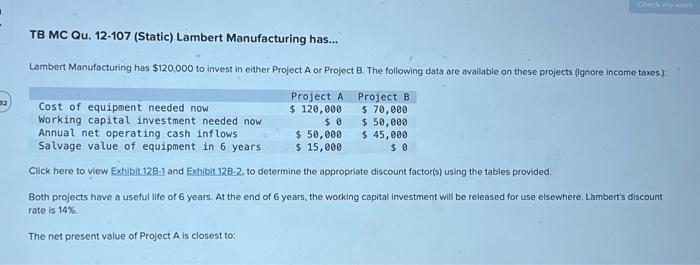

Question: help TB MC Qu. 12-107 (Static) Lambert Manufacturing has... Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data

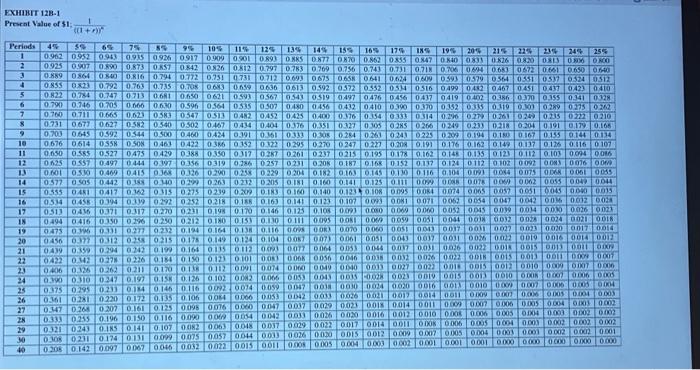

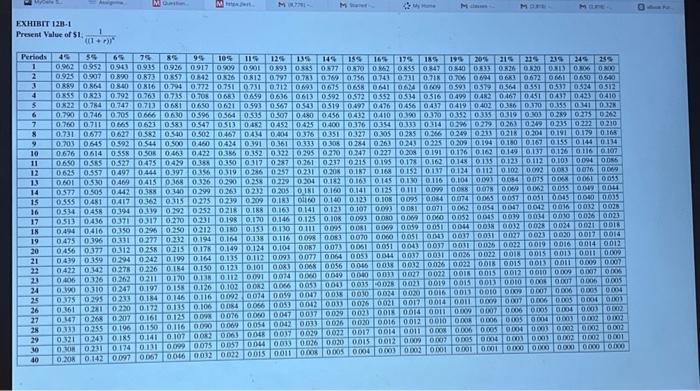

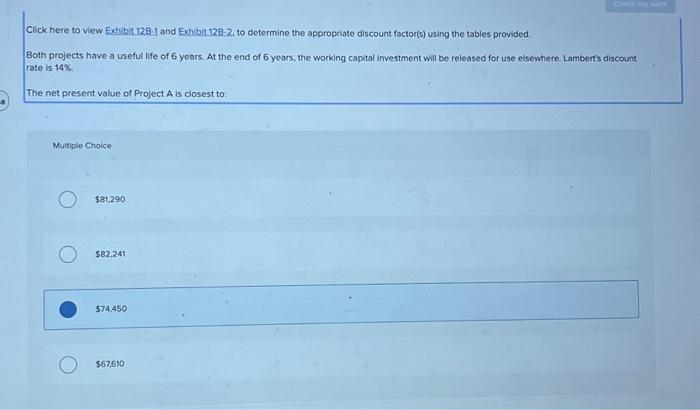

TB MC Qu. 12-107 (Static) Lambert Manufacturing has... Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data are avallable on these projects (lgnore income taxes) Click here to view Exhibit 128-1 and Exhibit 128-2, to determine the appropriate discount factori(s) using the tables provided. Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14% The net present value of Project A is closest to: FXHT 128-1 Present Value of 41 : ((1+r))21 FXHIBIT 12m-1 Present Walue of 51. 1 Click here to view Exti b.12B-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using the tables provided. Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14% The fet present value of Project A is ciosest to: Multiple Choice $81,290 $82,241 $74.450 $67,610

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts