Question: Help please!!!! Please answer all four questions :)) Thank you so much !! will give good rating:) The Grammar Corporation purchased equipment for $21,000 on

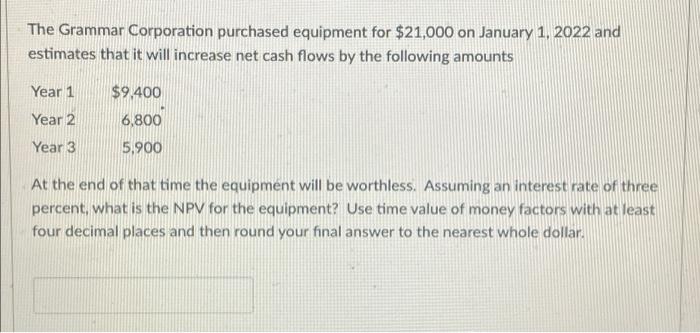

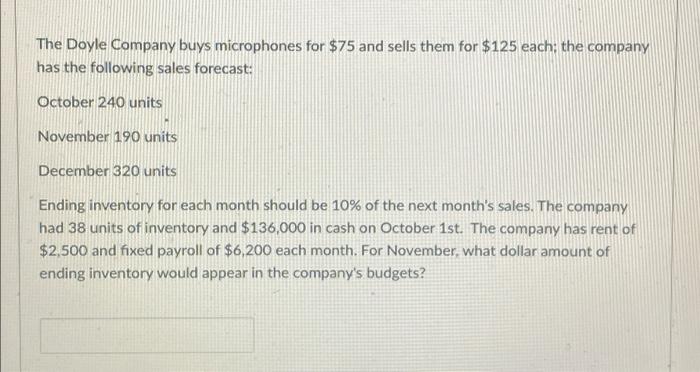

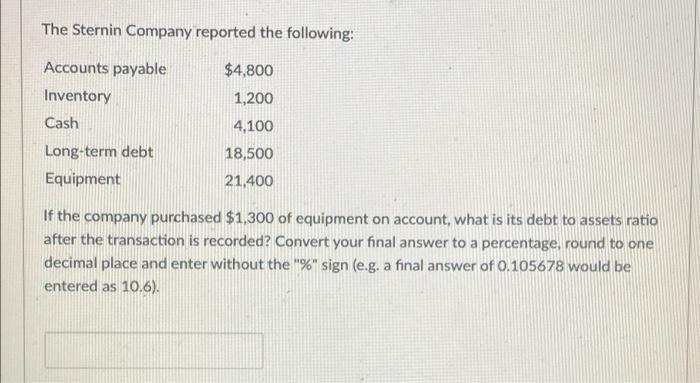

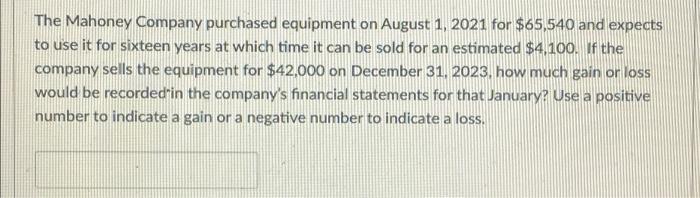

The Grammar Corporation purchased equipment for $21,000 on January 1, 2022 and estimates that it will increase net cash flows by the following amounts Year 1 $9.400 6,800 Year 2 Year 3 5,900 At the end of that time the equipment will be worthless. Assuming an interest rate of three percent, what is the NPV for the equipment? Use time value of money factors with at least four decimal places and then round your final answer to the nearest whole dollar. The Doyle Company buys microphones for $75 and sells them for $125 each: the company has the following sales forecast: October 240 units November 190 units December 320 units Ending inventory for each month should be 10% of the next month's sales. The company had 38 units of inventory and $136,000 in cash on October 1st. The company has rent of $2,500 and fixed payroll of $6,200 each month. For November, what dollar amount of ending inventory would appear in the company's budgets? The Sternin Company reported the following: $4,800 1,200 Accounts payable Inventory Cash Long-term debt Equipment 4,100 18,500 21,400 If the company purchased $1,300 of equipment on account, what is its debt to assets ratio after the transaction is recorded? Convert your final answer to a percentage, round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be entered as 10.6). The Mahoney Company purchased equipment on August 1, 2021 for $65,540 and expects to use it for sixteen years at which time it can be sold for an estimated $4, 100. If the company sells the equipment for $42,000 on December 31, 2023. how much gain or loss would be recorded in the company's financial statements for that January? Use a positive number to indicate a gain or a negative number to indicate a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts