Question: Help please. Read the case and answer the questions In July 2014, investors coughed up $437 million for the camera maker at the company's initial

Help please. Read the case and answer the questions

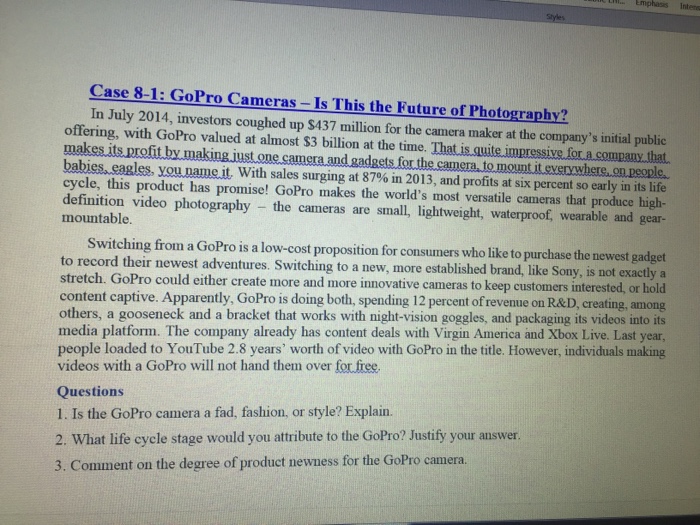

Help please. Read the case and answer the questions In July 2014, investors coughed up $437 million for the camera maker at the company's initial public offering, with GoPro valued at almost $3 billion at the time. That is quite Impressive for a company that makes its profit by making just one camera and gadgets for the camera, to mount it everywhere, on people, babies, eagles, you name. With sales surging at 87% in 2013, and profits at six percent so early in its life cycle, this product has promise! GoPro makes the world's most versatile cameras that produce high- definition video photography the cameras are small, lightweight, waterproof, wearable and gear- mountable. Switching from a GoPro is a low-cost proposition for consumers who like to purchase the newest gadget to record their newest adventures. Switching to a new, more established brand, like Sony, is not exactly a stretch. GoPro could either create more and more innovative cameras to keep customers interested, or hold content captive. Apparently, GoPro is doing both, spending 12 percent of revenue on R&D, creating, among others, a gooseneck and a bracket that works with night-vision goggles, and packaging its videos into its media platform. The company already has content deals with Virgin America and Xbox Live. Last year, people loaded to YouTube 2.8 years' worth of video with GoPro in the title. However, individuals making videos with a GoPro will not hand them over for free. Questions 1. Is the GoPro camera a fad, fashion, or style? Explain.2. What life cycle stage would you attribute to the Gopro? Justify your answer. 3. Comment on the degree of product newness for the GoPro camera

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts