Question: help please I don't have time help The main purpose of underwriting is to: 1) Assist in marketing the insurer's products 2) Help producers meet

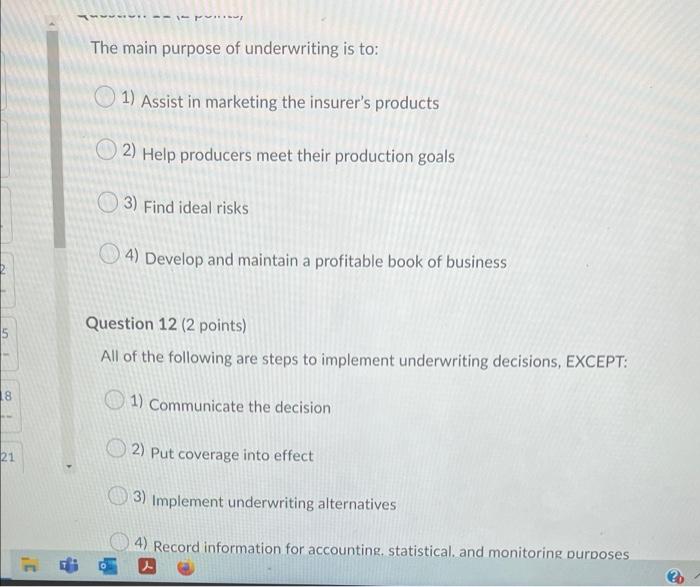

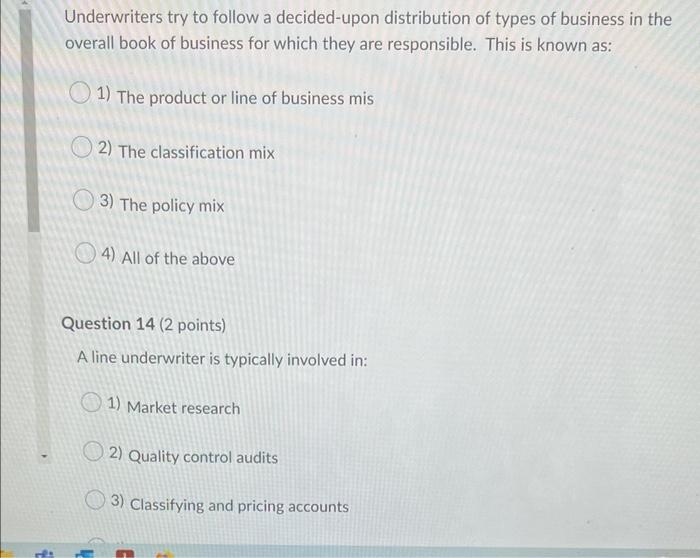

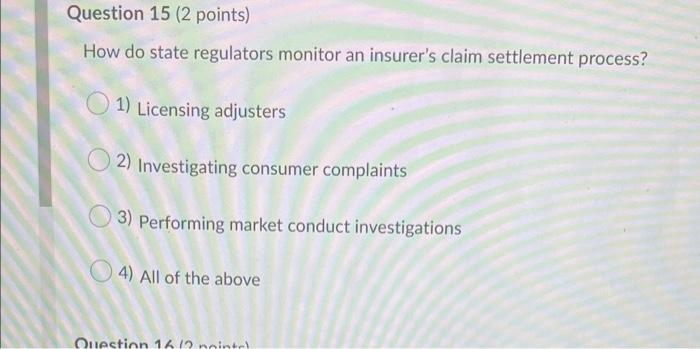

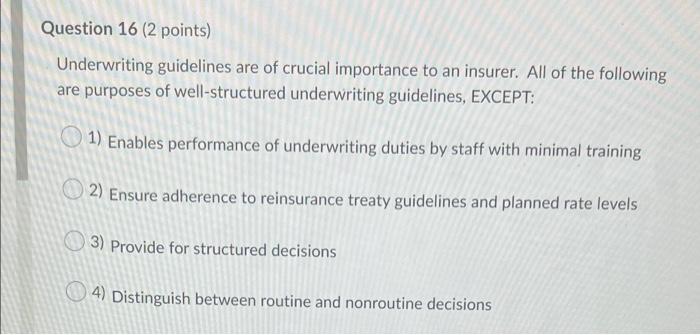

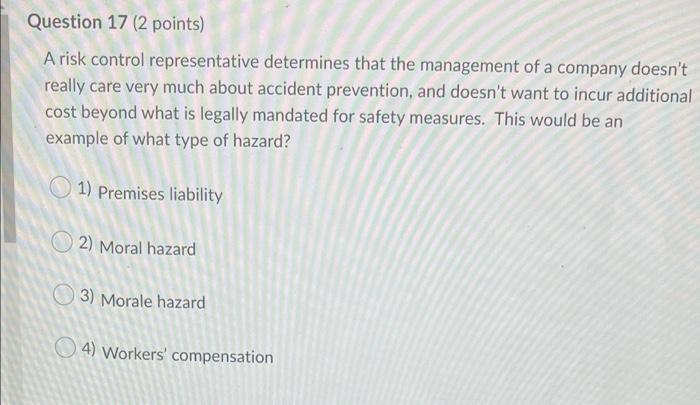

The main purpose of underwriting is to: 1) Assist in marketing the insurer's products 2) Help producers meet their production goals 3) Find ideal risks 4) Develop and maintain a profitable book of business 5 Question 12 (2 points) All of the following are steps to implement underwriting decisions, EXCEPT: 18 1) Communicate the decision 21 2) Put coverage into effect 3) Implement underwriting alternatives 4) Record information for accounting, statistical and monitoring purposes Underwriters try to follow a decided-upon distribution of types of business in the overall book of business for which they are responsible. This is known as: 1) The product or line of business mis 2) The classification mix 3) The policy mix 4) All of the above Question 14 (2 points) A line underwriter is typically involved in: 1) Market research 2) Quality control audits 3) Classifying and pricing accounts Question 15 (2 points) How do state regulators monitor an insurer's claim settlement process? 1) Licensing adjusters 2) Investigating consumer complaints 3) Performing market conduct investigations 4) All of the above Ouestion 1612 noint Question 16 (2 points) Underwriting guidelines are of crucial importance to an insurer. All of the following are purposes of well-structured underwriting guidelines, EXCEPT: 1) Enables performance of underwriting duties by staff with minimal training 2) Ensure adherence to reinsurance treaty guidelines and planned rate levels 3) Provide for structured decisions 4) Distinguish between routine and nonroutine decisions Question 17 (2 points) A risk control representative determines that the management of a company doesn't really care very much about accident prevention, and doesn't want to incur additional cost beyond what is legally mandated for safety measures. This would be an example of what type of hazard? 1) Premises liability 2) Moral hazard 3) Morale hazard 4) Workers' compensation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts