Question: hELP Question A a) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same asset volatility and

hELP

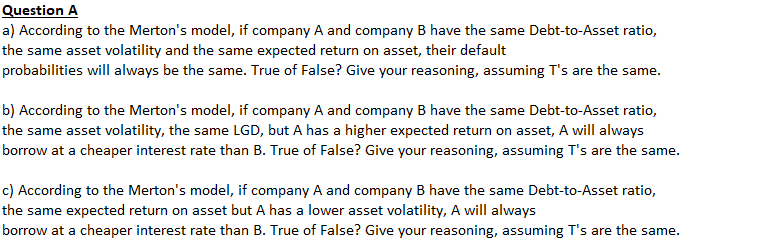

Question A a) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same asset volatility and the same expected return on asset, their default probabilities will always be the same. True of False? Give your reasoning, assuming T's are the same . b) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same asset volatility, the same LGD, but A has a higher expected return on asset, A will always borrow at a cheaper interest rate than B. True of False? Give your reasoning, assuming T's are the same. c) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same expected return on asset but A has a lower asset volatility, A will always borrow at a cheaper interest rate than B. True of False? Give your reasoning, assuming T's are the same. Question A a) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same asset volatility and the same expected return on asset, their default probabilities will always be the same. True of False? Give your reasoning, assuming T's are the same . b) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same asset volatility, the same LGD, but A has a higher expected return on asset, A will always borrow at a cheaper interest rate than B. True of False? Give your reasoning, assuming T's are the same. c) According to the Merton's model, if company A and company B have the same Debt-to-Asset ratio, the same expected return on asset but A has a lower asset volatility, A will always borrow at a cheaper interest rate than B. True of False? Give your reasoning, assuming T's are the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts