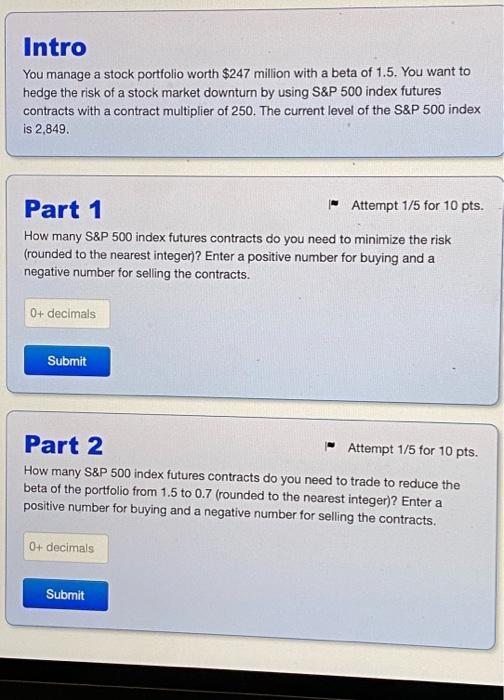

Question: help please. will give thumbs up if correct Intro You manage a stock portfolio worth $247 million with a beta of 1.5. You want to

Intro You manage a stock portfolio worth $247 million with a beta of 1.5. You want to hedge the risk of a stock market downturn by using S&P 500 index futures contracts with a contract multiplier of 250. The current level of the S&P 500 index is 2,849. Part 1 - Attempt 1/5 for 10 pts. How many S&P 500 index futures contracts do you need to minimize the risk (rounded to the nearest integer)? Enter a positive number for buying and a negative number for selling the contracts. 0+ decimals Submit Part 2 Attempt 1/5 for 10 pts. How many S&P 500 index futures contracts do you need to trade to reduce the beta of the portfolio from 1.5 to 0.7 (rounded to the nearest integer)? Enter a positive number for buying and a negative number for selling the contracts. 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts