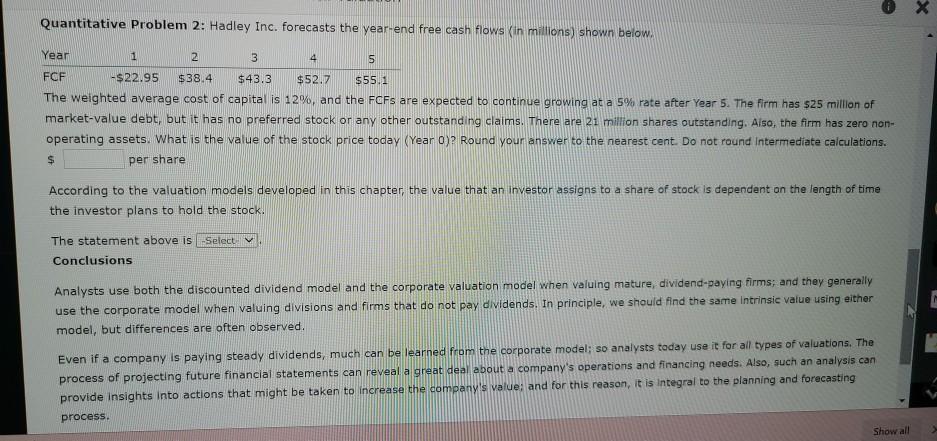

Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows in millions) shown below. 4 Year 1 2 3 5 FCF -$22.95 $38.4 $43.3 $52.7 $55.1 The weighted average cost of capital is 12%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $25 million of market value debt, but it has no preferred stock or any other outstanding claims. There are 21 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round Intermediate calculations. $ per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is Select Conclusions Analysts use both the discounted dividend model and the corporate valuation model when valuing mature, dividend paying firms; and they generally use the corporate model when valuing divisions and firms that do not pay dividends. In principle, we should find the same intrinsic value using either model, but differences are often observed. Even if a company is paying steady dividends, much can be learned from the corporate model: so analysts today use it for all types of valuations. The process of projecting future financial statements can reveal a great deal about a company's operations and financing needs. Also, such an analysis can provide insights into actions that might be taken to increase the company's value: and for this reason, it is integral to the planning and forecasting process. Show all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts