Question: Help, please Compute the monthly return data for the following stocks from January 01,2005 to January 01,2022 from the files uploaded. - Apple - Google

Help, please

Help, please

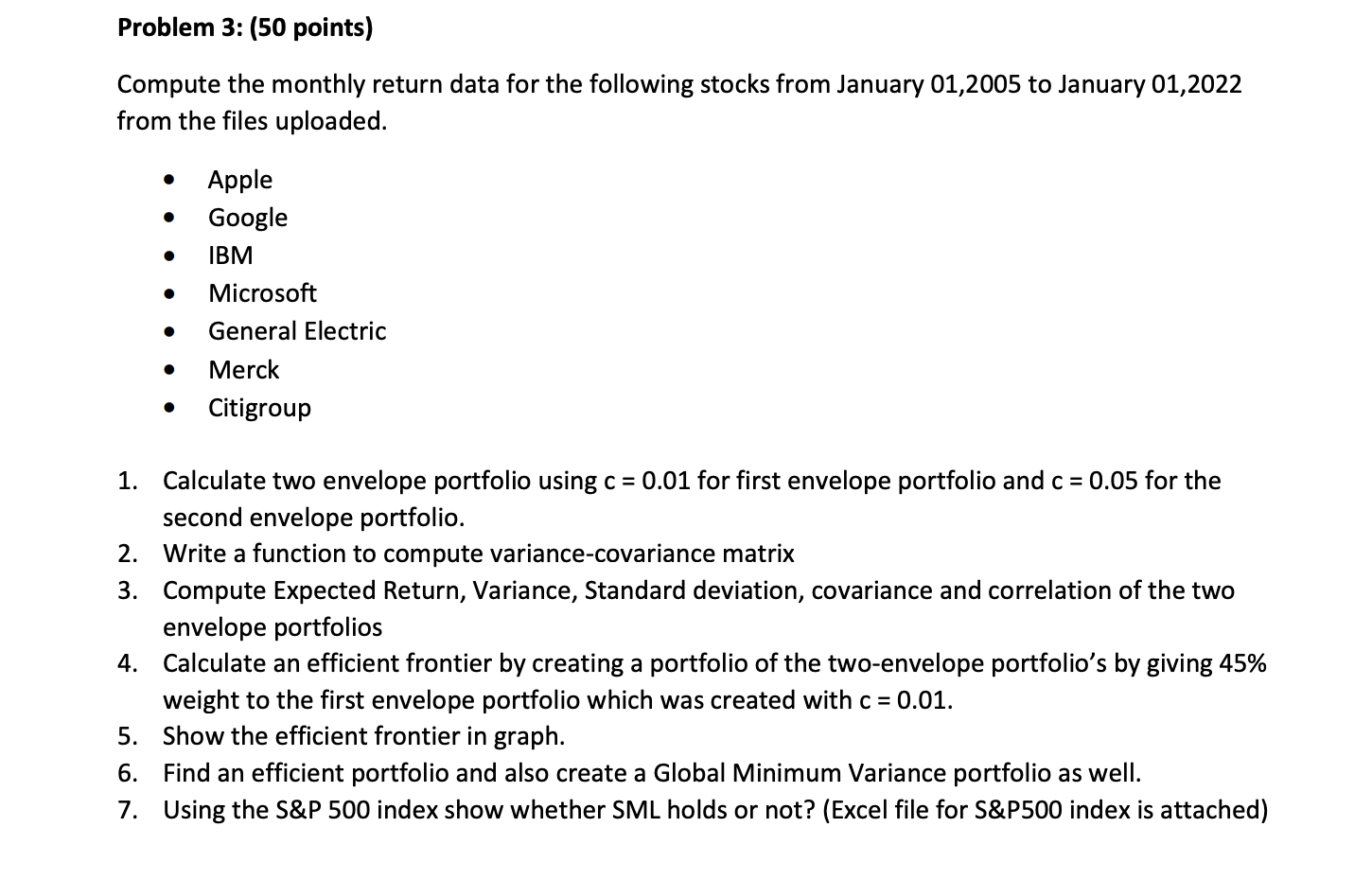

Compute the monthly return data for the following stocks from January 01,2005 to January 01,2022 from the files uploaded. - Apple - Google - IBM - Microsoft - General Electric - Merck - Citigroup 1. Calculate two envelope portfolio using c=0.01 for first envelope portfolio and c=0.05 for the second envelope portfolio. 2. Write a function to compute variance-covariance matrix 3. Compute Expected Return, Variance, Standard deviation, covariance and correlation of the two envelope portfolios 4. Calculate an efficient frontier by creating a portfolio of the two-envelope portfolio's by giving 45% weight to the first envelope portfolio which was created with c=0.01. 5. Show the efficient frontier in graph. 6. Find an efficient portfolio and also create a Global Minimum Variance portfolio as well. 7. Using the S\&P 500 index show whether SML holds or not? (Excel file for S\&P500 index is attached) Compute the monthly return data for the following stocks from January 01,2005 to January 01,2022 from the files uploaded. - Apple - Google - IBM - Microsoft - General Electric - Merck - Citigroup 1. Calculate two envelope portfolio using c=0.01 for first envelope portfolio and c=0.05 for the second envelope portfolio. 2. Write a function to compute variance-covariance matrix 3. Compute Expected Return, Variance, Standard deviation, covariance and correlation of the two envelope portfolios 4. Calculate an efficient frontier by creating a portfolio of the two-envelope portfolio's by giving 45% weight to the first envelope portfolio which was created with c=0.01. 5. Show the efficient frontier in graph. 6. Find an efficient portfolio and also create a Global Minimum Variance portfolio as well. 7. Using the S\&P 500 index show whether SML holds or not? (Excel file for S\&P500 index is attached)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts