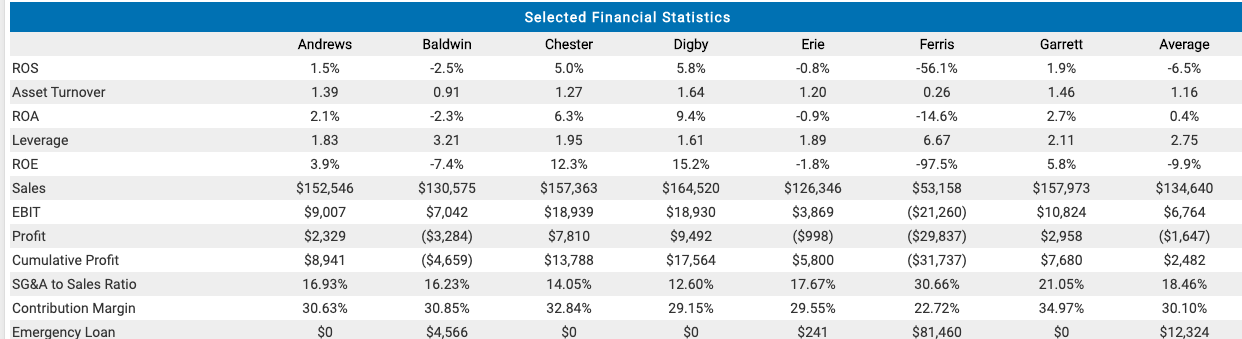

Question: help with capsim simulation, entering round 3 ( Team Ferris) Andrews Ferris -56.1% Garrett 1.9% Erie -0.8% 1.20 -0.9% 0.26 -14.6% 1.89 6.67 -97.5% ROS

help with capsim simulation, entering round 3 ( Team Ferris)

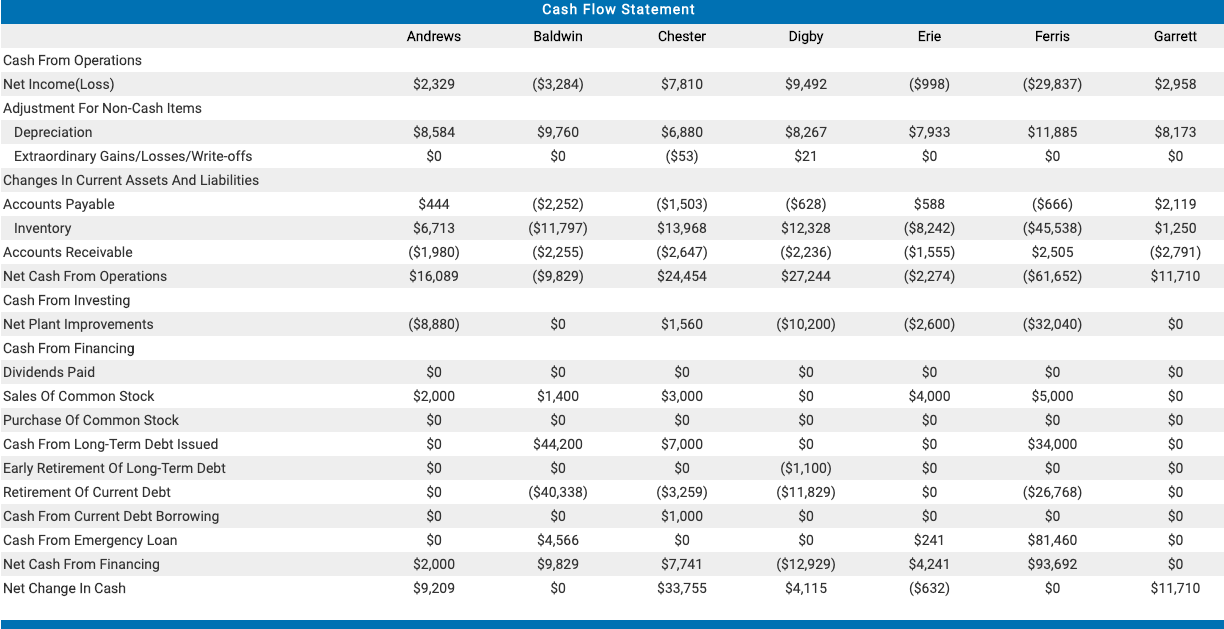

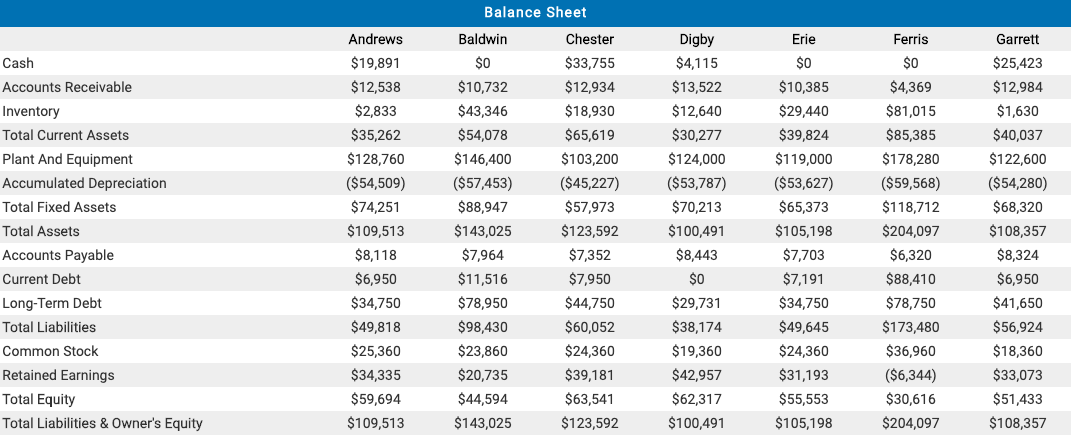

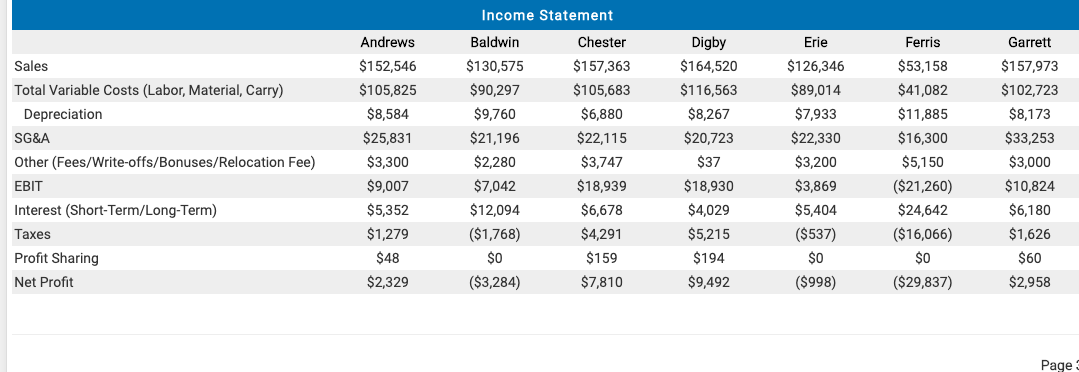

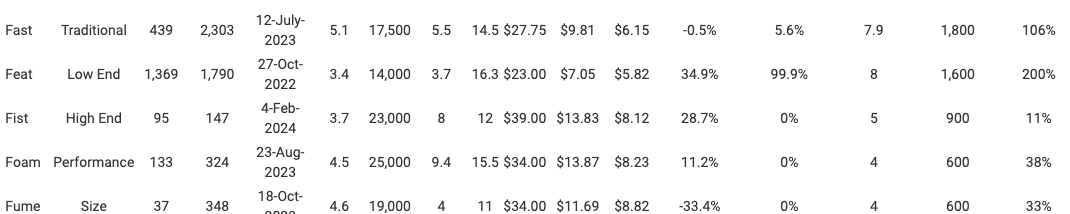

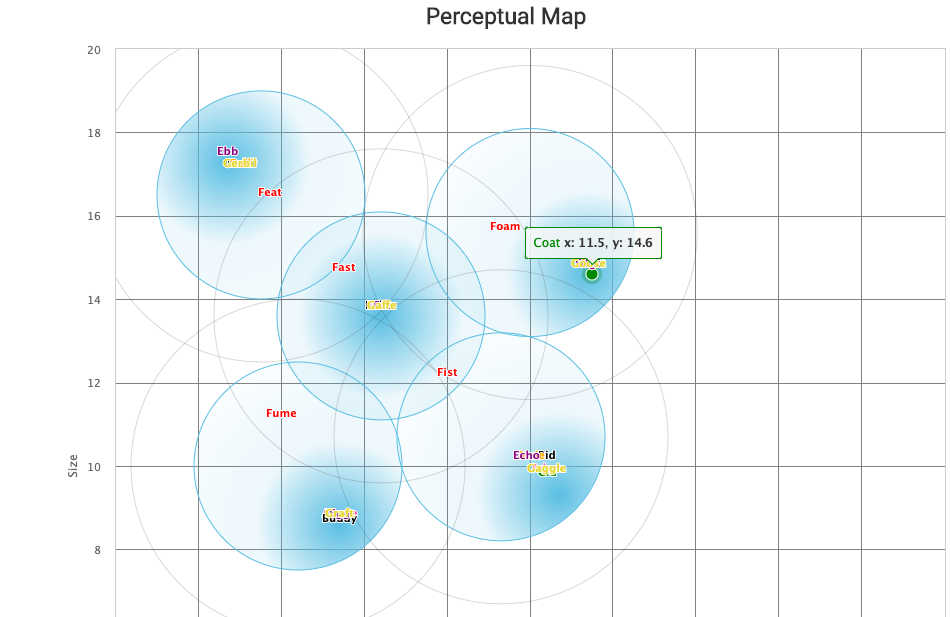

Andrews Ferris -56.1% Garrett 1.9% Erie -0.8% 1.20 -0.9% 0.26 -14.6% 1.89 6.67 -97.5% ROS Asset Turnover ROA Leverage ROE Sales EBIT Profit Cumulative Profit SG&A to Sales Ratio Contribution Margin Emergency Loan 1.5% 1.39 2.1% 1.83 3.9% $152,546 $9,007 $2,329 $8,941 16.93% 30.63% Baldwin -2.5% 0.91 -2.3% 3.21 -7.4% $130,575 $7,042 ($3,284) ($4,659) 16.23% 30.85% $4,566 Selected Financial Statistics Chester Digby 5.0% 5.8% 1.27 1.64 6.3% 9.4% 1.95 1.61 12.3% 15.2% $157,363 $164,520 $18,939 $18,930 $7,810 $9,492 $13,788 $17,564 14.05% 12.60% 32.84% 29.15% $0 -1.8% $126,346 $3,869 ($998) $5,800 17.67% 29.55% $241 $53,158 ($21,260) ($29,837) ($31,737) 30.66% 22.72% $81,460 1.46 2.7% 2.11 5.8% $157,973 $10,824 $2,958 $7,680 21.05% 34.97% Average -6.5% 1.16 0.4% 2.75 -9.9% $134,640 $6,764 ($1,647) $2,482 18.46% 30.10% $12,324 $0 $0 Cash Flow Statement Baldwin Chester Andrews Digby Erie Ferris Garrett Baldwin ($3,284) Cheste 97,810 $2,329 $2,329 $7,810 $9,492 ($998) ($29,837) $2,958 $8,584 $9,760 $8,173 $6,880 ($53) $8,267 $21 $7,933 $0 $11,885 $0 $0 $0 $0 $444 $6,713 ($1,980) $ 16,089 ($2,252) ($11,797) ($2,255) ($9,829) ($1,503) $13,968 ($2,647) ($628) $12,328 ($2,236) $27,244 $588 ($8,242) ($1,555) ($2,274) ($666) ($45,538) $2,505 ($61,652) $2,119 $1,250 ($2,791) $11,710 $24,454 Cash From Operations Net Income(Loss) Adjustment For Non-Cash Items Depreciation Extraordinary Gains/Losses/Write-offs Changes in Current Assets And Liabilities Accounts Payable Inventory Accounts Receivable Net Cash From Operations Cash From Investing Net Plant Improvements Cash From Financing Dividends Paid Sales Of Common Stock Purchase Of Common Stock Cash From Long-Term Debt Issued Early Retirement of Long-Term Debt Retirement of Current Debt Cash From Current Debt Borrowing Cash From Emergency Loan Net Cash From Financing Net Change In Cash ($8,880) $0 $1,560 ($10,200) ($2,600) ($32,040) $0 $0 $0 $0 $2,000 $0 $4,000 $1,400 $0 $0 $5,000 $0 $34,000 $0 $0 $44,200 $0 ($40,338) $3,000 $0 $7,000 $0 ($3,259) $1,000 $0 $0 $0 $0 ($1,100) ($11,829) $0 $0 ($12,929) $4,115 $0 ($26,768) $0 $81,460 $93,692 $0 $4,566 $9,829 $0 $2,000 $9,209 SO $241 $4,241 ($632) $7,741 $33,755 $11,710 Ferris $0 Cash Accounts Receivable Inventory Total Current Assets Plant And Equipment Accumulated Depreciation Total Fixed Assets Total Assets Accounts Payable Current Debt Long-Term Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Owner's Equity Andrews $19,891 $12,538 $2,833 $35,262 $128,760 ($54,509) $74,251 $109,513 $8,118 $6,950 $34,750 $49,818 $25,360 $34,335 $59,694 $109,513 Balance Sheet Baldwin Chester $33,755 $10,732 $12,934 $43,346 $18,930 $54,078 $65,619 $146,400 $103,200 ($57,453) ($45,227) $88,947 $57,973 $143,025 $123,592 $7,964 $7,352 $11,516 $7,950 $78,950 $44,750 $98,430 $60,052 $23,860 $24,360 $20,735 $39,181 $44,594 $63,541 $143,025 $123,592 Digby $4,115 $13,522 $12,640 $30,277 $124,000 ($53,787) $70,213 $100,491 $8,443 $0 $29,731 $38,174 $19,360 $42,957 $62,317 $100,491 Erie $0 $10,385 $29,440 $39,824 $119,000 ($53,627) $65,373 $105,198 $7,703 $7,191 $34,750 $49,645 $24,360 $31,193 $55,553 $105,198 $4,369 $81,015 $85,385 $178,280 ($59,568) $118,712 $204,097 $6,320 $88,410 $78,750 $173,480 $36,960 ($6,344) $30,616 $204,097 Garrett $25,423 $12,984 $1,630 $40,037 $122,600 ($54,280) $68,320 $108,357 $8,324 $6,950 $41,650 $56,924 $18,360 $33,073 $51,433 $108,357 Andrews $152,546 $105,825 $8,584 $25,831 $3,300 $9,007 $5,352 $1,279 $48 $2,329 Sales Total Variable Costs (Labor, Material, Carry) Depreciation SG&A Other (Fees/Write-offs/Bonuses/Relocation Fee) EBIT Interest (Short-Term/Long-Term) Taxes Profit Sharing Net Profit Income Statement Baldwin Chester $130,575 $157,363 $90,297 $105,683 $9,760 $6,880 $21,196 $22,115 $2,280 $3,747 $7,042 $18,939 $12,094 $6,678 ($1,768) $4,291 $159 ($3,284) $7,810 Digby $164,520 $116,563 $8,267 $20,723 $37 $18,930 $4,029 $5,215 $194 $9,492 Erie $126,346 $89,014 $7,933 $22,330 $3,200 $3,869 $5,404 ($537) $0 ($998) Ferris $53,158 $41,082 $11,885 $16,300 $5,150 Garrett $157,973 $102,723 $8,173 $33,253 $3,000 $10,824 $6,180 $1,626 $60 $2,958 ($21,260) $24,642 ($16,066) $0 ($29,837) $0 1837) Page 3 Fast Traditional 439 2,303 5.1 17,500 5.5 14.5 $27.75 $9.81 $6.15 -0.5% 5.6% 1,800 106% cod 1,369 1,790 3.4 12-July- 2023 27-Oct- 2022 4-Feb- 14,000 3.7 16.3 $23.00 $7.05 $5.82 34.9% 99.9% 1,600 Feat Fist 200% Low End High End 95 147 3.7 2024 23,000 8 12 $39.00 $13.83 $8.12 900 28.7% 11% Foam Performance 133 4.5 25,000 9.4 15.5 $34.00 $13.87 $8.23 11.2% 600 38% 23-Aug- 2023 18-Oct- Fume Size 37 348 4.6 19,000 4 11 $34.00 $11.69 $8.82 -33.4% 4 600 33% Perceptual Map Ebb Gero Foam Coat x: 11.5, y: 14.6 GO Teate Size Echo id aggle Andrews Ferris -56.1% Garrett 1.9% Erie -0.8% 1.20 -0.9% 0.26 -14.6% 1.89 6.67 -97.5% ROS Asset Turnover ROA Leverage ROE Sales EBIT Profit Cumulative Profit SG&A to Sales Ratio Contribution Margin Emergency Loan 1.5% 1.39 2.1% 1.83 3.9% $152,546 $9,007 $2,329 $8,941 16.93% 30.63% Baldwin -2.5% 0.91 -2.3% 3.21 -7.4% $130,575 $7,042 ($3,284) ($4,659) 16.23% 30.85% $4,566 Selected Financial Statistics Chester Digby 5.0% 5.8% 1.27 1.64 6.3% 9.4% 1.95 1.61 12.3% 15.2% $157,363 $164,520 $18,939 $18,930 $7,810 $9,492 $13,788 $17,564 14.05% 12.60% 32.84% 29.15% $0 -1.8% $126,346 $3,869 ($998) $5,800 17.67% 29.55% $241 $53,158 ($21,260) ($29,837) ($31,737) 30.66% 22.72% $81,460 1.46 2.7% 2.11 5.8% $157,973 $10,824 $2,958 $7,680 21.05% 34.97% Average -6.5% 1.16 0.4% 2.75 -9.9% $134,640 $6,764 ($1,647) $2,482 18.46% 30.10% $12,324 $0 $0 Cash Flow Statement Baldwin Chester Andrews Digby Erie Ferris Garrett Baldwin ($3,284) Cheste 97,810 $2,329 $2,329 $7,810 $9,492 ($998) ($29,837) $2,958 $8,584 $9,760 $8,173 $6,880 ($53) $8,267 $21 $7,933 $0 $11,885 $0 $0 $0 $0 $444 $6,713 ($1,980) $ 16,089 ($2,252) ($11,797) ($2,255) ($9,829) ($1,503) $13,968 ($2,647) ($628) $12,328 ($2,236) $27,244 $588 ($8,242) ($1,555) ($2,274) ($666) ($45,538) $2,505 ($61,652) $2,119 $1,250 ($2,791) $11,710 $24,454 Cash From Operations Net Income(Loss) Adjustment For Non-Cash Items Depreciation Extraordinary Gains/Losses/Write-offs Changes in Current Assets And Liabilities Accounts Payable Inventory Accounts Receivable Net Cash From Operations Cash From Investing Net Plant Improvements Cash From Financing Dividends Paid Sales Of Common Stock Purchase Of Common Stock Cash From Long-Term Debt Issued Early Retirement of Long-Term Debt Retirement of Current Debt Cash From Current Debt Borrowing Cash From Emergency Loan Net Cash From Financing Net Change In Cash ($8,880) $0 $1,560 ($10,200) ($2,600) ($32,040) $0 $0 $0 $0 $2,000 $0 $4,000 $1,400 $0 $0 $5,000 $0 $34,000 $0 $0 $44,200 $0 ($40,338) $3,000 $0 $7,000 $0 ($3,259) $1,000 $0 $0 $0 $0 ($1,100) ($11,829) $0 $0 ($12,929) $4,115 $0 ($26,768) $0 $81,460 $93,692 $0 $4,566 $9,829 $0 $2,000 $9,209 SO $241 $4,241 ($632) $7,741 $33,755 $11,710 Ferris $0 Cash Accounts Receivable Inventory Total Current Assets Plant And Equipment Accumulated Depreciation Total Fixed Assets Total Assets Accounts Payable Current Debt Long-Term Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Owner's Equity Andrews $19,891 $12,538 $2,833 $35,262 $128,760 ($54,509) $74,251 $109,513 $8,118 $6,950 $34,750 $49,818 $25,360 $34,335 $59,694 $109,513 Balance Sheet Baldwin Chester $33,755 $10,732 $12,934 $43,346 $18,930 $54,078 $65,619 $146,400 $103,200 ($57,453) ($45,227) $88,947 $57,973 $143,025 $123,592 $7,964 $7,352 $11,516 $7,950 $78,950 $44,750 $98,430 $60,052 $23,860 $24,360 $20,735 $39,181 $44,594 $63,541 $143,025 $123,592 Digby $4,115 $13,522 $12,640 $30,277 $124,000 ($53,787) $70,213 $100,491 $8,443 $0 $29,731 $38,174 $19,360 $42,957 $62,317 $100,491 Erie $0 $10,385 $29,440 $39,824 $119,000 ($53,627) $65,373 $105,198 $7,703 $7,191 $34,750 $49,645 $24,360 $31,193 $55,553 $105,198 $4,369 $81,015 $85,385 $178,280 ($59,568) $118,712 $204,097 $6,320 $88,410 $78,750 $173,480 $36,960 ($6,344) $30,616 $204,097 Garrett $25,423 $12,984 $1,630 $40,037 $122,600 ($54,280) $68,320 $108,357 $8,324 $6,950 $41,650 $56,924 $18,360 $33,073 $51,433 $108,357 Andrews $152,546 $105,825 $8,584 $25,831 $3,300 $9,007 $5,352 $1,279 $48 $2,329 Sales Total Variable Costs (Labor, Material, Carry) Depreciation SG&A Other (Fees/Write-offs/Bonuses/Relocation Fee) EBIT Interest (Short-Term/Long-Term) Taxes Profit Sharing Net Profit Income Statement Baldwin Chester $130,575 $157,363 $90,297 $105,683 $9,760 $6,880 $21,196 $22,115 $2,280 $3,747 $7,042 $18,939 $12,094 $6,678 ($1,768) $4,291 $159 ($3,284) $7,810 Digby $164,520 $116,563 $8,267 $20,723 $37 $18,930 $4,029 $5,215 $194 $9,492 Erie $126,346 $89,014 $7,933 $22,330 $3,200 $3,869 $5,404 ($537) $0 ($998) Ferris $53,158 $41,082 $11,885 $16,300 $5,150 Garrett $157,973 $102,723 $8,173 $33,253 $3,000 $10,824 $6,180 $1,626 $60 $2,958 ($21,260) $24,642 ($16,066) $0 ($29,837) $0 1837) Page 3 Fast Traditional 439 2,303 5.1 17,500 5.5 14.5 $27.75 $9.81 $6.15 -0.5% 5.6% 1,800 106% cod 1,369 1,790 3.4 12-July- 2023 27-Oct- 2022 4-Feb- 14,000 3.7 16.3 $23.00 $7.05 $5.82 34.9% 99.9% 1,600 Feat Fist 200% Low End High End 95 147 3.7 2024 23,000 8 12 $39.00 $13.83 $8.12 900 28.7% 11% Foam Performance 133 4.5 25,000 9.4 15.5 $34.00 $13.87 $8.23 11.2% 600 38% 23-Aug- 2023 18-Oct- Fume Size 37 348 4.6 19,000 4 11 $34.00 $11.69 $8.82 -33.4% 4 600 33% Perceptual Map Ebb Gero Foam Coat x: 11.5, y: 14.6 GO Teate Size Echo id aggle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts