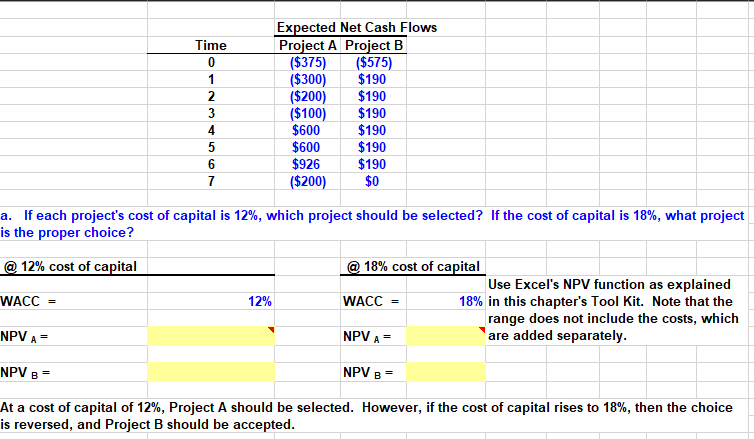

Question: Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190

Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190 $600 $190 $600 $190 $926 $190 ($200) $0 a. If each project's cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? @ 12% cost of capital WACC 12% 18% cost of capital Use Excel's NPV function as explained WACC 18% in this chapter's Tool Kit. Note that the range does not include the costs, which NPVA are added separately. NPV A = NPV B = NPVB At a cost of capital of 12%, Project A should be selected. However, if the cost of capital rises to 18%, then the choice is reversed, and Project B should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts